Mohawk (MHK) Benefits From Strategic Moves & Acquisitions

Mohawk Industries, Inc. MHK has been riding on strategic initiatives and its global presence via acquisitions. Also, multiple price increases in most product categories to overcome inflation is commendable.

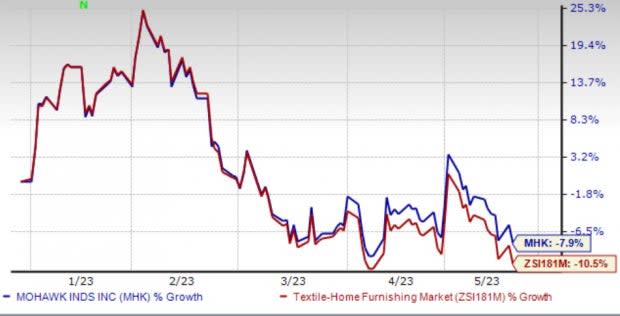

Although the stock has declined so far this year but it outperformed the Zacks Textile - Home Furnishing industry. The industry has been grappling with significant inflation and other operating costs. Nonetheless, MHK’s dominant market share in extremely fragmented and competitive industry is impressive.

Let’s delve deeper into the factors supporting growth of this Zacks Rank #2 (Buy) company.

Image Source: Zacks Investment Research

Strategic Moves to Combat Inflation: In order to combat inflationary pressure and labor shortages, Mohawk has been working on various strategic initiatives. Aligning ceramic production with demand in the United States, realigning its North America carpet operations, optimizing LVT manufacturing and ramping up its new plant are the most significant moves. Also, it has been focusing on new product categories, introducing innovative product extensions and optimizing the recent buyouts.

Mohawk is boosting sales personnel and marketing to improve its penetration of new and existing products. To that note, MHK is streamlining operations to enhance efficiencies, and leveraging automation and process enhancements to lower costs.

Meanwhile, Mohawk’s moves to reduce SG&A expenses, headcount, lower-performing products and SKUs will help it generate higher profits in future. It has also been closing less efficient operations and investing in more productive equipment.

Bolt-On Acquisitions: Acquisitions has been an important part of Mohawk’s growth strategy. Since 1992, Mohawk acquired 53 companies (till 2022) which broadened its product portfolio, and expanded its geographic footprint and market share.

In first-quarter 2023, MHK completed the acquisitions of two ceramic tile businesses in Brazil and Mexico within Global Ceramic. The Brazilian ceramic tile business, Elizabeth Revestimentos, is anticipated to display exceptional sales value in future. The Mexican ceramic business, Grupo Industrial Saltillo (GIS), is expected to position Mohawk as the second-largest ceramic producer in Mexico.

Strong Position & Presence: Mohawk is one of the largest flooring manufacturers in the global market. In addition, it commands a competitive advantage in the laminate flooring channel, backed by the Laminate and Wood segment’s industry-leading design, patented technologies, and brands.

MHK is making higher internal investments to boost capacity and enter new markets. It is also adding unique capabilities to introduce differentiated products and anticipates higher productivity improvement in the days ahead.

Particularly, it enjoys strong international presence, with higher net sales being generated outside the United States. The company has presence in Australia, Brazil, Canada, Europe, India, Malaysia, Mexico, New Zealand and Russia. The strong international presence allows MHK to capitalize on high demand in the lucrative global market.

Stocks to Consider

Some other top-ranked stocks in the Zacks Consumer Discretionary sector are MGM Resorts International MGM, Boyd Gaming Corporation BYD and Crocs, Inc. CROX. While MGM flaunts a Zacks Rank #1 (Strong Buy), BYD and CROX carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

MGM Resorts has a trailing four-quarter earnings surprise of 81%, on average.

The Zacks Consensus Estimate for MGM’s 2024 sales and EPS indicates rises of 2.2% and 31%, respectively, from the year-ago period’s reported levels.

Boyd Gaming has a trailing four-quarter earnings surprise of 13.7%, on average.

The Zacks Consensus Estimate for BYD’s 2023 sales and EPS indicates improvements of 2.3% and 3.8%, respectively, from the year-ago period’s actuals.

Crocs has a trailing four-quarter earnings surprise of 19.6%, on average.

The Zacks Consensus Estimate for CROX’s 2023 sales and EPS indicates gains of 13% and 5.8%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGM Resorts International (MGM) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Mohawk Industries, Inc. (MHK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance