Neogen's (NEOG) Q4 Earnings Beat Estimates, Revenues Miss

Neogen Corporation’s NEOG fourth-quarter fiscal 2019 earnings per share (EPS) of 30 cents beat the Zacks Consensus Estimate of 28 cents by 7.1%. However, EPS declined 9.1% from the year-ago quarter.

For fiscal 2019, EPS was $1.15, down 5.2% from a year ago. The figure surpassed the Zacks Consensus Estimate of $1.12 by 2.7%

Revenues in the quarter increased 1.6% on a year-over-year basis to $109.8 million, missing the Zacks Consensus Estimate of $111 million by 1.1%.

For fiscal 2019, revenues came in at $414.2 million, up 3.93% from the year-ago period. The figure missed the Zacks Consensus Estimate of $415.4 million by 0.3%.

The fiscal fourth quarter was the 109th of the past 114 quarters to mark a year-over-year revenue increase.

Revenues in Detail

Food Safety Segment: For the quarter under review, revenues at the segment totaled $56.4 million, up 9.1% year over year.

Animal Safety Segment: During the fourth quarter, this segment recorded revenues of $53.3 million, reflecting a 5.7% decline from the year-ago quarter.

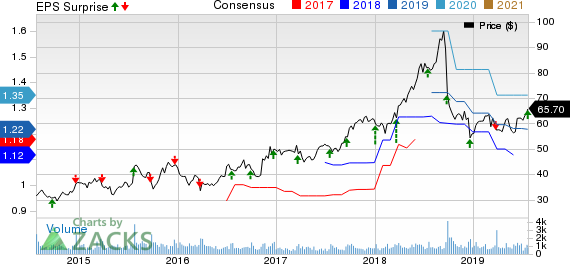

Neogen Corporation Price, Consensus and EPS Surprise

Neogen Corporation price-consensus-eps-surprise-chart | Neogen Corporation Quote

Margin Details

Gross margin expanded 110 basis points (bps) to 46% in the fiscal fourth quarter.

During the reported quarter, operating income was $18.7 million, declining 6.4% from the year-ago figure of $19.9 million. Operating margin contracted 130 bps to 17.1% in the quarter under review.

Our Take

Neogen’s strong international business and solid performance by core Food Safety segment resulted in year-over-year revenue growth. Per management, the company witnessed revenue growth in key geographies like Europe, Brazil, Mexico, China and India in fiscal 2019. The significant growth in revenues within the veterinary needle and syringe business as well as increased sales of products in the companion animal market at the end of fiscal 2019 is encouraging.

However, headwinds like unstable economic conditions, currency issues and challenges in the animal protein market led to the Animal Safety segment’s disappointing performance.

Zacks Rank & Key Picks

Neogen currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space are Hologic Inc. HOLX, DENTSPLY SIRONA Inc. XRAY and Teleflex Inc. TFX.

Hologic is scheduled to release second-quarter 2019 results on Jul 31. The Zacks Consensus Estimate for the quarter’s adjusted EPS is pegged at 61 cents and for revenues stands at $834.6 million. The stock carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DENTSPLY SIRONA is scheduled to release second-quarter 2019 results on Aug 2. The Zacks Consensus Estimate for its adjusted EPS is pegged at 62 cents and for revenues, $1.03 billion. The stock sports a Zacks Rank #1.

Teleflex is expected to release second-quarter 2019 results on Aug 1. The Zacks Consensus Estimate for its adjusted EPS is $2.59 and for the top line, $636.7 million. The stock has a Zacks Rank of 2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Neogen Corporation (NEOG) : Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance