MoneyGram (MGI) Ties Up to Ease Money Remittances in Bahrain

MoneyGram International, Inc. MGI recently joined forces with Batelco (a well-known Bahrain-based telecommunications company)-owned financial super app Beyon Money. The tie-up is likely to enable the app to help Bahrain’s consumers engage in sending money digitally across more than 200 countries and territories worldwide from this year itself.

MGI seems to upgrade the remittance prowess of Beyon Money’s super app and expand the offering throughout the Gulf Cooperation Council, the Middle East and North Africa. Apart from unleashing innovative remittance capabilities, the app serves as a linking node between the country’s consumers and their local bank accounts through which they can track their transaction history from a single gateway, drawing vital financial insights and getting a better grasp on their spending habits.

The latest partnership is expected to generate higher payment volumes for MoneyGram, which might provide an impetus to its processing revenues in the days ahead. The alliance marks yet another instance of financial technology companies accessing MoneyGram’s widespread global money transfer network.

It took years for MoneyGram to build a solid digital arm on the back of continuous partnerships and technological upgrades. Over time, these helped reinforce its status as one of the most trustworthy international money transfer companies. This by far explains the reason why several fintechs remain intrigued to avail MGI’s vast global ecosystem to upgrade their service suite and boost the business scale.

MoneyGram seems to keep close tabs on strengthening its footprint across the Middle East, one of the most rapidly evolving outbound remittance regions. The recent move bears testament to this as Bahrain (a Gulf nation in the Middle East) has been witnessing a swift rise in outbound remittances over the past two decades, per the World Bank.

MGI frequently resorts to partnerships with the Middle East fintechs or makes investments in the same. The reason can be attributed to booming digital growth witnessed in the region. This serves a perfect ground for MoneyGram to capitalize on growing demand for speedy money transfers via its money transfer platform. A tech-savvy population with higher smartphone usage and increased Internet penetration is likely to increase utilization of the MGI platform to a great degree.

MoneyGram leaves no stone unturned to grab opportunities to boost its money transfer platform. Hence, it agreed to be acquired by Chicago-based private equity firm Madison Dearborn Partners, LLC, for $1.8 billion. Expected to close in the fourth quarter of 2022, the buyout is likely to upgrade MGI’s digital platform by utilizing the acquirer’s payment prowess and experience in boosting the digital business.

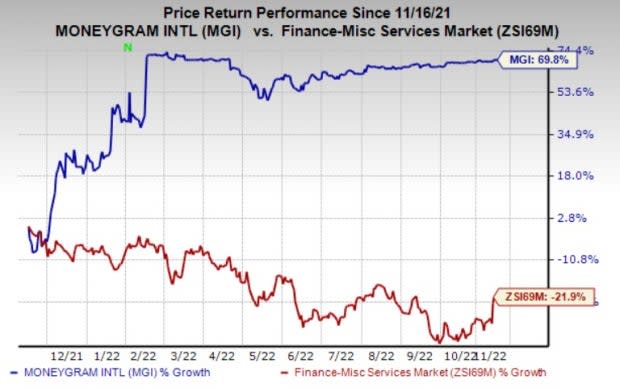

Shares of MoneyGram have soared 69.8% in a year against the industry’s decline of 21.9%. MGI currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Finance space are Amalgamated Financial Corp. AMAL, BlackRock Capital Investment Corporation BKCC and Community West Bancshares CWBC. While Amalgamated Financial flaunts a Zacks Rank #1 (Strong Buy), BlackRock Capital Investment and Community West Bancshares carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Amalgamated Financial’s earnings surpassed estimates in each of the trailing four quarters, the average being 19.41%. The Zacks Consensus Estimate for AMAL’s 2022 earnings suggests an improvement of 51.7%, while the same for revenues suggests growth of 31.3% from the corresponding year-ago reported figures. The consensus mark for AMAL’s 2022 earnings has moved 2.4% north in the past 60 days.

The bottom line of BlackRock Capital Investment beat estimates in three of the trailing four quarters and missed the mark once, the average surprise being 6.70%. The Zacks Consensus Estimate for BKCC’s 2022 earnings suggests an improvement of 40.7%, while the same for revenues suggests growth of 22.8% from the corresponding year-ago reported figures. The consensus mark for BKCC’s 2022 earnings has moved 5.6% north in the past 30 days.

Community West Bancshares’ earnings outpaced estimates in two of the last four quarters and missed the mark twice, the average surprise being 8.19%. The Zacks Consensus Estimate for CWBC’s 2022 earnings suggests an improvement of 0.7%, while the same for revenues suggests growth of 7.3% from the corresponding year-ago reported figures. The consensus mark for CWBC’s 2022 earnings has moved 7.9% north in the past 30 days.

Shares of Amalgamated Financial and Community West Bancshares have gained 37.2% and 14%, respectively, in a year. However, the BlackRock Capital Investment stock has lost 10.4% in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MoneyGram International Inc. (MGI) : Free Stock Analysis Report

BlackRock Capital Investment Corporation (BKCC) : Free Stock Analysis Report

Community West Bancshares (CWBC) : Free Stock Analysis Report

Amalgamated Financial Corp. (AMAL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance