Microsoft (MSFT) Azure Expands Strategic Partnership With Epic

Microsoft MSFT announced that it expanded its long-standing partnership with Epic. The company will integrate Azure OpenAI Service with Epic’s industry-leading electronic health record ("EHR") software.

The long-standing partnership includes organizations to run Epic environments on the Microsoft Azure cloud platform.

The collaboration is focused to provide an array of AI-powered solutions. With EHR, it will provide enhanced care, improve financial integrity of health systems globally and boost productivity. Stanford Health Care, UW Health in Madison, Wisconsin and UC San Diego Health have already started integrating solutions to automatically draft query responses.

Industry experts have identified the need for modern hospitals and health care systems to reduce pressure on margins and costs. More than half of the hospitals in the United States reported negative margins in 2022. This was mainly due to inflation, supply disruptions, increased labour expenses and workforce shortage. Technology advancement and increased productivity can ensure long-term financial stability.

Microsoft believes that firms should use technology responsibly. Microsoft’s responsible AI commitment is driven by core values, which include accountability, transparency, inclusiveness, privacy, safety, reliability and fairness.

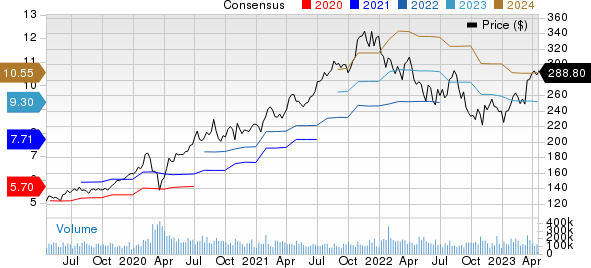

Microsoft Corporation Price and Consensus

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

Intense Competition in the Enterprise Public Cloud Space

The Zacks Rank #3 (Hold) company is among the leaders in the enterprise public cloud adoption market. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Microsoft have gained 3% in the past year against the Zacks Computer and Technology sector’s decline of 6.7% in the same period.

The Zacks Consensus Estimate for MSFT’s third-quarter 2023 earnings is pegged at a profit of $2.22 per share, indicating year-over-year growth of 0%. The Zacks Consensus Estimate for 2024 revenues is pegged at $230.23 billion, indicating year-over-year growth of 10.34%.

Microsoft Azure is a platform that can be used for various purposes like testing, creating, deploying and maintaining services. The company provides IaaS, SaaS and PaaS all under one platform unlike its competitors. It provides up to 600 services, which are available in 54 regions around the world.

According to a AlterWebHost report, Amazon.com’s AMZN Amazon Web Services ("AWS") leads the enterprise public cloud adoption market with 68% and Azure comes second with 58%. Other cloud services like Alphabet’s GOOGL Google Cloud comes third with 19%, followed by International Business Machines IBM Cloud with 15%.

AWS is one of the biggest competitors of Azure. The company's customers include industry giants like Netflix, Samsung, Nokia and NASA. Although it offers a wide range of products but it requires deep expertise to handle the products.

Google Cloud is built with cutting-edge hardware and it delivers technologically advanced products. Being one of the well-known brands across the globe, Google Cloud have servers in more than 200 countries, with products for almost all type of users.

IBM Cloud is a cloud compute solutions vendor that has expertise in high-performance bare metal servers. The company is highly suitable for large enterprises. It offers more than 170 products capable of executing containers, AI, blockchain, data management and IoT.

With slowing cloud spending, Microsoft Azure expects flat revenues in the coming quarters. Microsoft will look to gain market share and build loyal customers focusing on long-term gains to grow in a relatively slow market.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report