Monolithic Power (MPWR) Q1 Earnings & Revenues Top Estimates

Monolithic Power Systems, Inc. MPWR reported first-quarter 2020 non-GAAP earnings of 95 cents per share, which beat the Zacks Consensus Estimate by 1%. Notably, the figure increased 13.1% on a year-over-year basis.

Revenues of $165.8 million increased 17.3% from the year-ago quarter’s figure and surpassed the Zacks Consensus Estimate by 3.4%. The reported figure was also towards the higher end of management’s guidance of $161-$167 million.

Strong demand across Computing & Storage and Automotive and Communications end-markets as well as a diversified multi-market strategy drove year-over-year growth.

Notably, shares of the company have returned 7.4% in the past year against the industry’s decline of 14.5%.

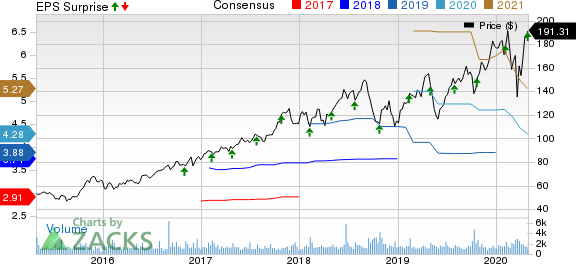

Monolithic Power Systems, Inc. Price, Consensus and EPS Surprise

Monolithic Power Systems, Inc. price-consensus-eps-surprise-chart | Monolithic Power Systems, Inc. Quote

Quarter in Details

Revenues by Product Family

Revenues in the DC to DC segment (94.6% of total revenues) increased 18.2% year over year to $156.8 million. Moreover, Lighting Control (5.4% of total revenues) revenues increased 2.9% to $8.9 million.

Revenues by End Market

Computing & Storage (31.3% of total revenues) revenues rallied 32.6% year over year to $52 million. The market’s solid performance was driven by robust sales of cloud servers and storage.

Consumer (22.6%) revenues dropped 1.9% from the year-ago quarter’s figure to $37.4 million due to softening demand for set-top boxes and flat-panel TVs.

Industrial (15.2%) revenues increased 18.3% year over year to $25.2 million due to strong performance of games, smart meters and security applications.

Automotive (14.1%) revenues were $23.3 million, up 13.6% year over year. This was driven by sales of infotainment, safety and connectivity application products.

Communications (16.8%) revenues rallied 25.6% year over year to almost $27.9 million. The end-market benefited from strong 5G networking sales.

Margins in Detail

Non-GAAP gross margin contracted 10 basis points (bps) from the year-ago quarter’s level to 55.5%. Management had predicted the figure to be between 55.4% and 56%.

Non-GAAP operating expenses amounted to $46.1 million during the reported quarter, up 18.1% year over year. As a percentage of revenues, the figure expanded 20 bps on a year-over-year basis to 27.8%.

Non-GAAP operating income improved almost 9% year over year to $45.9 million. Non-GAAP operating margin (as a percentage of revenues) contracted 30 bps from the year-ago quarter’s level to 27.7%.

Balance Sheet & Cash Flow

As of Mar 31, 2020, cash, cash equivalents and short-term investments were $489.3 million, up from $455.4 million reported as of Dec 31, 2019.

Monolithic Power generated operating cash flow of approximately $51.4 million compared with $61 million in the prior quarter.

Guidance

For second-quarter 2020, Monolithic Power projects revenues between $167 million and $173 million. The Zacks Consensus Estimate for revenues is currently pegged at $166.5 million, which indicates growth of 10.3% from the year-ago quarter’s reported figure.

Management anticipates non-GAAP gross margin between 55.3% and 55.9%.

Conclusion

We believe that Monolithic Power has significant prospects on account of increased demand for storage and computing as well as data centers and cloud due to COVID-19-induced work from home trends.

Moreover, the outbreak of the pandemic has created opportunities for the company in the medical devices vertical. Notably, the company has built a low-cost emergency ventilator based on an open-source MIT design to aid medical workers in their fight against the pandemic. (Read More: Monolithic Power Designs Ventilator to Fight COVID-19)

However, softening demand in consumer segment is anticipated to dampen top-line growth.

Zacks Rank & Stocks to Consider

Currently, Monolithic Power carries a Zacks Rank #3 (Hold).

Netlist, Inc. NLST, Pixelworks, Inc. PXLW and InterDigital, Inc. IDCC are some better-ranked stocks worth considering in the broader computer and technology sector, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Netlist and InterDigital is pegged at 15% each, while Pixelworks is pegged at 20%.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Monolithic Power Systems, Inc. (MPWR) : Free Stock Analysis Report

Pixelworks, Inc. (PXLW) : Free Stock Analysis Report

Netlist, Inc. (NLST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance