Here’s more evidence of Wall Street’s obsession with technology

Wall Street banks are well-aware of the potential change technology could bring to its field — and new data shows they don’t want to miss out on a chance to team up with financial tech startups early on.

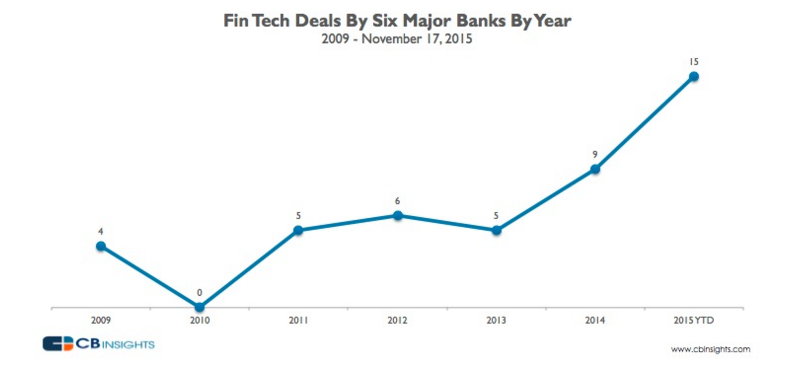

According to CB Insights, big banks have been stepping up their investments in financial tech startups in a major way this year, with more than a third of the deals since 2009 happening in the first 11 months of 2015. Fifteen of the 44 total investments made in that span were done this year, compared to just 9 in the previous year and 4 in 2009.

CB Insights

Citi Ventures, Citi Group’s venture arm, has been leading the pack with 20 total investments in the 6-year period, but Goldman Sachs has been the most active this year, with funding in Circle Internet Financial and FinanceIt, according to CB Insights. The report also notes that a lot of the banks are now co-investing in the same deals, as they did with the $100 million round in Symphony, the communications app that’s considered to be a Bloomberg terminal competitor.

Financial tech startups have been drawing a lot of interest lately for offering services that were traditionally only available through banks, such as lending, payments, and wealth management, in a cheaper and more efficient way. Companies like Lending Club, Square, and Venmo are some of the biggest names in this space.

In fact, a recent survey by software company Temenos showed that bankers consider technology to be the biggest threat to their business, while more than a half of them said they plan on spending more on IT this year.

Some of the biggest names in finance have also been sending warning signs to banks over the rise of financial tech startups.

JP Morgan Chase CEO Jamie Dimon wrote in a note earlier this year, “There are hundreds of startups with a lot of brains and money working on various alternatives to traditional banking,” while ex-Barclays CEO Antony Jenkins recently said, “We will see massive pressure on incumbent banks, which will struggle to implement new technologies at the same pace as their new rivals.”

NOW WATCH: A 56-year-old man filmed a conversation with his 18-year-old self, and it’s going viral

The post Here’s more evidence of Wall Street’s obsession with technology appeared first on Business Insider.

Yahoo Finance

Yahoo Finance