Most Miserable Economies of 2018 Stay Haunted by Inflation Beast

By Michelle Jamrisko and Catarina Saraiva

Rising prices are more of a threat to the global economy this year than joblessness, according to Bloomberg’s Misery Index, which sums inflation and unemployment outlooks for 66 economies.

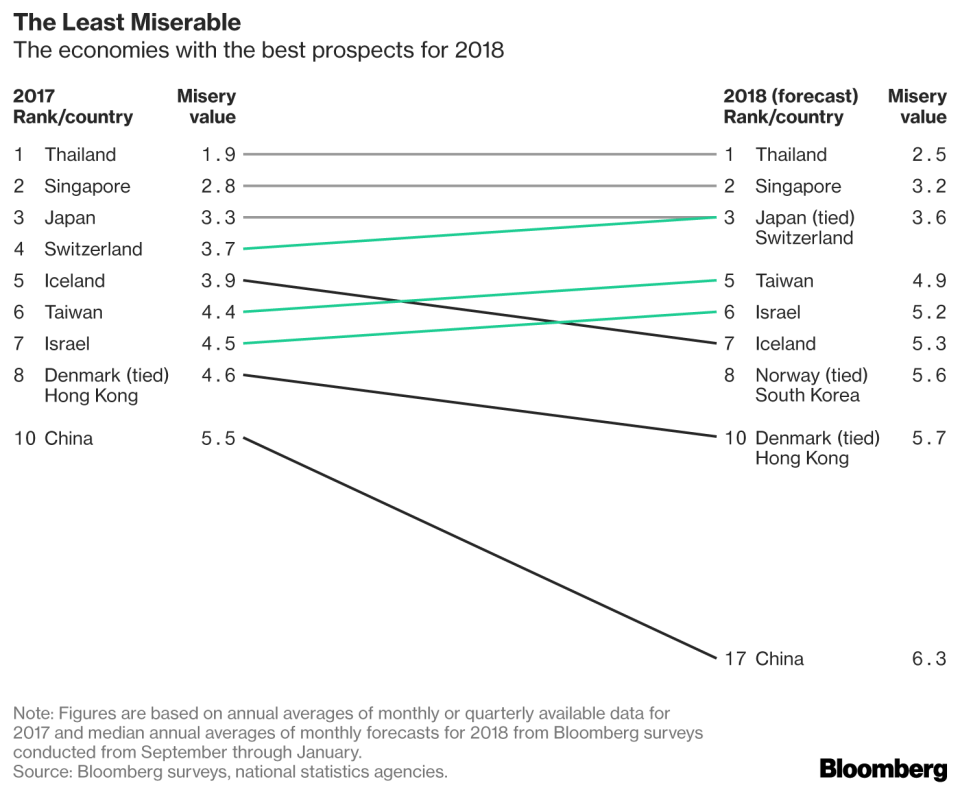

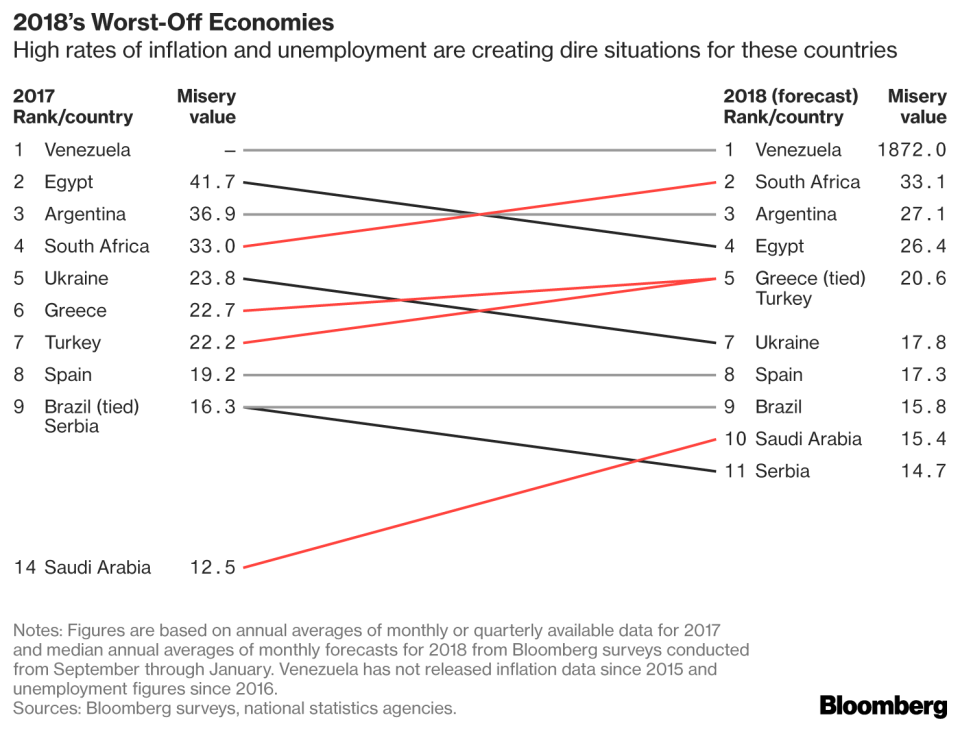

Venezuela marks its fourth year as the world’s most miserable economy, with a score that’s more than three times what it was in 2017. Thailand again claimed “least miserable” status, though the nation’s unique way of calculating unemployment makes No. 2 Singapore worth noting. Elsewhere, Mexico looks to make big strides this year as inflation becomes more manageable, while Romania absorbs more misery for the opposite reason.

The Bloomberg Misery Index relies on the age-old concept that low inflation and unemployment generally illustrate how good an economy’s residents should feel. Sometimes, of course, a low tally can be misleading in either category: Persistently low prices can be a sign of poor demand, and too-low joblessness shackles workers who want to switch to better jobs, for instance.

The results largely signal a global economic outlook that remains bright overall: Economists are penciling in 3.7 percent year-on-year growth for the world in 2018, matching last year’s pace that was the best since 2011, according to the Bloomberg survey median.

Some have not been so fortunate. In Venezuela, hyperinflation has left many economists throwing up their hands at the actual rate of price growth. Black-market currency rates have provided an angle on the numbers, while alternative measures have chased daily cost swings. A recent government slashing of grocery prices gave a brief reprieve to inflation, while the surveyed economists see it rising 1,864 percent this year.

It’s anyone’s guess: The International Monetary Fund’s latest estimate has that figure at 13,000 percent for this year after about 2,400 percent in 2017.

Romania also is heading in the wrong direction. Economists see a 3.3 percent inflation rate for 2018 after much more subdued price growth last year, pushing its misery down 16 notches, to No. 34. The National Bank of Romania is chasing inflation with interest-rate hikes, aiming to stay ahead of any overheating while growth surges on ballooning government spending.

At the other end of the spectrum, Mexico makes the biggest progress this year, moving 16 notches toward “least miserable” as economists remain optimistic that the central bank will be able to tame last year’s bout of high inflation, bringing it to an average 4.1 percent this year after 6 percent in 2017. Unemployment is set to remain around 3.4 percent.

Two caveats here: Mexico’s jobless figures don’t take into account the 60 percent or so of workers who are in the informal economy. And despite this year’s improvement, consumer confidence remains in a funk and Nafta negotiations might not see a happy ending.

Some other notable mentions:

Malaysia moves down the misery scale to No. 52 from No. 43 due to moderating inflation. The tepid price growth is allowing Bank Negara Malaysia to be patient with interest-rate hikes, even as they were first in the region this year to tighten this year.

Argentina, ranked at No. 3, belies a third year of improvement in its overall score, set to be the lowest since at least 2013, the year in which the IMF censured the country for covering up high inflation and when Bloomberg began calculating the data

South Korea and Norway, which also happened to perform well in the Bloomberg 2018 Innovation Index at Nos. 1 and 15, broke into the top-10 least miserable

Saudi Arabia, projected to make the biggest plunge from 2017 in its misery index number, climbs into the top 10 most-miserable economies

The U.S. will see its misery score improve to 6.2 this year from 6.5 in 2017 even as inflation rises following years of persistently low price gains, and as the labor market continues to tighten

China, the world’s second-largest economy, saw its misery score rise to 6.3 this year from 5.5 in 2017. Consumer prices are estimated to rise 2.3 percent this year, compared with 1.6 percent in 2017.

Asian economies are fortunate to escape the top 10 most miserable this year, which are otherwise geographically diverse with Europe, Latin America, and Africa almost equally represented.

To contact the reporters on this story: Michelle Jamrisko in Singapore at mjamrisko@bloomberg.net; Catarina Saraiva in Washington at asaraiva5@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net; Joshua Robinson at jrobinson37@bloomberg.net; Chris Bourke

© 2018 Bloomberg L.P

Yahoo Finance

Yahoo Finance