After Muted Minutes Response, Pressure Squarely on Powell to Deliver Powerful Message

In the aftermath of the release of the minutes of the July Federal Reserve monetary policy meeting, we saw another bond market yield curve inversion, but other than that, the response in the financial markets was pretty tame.

Does this mean investors have already become accustomed to the phenomenon, or that the minutes are old news and investors would rather keep their powder dry until they hear from Fed Chief Jerome Powell on Friday?

Given that the minutes are old news and usually are a reiteration of the Federal Reserve’s monetary policy statement and press conference remarks from Powell, the response seems reasonable. Essentially, the minutes contained no surprises.

The price action in the Treasury and stock markets is interesting. In my opinion. The yield inversion was the warning signal to the Federal Open Market Committee (FOMC) to be aggressive in its quest to save the economy, while the strength in the stock market indicates that investors are betting that they will do the right thing in a timely manner.

Bond Market Yield Curve Inverts

Shortly after the Fed’s 18:00 GMT release of its minutes, the yield curve between the 2-year note and the 10-year note flattened. It then briefly inverted a little later with the 2-year yield rising above the 10-year yield. This move was similar to the one made about a week ago.

I think it’s best to describe this “brief inversion” as a “flash” recession signal. In other words, this is a warning to the Fed to act aggressively to prevent a recession. I know there are some who believe that since it flashed the recession, it is going to happen. This is not the right way to look at the signal. There are other events that have to take place before we actually have a recession.

Credit Suisse ‘Recession Dashboard’ Shows Economy is Nowhere Near Recession

Remember the classic definition of a recession? An economic recession is typically defined as a decline in gross domestic product (GDP) for two or more consecutive quarters. Additionally, keep in mind the research from Credit Suisse. Its shows that stocks usually rally after the yield-curve inverts, and that an actual recession tends to begin on average about 22-months after the inversion.

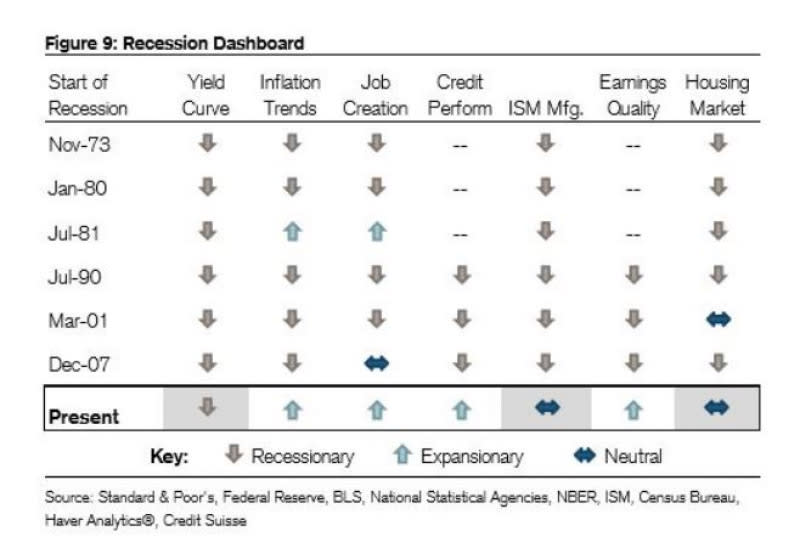

According to the current Credit Suisse ‘Recession Dashboard’, the yield curve is the only economic indicator pointing to a recession.

Furthermore, in past recessions, indicators like inflation trends, job creation, credit performance, ISM manufacturing, earnings quality and the housing markets were all recessionary or neutral, while the current state of the economy is telling a different story.

Treasury Traders Issue Warning to Fed

Given the Credit Suisse data and the muted reaction to the Fed minutes, I have to conclude that Wednesday 2-year/10-year yield inversion was just a warning to the Fed that a recession could develop.

Furthermore, it shows that investors want Federal Reserve Chairman Jerome Powell and the FOMC members to cut very aggressively. Due to the muted reaction in the financial markets, a dovish spin by Powell on Friday should trigger a more volatile reaction in the markets.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance