MoneyGram (MGI) Unveils Digital Money Transfers in Brazil

MoneyGram International, Inc. MGI recently announced the launch of its digital platform, MoneyGram Online ("MGO"), across Brazil. For the introduction of the platform, MGI has collaborated with Frente Corretora, a fintech company in Brazil.

Brazilian consumers can start leveraging MGI’s website to seamlessly send money within a few seconds to families and loved ones across the globe. The recipients can choose to receive funds either in their accounts or mobile wallets or may even opt to receive cash from retail locations.

Further, the country’s consumers can engage in fee-less transactions with multiple benefits through the MoneyGram website.

An initiative similar to the latest one reinforces MoneyGram’s effort to expand the geographic reach of its digital business. The recent service launch is likely to empower MGI in attracting new consumers and solidifying relationships with existing ones. Venturing into Brazil is also likely to provide an opportunity for MGI to boost market share in the densely populated country.

Undoubtedly, a growing market share will enable MoneyGram to further strengthen its footprint across Brazil. Until the time the digital platform of MGI was launched, Brazil’s consumers continued to engage in seamless money transfers for more than two decades using MoneyGram’s 1000+ retail locations.

The latest move of MGI to bring about seamless digital remittances throughout Brazil, a Latin American country, can be termed a time-opportune move as well. Per the World Bank, outbound money transfers from Latin America have been on an uptrend in recent years. Brazil’s rising immigrant population coupled with the solid demand for digital solutions offers MoneyGram’s digital arm enough scope to capitalize on the current scenario.

MoneyGram has frequently resorted to partnerships with financial service providers or pursued technology investments to build a powerful digital platform. The strength of the platform has lured several fintech to avail MGI’s vast global ecosystem to upgrade their service suite and boost the business scale.

In November 2022, MoneyGram teamed up with Batelco (a well-known Bahrain-based telecommunications company)-owned financial super app Beyon Money to aid Bahrain’s consumers with seamless outbound money transfers across more than 200 countries and territories worldwide, probably from this year itself.

A solid money transfer platform might have intrigued Chicago-based private equity firm Madison Dearborn Partners, LLC, to purchase MoneyGram. The transaction is likely to close in the fourth quarter of 2022.

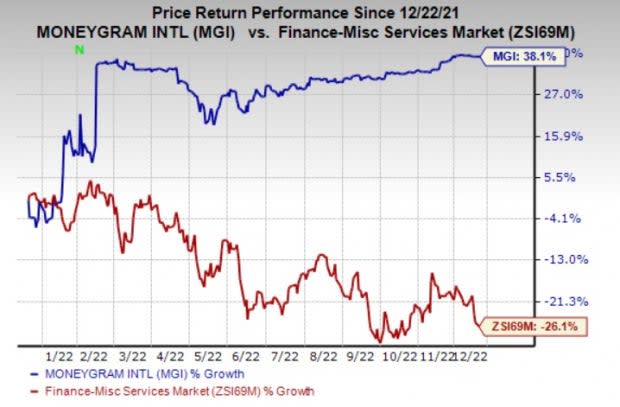

Shares of MoneyGram have soared 38.1% in a year against the industry’s 26.1% decline.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

MGI currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the Finance space are Amerant Bancorp Inc. AMTB, CF Bankshares Inc. CFBK and Enterprise Financial Services Corp EFSC, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Amerant Bancorp’s earnings surpassed estimates in three of the trailing four quarters and missed the mark onc, the average being 24.32%. The Zacks Consensus Estimate for AMTB’s 2022 earnings suggests an improvement of 35.4% from the year-ago reported figure. The consensus mark for AMTB’s 2022 earnings has moved 10% north in the past 60 days.

The bottom line of CF Bankshares beat estimates in two of the trailing four quarters and missed the mark twice, the average surprise being 1.82%. The Zacks Consensus Estimate for CFBK’s 2022 earnings suggests an improvement of 6.1% from the year-ago reported figures. The consensus mark for CFBK’s 2022 earnings has moved 5% north in the past 30 days.

Enterprise Financial Services’ earnings outpaced estimates in each of the last four quarters, the average surprise being 9.93%. The Zacks Consensus Estimate for EFSC’s 2022 earnings suggests an improvement of 2.2%, while the same for revenues suggests growth of 21.9% from the corresponding year-ago reported figures. The consensus mark for EFSC’s 2022 earnings has moved 2.2% north in the past 60 days.

Shares of CF Bankshares and Enterprise Financial Services have gained 10.1% and 3.4%, respectively, in a year. However, the Amerant Bancorp stock has lost 21.7% in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MoneyGram International Inc. (MGI) : Free Stock Analysis Report

Enterprise Financial Services Corporation (EFSC) : Free Stock Analysis Report

CF Bankshares Inc. (CFBK) : Free Stock Analysis Report

Amerant Bancorp Inc. (AMTB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance