Nielsen (NLSN) Partners New York Interconnect, Boosts Clientele

Nielsen Holdings NLSN has been consistently gaining customer momentum on the back of robust portfolio offerings.

This is evident from the company’s recent multi-year agreement with New York Interconnect (NYI) for local TV measurement in the New York Designated Market Area (DMA).

On the back of this partnership, NYI will leverage Nielsen’s data for evaluating the daily performance of its campaigns and cable networks. NYI will also be able to calculate TV campaign reach and frequency at the DMA level.

Further, NYI licensed the company’s Nielsen Ad Intel to get details on money spent in the New York market on a category and advertiser basis.

Thus, the latest move has highlighted the reliability and efficiency of Nielsen’s portfolio of solutions.

The recent partnership with NYI has expanded Nielsen’s customer base. This is expected to contribute well to the company’s top line in the upcoming period.

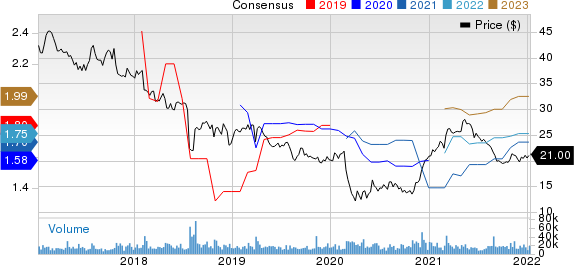

Nielsen Holdings Plc Price and Consensus

Nielsen Holdings Plc price-consensus-chart | Nielsen Holdings Plc Quote

Growing Partnerships

Apart from the recent collaboration, Nielsen has signed a multi-year deal with Antietam Broadband for Local TV measurement in Washington, DC, DMA.

The company has also inked a multi-year contract with Whitehardt Inc. for local TV measurement in all markets served. With the partnership, Nielsen’s data will aid Whitehardt’s ability to evaluate viewership differences, plus shifts and trends in each market served.

Additionally, Nielsen and Meredith Corp. renewed a multi-year agreement for Nielsen Local TV ratings. Per the agreement, Nielsen’s unique suite of measurement services will be leveraged for establishing a cross-platform currency for Meredith’s commercial strategies.

Further, the company’s content solutions arm, Gracenote collaborated with Lucid Group to equip the latter’s Lucid Air luxury electric vehicle with advanced audio features.

Portfolio Strength

Nielsen’s growing partnerships are attributed to its strong efforts toward strengthening its portfolio offerings.

Recently, Gracenote introduced a content analytics tool named Audience Predict to help content distributors and owners predict the future of program performance and accordingly make strategic decisions that maximize return on programming investments.

In addition, it added Nielsen Impact Score to the portfolio of Nielsen Sports. On the back of Impact Score, the company is gaining momentum among collegiate basketball and football teams.

Also, the introduction of digital audience measurement capabilities to combat the issues related to cookies and mobile ad id erosion, remains a positive.

Further, it acquired a Paris-based TV attribution provider and ad monitoring company, TVTY. With the acquisition, NLSN expanded TV Attribution and Ad Intel services.

Zacks Rank & Stocks to Consider

Currently, Nielsen carries a Zacks Rank #3 (Hold).

Investors interested in the business services sector can consider stocks like Franklin Covey FC, Marvell Technology MRVL and Avis Budget Group CAR, each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Franklin Covey has gained 107.7% over a year. The long-term earnings growth rate for the stock is currently projected at 27.5%.

Marvell Technology has gained 62.4% over a year. The long-term earnings growth rate for the stock is currently projected at 24.3%.

Avis Budget Group has gained 414.8% over a year. The long-term earnings growth rate for the stock is currently projected at 19.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Nielsen Holdings Plc (NLSN) : Free Stock Analysis Report

Franklin Covey Company (FC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance