Netflix Produces The Cuphead Show! Based on Hit Video Game

Netflix NFLX is producing The Cuphead Show!, which is based on Studio MDHR’s hit video game, Cuphead. The new series explores the world of two brothers — Cuphead and Mugman — in their Inkwell Isles home.

Notably, the retro-styled video game has sold more than 4 million units globally till date. In fact, per IGN, Elon Musk approached Studio MDHR to bring it on Tesla’s TSLA electric cars (Model 3, X and S). This also reflects the game’s widespread popularity.

Hence, Cuphead’s solid player base is expected to help the new series gain viewership, which has become an important metric for Netflix. Reportedly, the company is planning to put a brake on original content spending, particularly for big-budget projects, which lack viewership. The strategy is expected help reduce cash burn rate.

The company expects 2019 free cash outflow to be modestly higher at roughly $3.5 billion due to increased cash taxes related to change in its corporate structure, and additional investments in real estate and other infrastructure.

Netflix’s Content Diversity: Key Catalyst

Netflix’s focus on originals — both movies and TV shows — has been the key catalyst behind its surging subscriber base. In first-quarter 2019, the streaming giant added 9.6 million subscribers, up 16.2% year over year. In fact, Netflix expects to add 5 million paid subscribers in the second quarter of 2019.

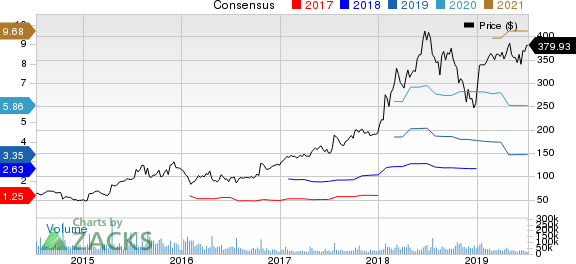

Netflix, Inc. Price and Consensus

Netflix, Inc. price-consensus-chart | Netflix, Inc. Quote

Moreover, the success of films like Murder Mystery, Triple Frontier, Roma and Bird Box surely validates the company’s evolution as a major movie studio. Additionally, the growing involvement of well-known Hollywood stars is making the movies and shows on the platform more attractive.

Notably, Netflix recently acquired the rights of Red Notice, starring Ryan Reynolds, Dwayne Johnson and Gal Gadot.

Further, the company’s endeavor to offer content catering to various genres, evident from The Cuphead Show!, is a key catalyst in driving user engagement.

Netflix’s Content Strength to Fend Off Competition

Netflix’s content-related spending is expected to remain high due to intensifying competition in the streaming space. Notably, content providers with upcoming streaming services like Disney DIS, Comcast CMCSA and AT&T T are now looking to remove their popular movies and shows from Netflix.

Disney is set to pull its movies and shows from the platform ahead of the launch of Disney+ in November. Netflix is also set to lose hit shows like Friends and The Office to AT&T’s HBO Max and Comcast’s NBC, respectively.

Netflix has to replace these third-party popular shows to keep its user base engaged. Per Variety, the company has a budget of $15 billion this year, much higher than $12.04 billion it spent on content in 2018.

Currently, Netflix has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

AT&T Inc. (T) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance