Muted Lending, High Costs to Mar KeyCorp (KEY) Q2 Earnings

KeyCorp KEY is scheduled to report second-quarter 2019 results on Jul 23, before the opening bell. The quarter did not witness significant improvement in the lending scenario, particularly in the areas of commercial and industrial, which account for nearly 50% of KeyCorp’s average loan balances.

In fact, the Zacks Consensus Estimate for the company’s average total loans and average interest earning assets show that these are likely to rise modestly in the to-be-reported quarter. The consensus estimate for average total loans of $90.5 billion indicates growth of nearly 1% from the previous quarter’s reported figure.

Also, the consensus estimate for average interest earning assets of $127.8 billion suggests marginal rise on a sequential basis.

Thus, given soft loan growth, flattening of the yield curve and steadily rising deposit betas; the company’s net interest income (NII) growth is expected to remain moderate in the to-be-reported quarter. The Zacks Consensus Estimate for NII (tax-equivalent basis) for the second quarter is pegged at $999 million, indicating a rise of 1.4% from the prior quarter.

Now, let’s check out the other main factors that are likely to influence KeyCorp’s second-quarter performance:

Non-interest income to remain relatively stable: Decent equity markets performance and the central banks’ dovish stance seem to have supported equity issuance across the globe in the second quarter. However, fears of economic slowdown somewhat weighed on companies’ plans to raise fresh capital by issuing shares. Additionally, relatively higher rates and several geopolitical concerns adversely impacted debt issuances in the to-be-reported quarter. These are likely to have hurt KeyCorp’s investment banking performance.

Moreover, while dealmakers across the globe were active during the second quarter, global deal value and volume declined due to higher borrowing costs. Thus, the company’s advisory fees are likely to be negatively impacted. Nonetheless, the strong M&A deal pipeline from the previous quarters will offer some respite.

Nevertheless, mortgage banking fees are projected to improve due to an expected increase in refinancing activities, mainly driven by lower mortgage rates, seasonality and the Federal Reserve’s accommodative stance.

Expenses might not provide much support: While KeyCorp’s efforts to diversify products, reorganize operations and exit unprofitable/non-core businesses have helped in saving costs, its continued investments in franchise and inorganic growth strategies are expected to lead to rise in overall expenses.

Asset quality to offer some support: The consensus estimate for non-performing assets of $583 million indicates a 2.3% decline from the previous quarter’s reported figure. Likewise, the estimate for non-performing loans of $541 million suggests a 1.3% decrease from the prior quarter’s reported figure.

Here is what our quantitative model predicts:

Chances of KeyCorp beating the Zacks Consensus Estimate in the second quarter are low. This is because it doesn’t have the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for KeyCorp is -2.88%.

Zacks Rank: The company currently carries a Zacks Rank #4 (Sell).

Notably, the Zacks Consensus Estimate for KeyCorp’s earnings for the to-be-reported quarter is pegged at 44 cents, which indicates no change from the year-ago quarter’s reported figure. The consensus estimate for sales of $1.62 billion suggests nearly 1% decline from the prior-year quarter’s reported number.

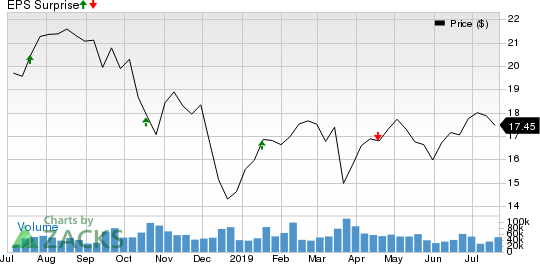

KeyCorp Price and EPS Surprise

KeyCorp price-eps-surprise | KeyCorp Quote

Stocks That Warrant a Look

Here are some finance stocks that you may want to consider as these have the right combination of elements to post an earnings beat this quarter, per our model.

T. Rowe Price Group, Inc. TROW has an Earnings ESP of +0.33% and sports a Zacks Rank #1 (Strong Buy) at present. The company is scheduled to release results on Jul 24.

Franklin Resources, Inc. BEN is slated to release results on Jul 30. It currently has an Earnings ESP of +0.13% and flaunts a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ares Capital Corporation ARCC is slated to release results on Jul 30. It presently has an Earnings ESP of +1.02% and a Zacks Rank #2 (Buy).

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KeyCorp (KEY) : Free Stock Analysis Report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance