Mondelez (MDLZ) Invests $200M in Opava Manufacturing Facility

In an effort to build an outstanding supply chain, Mondelez International, Inc. MDLZ has invested $200 million in its Opava biscuit manufacturing facility ever since 2014. For the European market, this manufacturing unit produces Power Brands like Oreo, belVita, Milka and Cadbury. Notably, the company’s portfolio includes seven brands that generate revenues in excess of $1 billion and have been christened as Power Brands.

Over the last few years, the company have opened or upgraded Mondel??z International Sites like Sri City, India; Salinas, Mexico; Bournville, the United Kingdom; and Bahrain.

International Expansion: A Key Catalyst

Mondelez is reviving its brand portfolio through product innovation and extending its brands to newer geographies and platforms. Also, the company’s expenditures on advertisement are biased toward the high-margin Power Brands. In fact, it is increasing investments in in-store execution and advertising to support the Power Brands and innovation funded by cost savings from the company’s restructuring plans.

The company generates around 75% of its revenues from outside the United States, with around 40% coming from the emerging markets like Brazil, China, India, Mexico, Russia and Southeast Asia. This is because food/beverage companies are increasingly investing in developing and the emerging markets like India, China and Brazil, which boast significant growth potential owing to relatively low per-capita consumption. Also, this Zacks Rank #3 (Hold) company is keen on expanding its business via acquisitions. In this regard, Mondelez’s acquisition of the LU biscuit business in 2007 and Cadbury in 2010 are the worth mentioning. These buyouts significantly expanded its routes-to-market across the globe, especially in Europe and emerging markets. Further, the company intends to make more acquisitions for improving its categories or distribution capabilities. In May 2018, Mondelez inked a deal to acquire Tate’s Bake Shop for approximately $500 million. Tate’s has been one of the fastest growing biscuit brands in the United States and complements well with Mondelez’s portfolio.

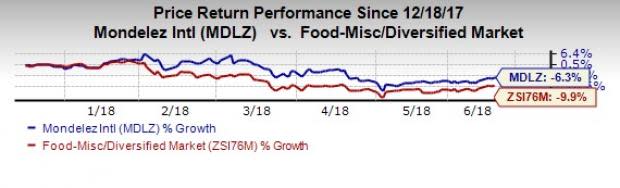

Stock Price Performance

So far, the current year has not been encouraging for Food - Miscellaneous industry as well as Mondelez. Year to date, the company has lost 6.3% compared with the industry’s 9.9% decline. Stocks such as B&G Foods, Inc. BGS, Darling Ingredients Inc. DAR and Blue Apron Holdings, Inc. APRN, which belong to the same industry, has also witnessed a decline of 15.8%, 2.14% and 23.1%, respectively.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

B&G Foods, Inc. (BGS) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Darling Ingredients Inc. (DAR) : Free Stock Analysis Report

Blue Apron Holdings, Inc. (APRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance