Is The NFT Bubble Bursting Already?

Key Points

An NFT of Jack Dorsey’s first tweet, initially bought for $2.9M, has currently only received a $6,823.54 bid.

This is indicative of a drastic cooldown in NFT market conditions since last summer.

But “social tokens”, such as Bored Ape Yacht Club NFTs, may be an area of growth.

In March 2021, an Iranian-born crypto entrepreneur, purchased a Non Fungible Token (NFT) of Twitter founder Jack Dorsey’s first tweet for $2.9M.

On 6 April, he listed it on NFT marketplace OpenSea hoping to scoop up $48M and pledged to donate half of the proceeds to charity. As of 14 April, the largest bid stands at just $6,823.54.

Unsurprisingly, NFT critics have jumped on the news as further evidence that the air is coming out of the NFT bubble. Could that be true? What is really going on in the NFT market?

NFT Market Trends

Up until the start of 2021, NFTs were a little-known, very niche segment within the crypto industry.

But in February last year, Mike “Beeple” Winklemann famously sold a collage of his digital art at Christie’s auction house for $69.3M, sparking a historic period of growth in the NFT marketplace.

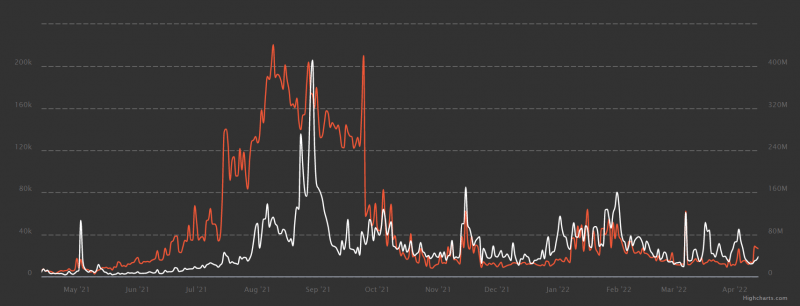

At the start of 2021, total global NFT sales averaged around 2,000 per day for a total value of a few hundred thousand dollars max, data from nonfungible.com’s Market Tracker shows.

However, at the market’s peak in August 2021, over 200,000 NFT sales were taking place each day, with the total value of sales at one point briefly surpassing $400M.

Since then, NFT market conditions have cooled substantially.

According to nonfungible.com’s Market Tracker, the total number of daily NFT sales has mostly stuck within a 10,000-30,000 range, excluding the occasional spike. Meanwhile, the total value of daily sales has mostly stayed in the tens of millions of dollars, excluding the occasional spike above $100M.

According to data on CryptoSlam, total NFT sales in March this year were valued at $2.435B, the lowest since July 2021, while 661,748 people purchased NTFs, the lowest number since September 2021.

Digital Art Collector/Analyst Views

“I am prepared, I think, for a cataclysmic market crash,” Colborn Bell, the founder and curator of the Museum of Crypto Art, was quoted as telling Fortune in February.

Bell noted that the NFT marketplace is struggling with too many sellers and not enough buyers. “The barrier to entry for artists is much lower than it is for collectors… In my mind, that formula does not work”.

Meanwhile, digital art collector Pablo Rodriguez-Fraile said that “obviously the enthusiasm and interest that we had at some periods last year is not here anymore”. “I think we achieved something that wasn’t sustainable”, he noted, referring to the high valuations and high volume of sales last summer.

Modesta Masoit, director at NFT research company DappRadar, took a more positive view of the market. He told Reuters last week that rather than the market being in overall decline, it is “consolidating” after its meteoric growth in 2021.

“Everybody was expecting that there was going to be a consolidation period… It’s not going away, it’s just consolidating,” he said.

Social NFTs The Next Area of Growth?

Bored Ape Yacht Club NFTs have not seen a substantial slowdown in demand in 2022.

On the contrary, in the marketplace for the 10,000 different variants of the iconic cartoon ape, prices have continued to fetch an average of well over $250,000 since the start of the year.

That compares to around $87,000 on average last August when much of the rest of the NFT market peaked.

NFT market commentators have said that continued growth in the market for Bored Ape Yacht Club NFTs is representative of growing demand for so-called “social tokens”.

Buyers of Bored Ape NFTs join an exclusive group of high-profile owners that includes the likes of celebrities such as Paris Hilton and Madonna.

Yuga Labs, the firm behind the Bored Ape NFT collection, recently secured a $450M funding round for the creation of an NFT metaverse.

Owners of Bored Ape NFTs were last month gifted Yuga Labs’s new cryptocurrency ApeCoin, which a few weeks on already has a market capitalisation of more than $3.7B.

Raoul Pal, a widely followed former Goldman Sachs executive, wrote recently that expectations for growth in the market for Bored Ape NFTs had encouraged him to invest about $400,000. “Social tokens are the BIG thing,” he exclaimed.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance