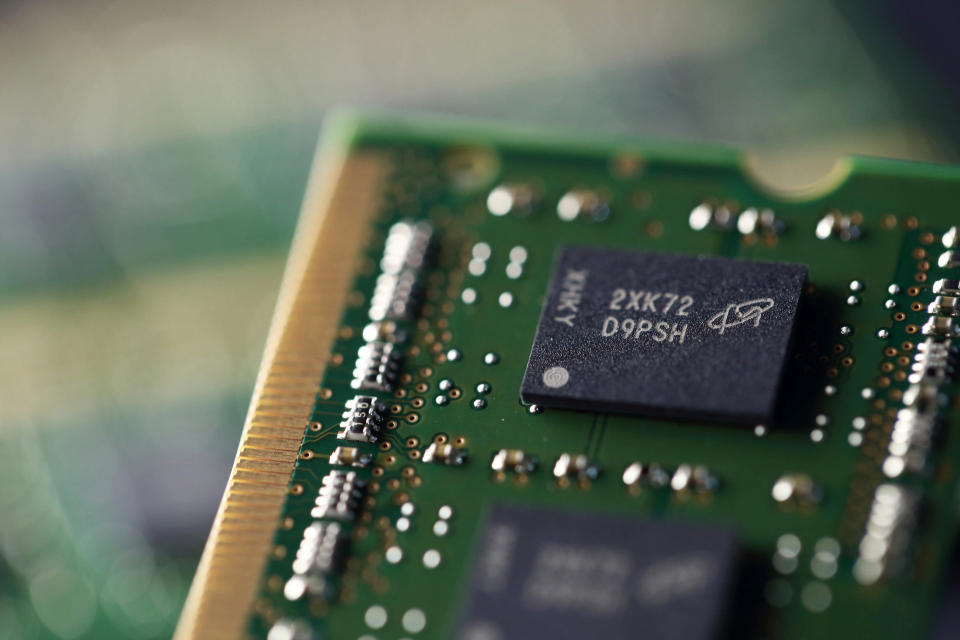

Micron shares fall on weaker-than-expected sales

Micron (MU) reported fiscal 2019 Q1 earnings after the market close Tuesday.

The chipmaker earned $2.97 per share during the quarter which was better than consensus estimates of $2.95 per share.

“Micron reported strong profitability in the fiscal first quarter, highlighted by double-digit year-over-year revenue growth across our major markets and solid business execution,” president and CEO Sanjay Mehrotra said in a statement. “Despite weak near-term industry supply-growth dynamics entering calendar 2019, Micron is well-positioned to deliver healthy profitability throughout the year.”

However, revenue came in weaker than anticipated at $7.91 billion. Analysts polled by Bloomberg were expecting $8.01 billion in revenue.

Shares of Micron were trading 1.41% lower in after-hours trade Tuesday as of 4:07 p.m. ET.

Semiconductors have been caught in the crosshairs of the escalating trade war between the U.S. and China. The Trump administration’s plan to increase tariffs on over $250 billion of Chinese goods from 10% to 25% in March if no trade deal is reached threatens to shake the entire semiconductor industry. China still relies heavily on advanced U.S. chips, and if those tariffs increase to 25%, it is expected to hurt the U.S. chipmakers.

Micron shares have suffered this year along with the rest of the chip space. After hitting a nearly 18-year high in May, shares have fallen 47% from those levels.

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Heidi:

Why 2019 could be a stellar year for gold

Facebook and PayPal are a match made in heaven, according to MoffettNathanson

Investors are behaving like ‘rats on a sinking ship,’ strategist says

Yahoo Finance

Yahoo Finance