Micron Technology, Inc. (MU) Stock Dips Are Long Opportunities

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

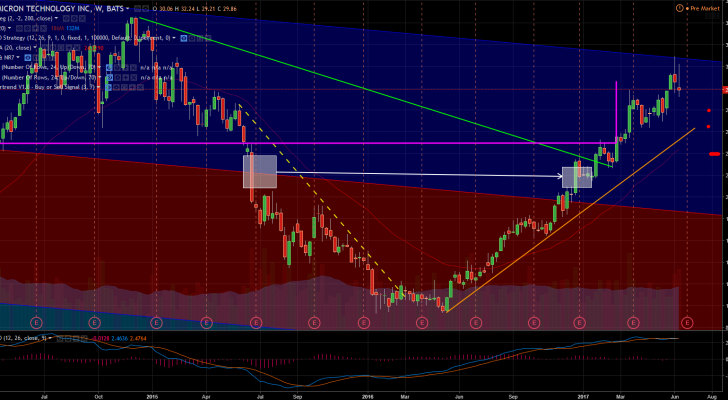

Micron Technology, Inc. (NASDAQ:MU) is a winner in the red-hot technology sector. The whole group’s steep rising wedge left us with nearly no clear long entry points, and MU stock hasn’t been much different.

Source: Mike Deal via Flickr

The rallies have been fierce, and the retracements rare. So when they come, I like to position for another run higher.

I am a conservative trader, so I usually like to leave my self room for error, even in strong momentum stocks. Besides, a small dip in Micron stock doesn’t not qualify as an obvious entry point upon which I can risk $30 per share. Remember: The stock was $12 about 52 weeks ago, which makes the $3 dip off $31 minimal. This is as big an opportunity as we are likely to get.

I could wait for a more significant dip, but it’s not likely to come anytime soon. So today, I will share an options trade on MU stock that leaves much room for error. The trick is to leverage proven support levels, thereby eliminating the the need to have impeccable timing.

Instead of chasing price targets, my Micron trade will profit without any out of pocket expense and without the need for a rally. Also, I will build a large buffer for more ease of mind. This is a process that I can repeat often because I am not as worried about timing as much as someone who is paying full price for the stock.

Fundamentally, MU stock is almost three times more expensive than that of Intel Corporation (NASDAQ:INTC) which actually pays dividends. So Micron is not a bargain, even after dips.

Technically, I think it’s constructive that Micron can maintain a rising wedge this steep for this long. It could become a concern if it falls out, as then bears could overshoot lower. But so far, that hasn’t been the case, so I’ll make the assumption that MU will be able to maintain its momentum.

Nevertheless, I am glad that I will have some room for error just in case.

Over the long-term, the whole sector is likely to prosper, and Micron is one of its leaders. So I can generate income out of thin air by selling downside risk against extreme fears that are not likely to materialize. Worst-case scenario, I am willing to own the shares at a discount should the price go against me in the short-term.

Let’s take a look at the trade.

How to Trade MU Stock

The bet: Sell the Oct $24 put and collect 80 cents per contract to open. Here I have an 80% theoretical chance of success, but if price falls below my strike, I will suffer losses below $23.2.

Selling naked options is not suitable for all investors. So for a milder version of this, I could use spreads instead.

The alternate: Sell the Oct $24/$23 credit put spread. Here I have about the same odds of winning, but with a limited risk profile. Do a little comparison shopping here. On the one hand, you could go with this spread, which yields 18%. Or you could try to chase MU stock outright at $30, then hope for an 18% rally in three months, with no room for error.

Sounds like an easy choice to me.

Selling options is risky, so never risk more than you’re willing and able to lose.

Learn how to generate income from options here. Nicolas Chahine is the managing director of SellSpreads.com. As of this writing, he did not hold a position in any of the aforementioned securities. You can follow him on Twitter at @racernic and stocktwits at @racernic.

More From InvestorPlace

The post Micron Technology, Inc. (MU) Stock Dips Are Long Opportunities appeared first on InvestorPlace.

Yahoo Finance

Yahoo Finance