Microchip ( MCHP) Updates Outlook Amid Coronavirus Concerns

Microchip Technology Inc. MCHP recently updated its guidance for fourth-quarter fiscal 2020 revenues.

The company now anticipates fiscal fourth-quarter net sales to grow 3% sequentially compared with the previously revised guidance of flat sequential growth, provided on March 2. Microchip generated net sales of $1.29 billion in the fiscal third-quarter.

Notably, the Zacks Consensus Estimate for fiscal fourth-quarter revenues is currently pegged at $1.29 billion.

Microchip also stated that there has been a growth in bookings in fiscal fourth quarter. The company attributes the surge to be triggered by coronavirus crisis-led supply chain disruptions. The company also notes that backlog for first-quarter fiscal 2021 improved 9% compared with fourth-quarter of fiscal 2020.

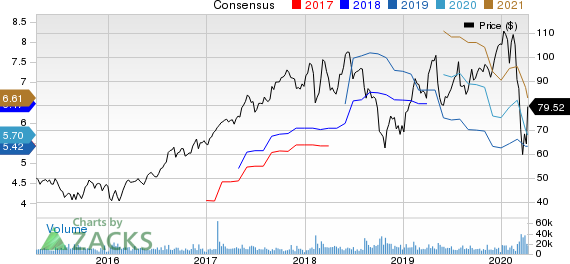

Markedly, shares of Microchip moved up 8.4% on Apr 8, eventually closing at $79.52. The stock has declined 24% year to date compared with the industry’s fall of 24.6%.

Microchip Technology Incorporated Price and Consensus

Microchip Technology Incorporated price-consensus-chart | Microchip Technology Incorporated Quote

Cost Cutting Measures to Tide the Crisis

Nevertheless, Microchip anticipates the surge in bookings to be temporary and that the economic slowdown caused by the coronavirus pandemic will lead to weakened demand for its products.

As a result, Microchip is taking stringent cost-cutting measures. Markedly, employees from all levels of the hierarchy, including the CEO, will be taking pay cuts starting from April 20.

Further, the company expects to reduce capital expenditures for fiscal 2021 to $50-$70 million, mainly for maintenance of capital and to support the launch of new products.

Downward Estimate Revision

The company provided no other updates on the remaining financial metrics. Per the previous guidance provided in the last earnings call, non-GAAP earnings per share were projected in the range of $1.35-$1.51 per share (mid-point $1.43).

In the past 30 days, the Zacks Consensus Estimate for fiscal fourth-quarter earnings moved down 3% to $1.26 per share. The consensus mark indicates a decline of 14.9% from the year-ago quarter’s reported figure.

Wrapping Upa

Microchip’s strength in its 8-bit, 16-bit and 32-bit microcontrollers, holds promise in the longer haul. Also, new design wins for the company’s latest PolarFire solutions are expected to drive FPGA revenues.

However, sluggish demand across communication and appliance end-markets is a headwind. Also, significant exposure to Asian markets amid coronavirus outbreak in China remains a concern.

Zacks Rank & Stocks to Consider

Microchip currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are CyberOptics Corporation CYBE, Netlist, Inc. NLST and LogMeIn, Inc. LOGM, which sport a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for CyberOptics, Netlist and LogMeIn are currently pegged at 12%, 15% and 5%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

LogMein, Inc. (LOGM) : Free Stock Analysis Report

Netlist, Inc. (NLST) : Free Stock Analysis Report

CyberOptics Corporation (CYBE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance