Nasdaq's (NDAQ) Q4 Earnings and Revenues Surpass Estimates

Nasdaq, Inc. NDAQ reported fourth-quarter 2021 adjusted earnings per share of $1.93, beating the Zacks Consensus Estimate of $1.78 by nearly 8.4%. The bottom line improved 21% year over year.

The improvement was mainly driven by organic growth, margin expansion and solid segmental performance.

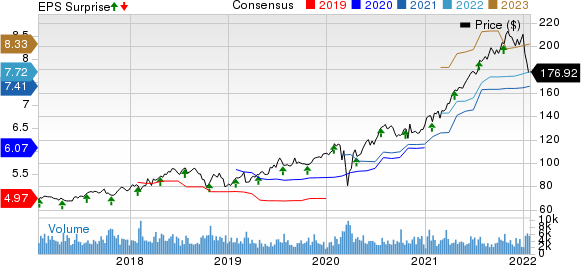

Nasdaq, Inc. Price, Consensus and EPS Surprise

Nasdaq, Inc. price-consensus-eps-surprise-chart | Nasdaq, Inc. Quote

Performance in Detail

Nasdaq’s revenues of $885 million increased 12% year over year. The upside can primarily be attributed to $78 million positive impact from organic growth and a $26 million increase from the net impact of acquisitions and divestitures. It was partially offset by a $7 million decrease from the impact of changes in FX rates. The top line beat the Zacks Consensus Estimate by 2.5%.

Adjusted operating expenses were $434 million, up 7% from the year-ago period. The increase was due to organic increase of 1% over the prior year period, 6% increase from the net impact of acquisitions and divestitures. It was partially offset by a $2 million decrease from changes in FX rates. The organic increase was due to higher compensation and benefit expense; marketing and advertising expense; and computer operations and data communication expense. It was partially offset by lower general, administrative and other expense.

Operating margin of 51% expanded 300 basis points year over year.

The Nasdaq Stock Market welcomed 1,000 new company listings in 2021, including 752 IPOs representing $181 billion in capital raised. Meanwhile, Nasdaq’s European exchanges welcomed 207 new listings. New listings in 2021 included the IPOs of Rivian, the largest by capital raised, and GlobalFoundries as well as 33 listing switches including Honeywell, Palo Alto Networks and Baker Hughes.

Segment Details

Net revenues at Market Services were up 5% from the year-ago quarter to $303 million. This upside was largely owing to positive impact from organic growth. It was partially offset by a $2 million decrease from the impact of changes in FX rates.

Revenues at Corporate Platforms increased 16.5% year over year to $162 million, driven by higher listings services revenues as well as IR & ESG revenues.

Investment Intelligence revenues rose 17.6% year over year to $288 million. Higher market data, index and analytics revenues drove the upside.

Revenues at Market Technology increased 23.6% year over year to $131 million, largely on account of higher Anti Financial Crime Technology revenues.

Full-Year Update

Adjusted earnings per share of $7.56 surpassed the Zacks Consensus Estimate of $7.41. The bottom line improved 22.3% year over year.

Total revenues increased 18% from the year-ago quarter to $3.42 billion and beat the Zacks Consensus Estimate of $3.40 billion.

Financial Update

Nasdaq had cash and cash equivalents of $393 million as of Dec 31, 2021, down 85.6% from 2020-end level. Long-term debt decreased 13.1% from 2020-end level to $4.8 billion as of Dec 31, 2021.

Capital Deployment

The company returned $1,293 million of cash to shareholders in 2021, including $943 million in share repurchases and $350 million in dividends.

As of Jan 25, 2022, there was $784 million remaining under the board authorized share repurchase program.

Guidance

Nasdaq expects its 2022 non-GAAP operating expense guidance in the range of $1.68 billion to $1.76 billion.

Nasdaq forecast non-GAAP tax rate in the range of 24% to 26% in 2022.

Nasdaq and AWS teamed up to transform capital markets by leveraging benefits of a cloud enabled infrastructure. Nasdaq and Amazon Web Services, Inc. (“AWS”) announced a multi-year partnership to build the next generation of cloud-enabled infrastructure for the world’s capital markets. Nasdaq will utilize a new edge computing solution that is co-designed by Nasdaq and AWS specifically for market structure. Beginning in 2022, Nasdaq plans to migrate its North American markets to AWS in a phased approach, starting with Nasdaq MRX, a U.S. options market.

Zacks Rank

Nasdaq currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

CME Group Inc. CME is slated to release fourth-quarter 2021 earnings on Feb 9. The Zacks Consensus Estimate for the fourth quarter is pegged at $1.65 per share, indicating an increase of 18.7% from the year-ago reported figure.

CME Group beat estimates in the three reported quarters of 2021.

Intercontinental Exchange Inc. ICE is scheduled to release fourth-quarter 2021 earnings on Feb 3. The Zacks Consensus Estimate for the fourth quarter is pegged at $1.32, indicating an increase of 16.8% from the year-ago reported figure.

Intercontinental Exchange beat estimates in the three reported quarters of 2021.

Cboe Global Markets, Inc. CBOE is set to release fourth-quarter 2021 earnings on Feb 4. The Zacks Consensus Estimate for the fourth quarter is pegged at $1.53, indicating an increase of 26.4% from the year-ago reported figure.

Cboe Global beat estimates in the three reported quarters of 2021.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intercontinental Exchange Inc. (ICE) : Free Stock Analysis Report

CME Group Inc. (CME) : Free Stock Analysis Report

Nasdaq, Inc. (NDAQ) : Free Stock Analysis Report

Cboe Global Markets, Inc. (CBOE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance