NextEra Energy (NEE) Stock Rises 18.7% YTD: Time to Buy?

NextEra Energy's NEE shares have rallied 18.7% year to date compared to its industry’s growth of 1%. The company continues to add clean energy volume to the grid, and benefits from improving economic conditions in Florida and load growth in its service region.

NextEra Energy has outperformed its sector and the S&P 500 in the year-to-date period.

NextEra Energy Outperforms Industry, Sector & S&P YTD

Image Source: Zacks Investment Research

Factors Acting in Favor of NextEra Energy

The demand for clean electricity is rising and NextEra Energy can meet it through strategic investment it is making to strengthen and upgrade its infrastructure. NextEra’s unit Florida Power & Light Company (“FPL”), including Gulf Power, has plans to invest $43.8 billion in the 2024-2028 time period. FPL's focus is on clean, efficient, modernized generation and a stronger and smarter grid. The improving economic condition of Florida is also boosting the company’s prospects. FPL served 81,000 more customers in the fourth quarter than in the year-ago period.

Another unit of NextEra Energy, NextEra Energy Resources, continues to make long-term investments in clean energy assets. The company expects to be able to add 36.5-46.5 gigawatts (GW) of new renewables in the 2024-2027 time frame to the generation portfolio via clean energy investments. NextEra Energy has plans to invest $18.3 billion in this segment in the 2024-2028 time period. NextEra Energy Resources has more than 21 GW in the backlog of signed contracts, which provides clear visibility into the ongoing expansion of clean power generation.

NextEra Energy’s unmatched scale, experience and technology lead to predictable, superior returns. Its combined utility and renewables assets create unmatched competitive advantages as U.S. power demand is expected to grow 38% over the next two decades. The increase in electricity demand is expected to come from big data centers and higher demand from Oil and Gas companies in the Permian Basin region.

Storage Holds the Key to Clean Energy Transition

Last month, NextEra Energy Resources and Entergy Corporation ETR agreed to develop up to 4.5 gigawatts (GW) of new solar generation and energy storage projects. These projects assist in storing electricity from renewable projects when production is higher than demand. NextEra Energy Resources is expected to bring in 7.8-10.7 GW of storage projects online in the 2024-2027 time frame.

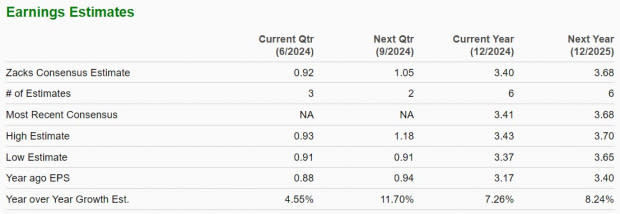

Estimates Moving Up

NextEra Energy now expects its 2024 earnings per share in the range of $3.23-$3.43 compared with $3.17 a year ago. The Zacks Consensus Estimate for NEE’s 2024 and 2025 earnings per share indicates year-over-year growth of 7.26% and 8.24%, respectively. The year-over-year increase in earnings estimates indicates analysts’ increasing confidence in the stock. The company expects to increase its earnings per share in the range of 6-8% annually through 2027.

Image Source: Zacks Investment Research

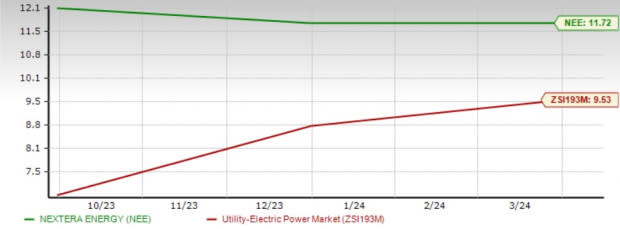

Returns Higher Than the Industry

NEE’s trailing 12-month return on equity is 11.72%, ahead of the industry average of 9.53%. Return on equity, a profitability measure, reflects how effectively a company is utilizing its shareholders’ funds in its operations to generate income.

ROE Chart

Image Source: Zacks Investment Research

Delivering Value to Shareholders

NextEra Energy continues to return value to its shareholders through dividend payments.

NextEra Energy plans to increase the dividend rate annually by 10%, subject to its board’s approval. During the first quarter, the board of directors of NextEra Energy declared a regular quarterly common stock dividend of 51.5 per share, a nearly 10% increase from the prior-year comparable quarterly dividend.

NEE’s payout ratio at the end of 2023 was 59%. With continued strength in its earnings and operating cash flow growth, NEE is expected to continue boosting its dividend going forward. Check NEE’s dividend history here.

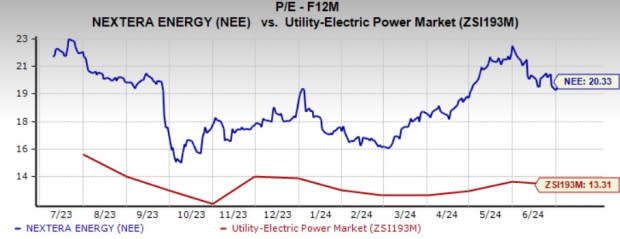

Valuation

The company is currently valued at a premium compared to its industry on a forward 12-month P/E basis. Given its high valuation at present, it is better to hold positions in the stock and wait for a better entry point.

Image Source: Zacks Investment Research

Round Up

NextEra Energy's investment in increasing clean energy production volumes, expansion of operations through organic and inorganic initiatives, strengthening transmission and distribution operations, and rising demand from its customers place it well for growth from the current levels. Unfavorable supply costs and increasing indirect input costs can, however, adversely impact performance.

Given the improvement in earnings estimates and return on capital, it will be wise to remain invested in this Zacks Rank #3 (Hold) utility.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report