Microchip (MCHP) Narrows Sales & Earnings Expectations for Q3

Microchip Technology Incorporated MCHP provided an update on third-quarter fiscal 2020 outlook.

The company now anticipates consolidated net sales in the range of $1.244-$1.298 billion (mid-point $1.271) compared with the earlier forecast of $1.204-$1.311 billion (mid-point $1.257 billion). The revised guidance reflects a sequential fall of 3-7% and a decline from the prior-year quarter’s net sales of $1.416 billion. The Zacks Consensus Estimate for third-quarter fiscal 2020 revenues is currently pegged at $1.26 billion.

Non-GAAP earnings per share are projected in the range of $1.19-$1.30 per share (mid-point $1.24) compared with the previous guidance of $1.12-$1.32 (mid-point $1.22 billion). The revised bottom-line view indicates a decline from $1.66 in the prior-year quarter.

In the past two months, analysts have become cautious regarding Microchip’s financial performance with estimates moving south. In the past 30 days, the Zacks Consensus Estimate for the current quarter earnings has declined 13.2% and is pegged at $1.25.

Nevertheless, at mid-point, the company’s guidance for net sales as well as non-GAAP earnings reflects improvements.

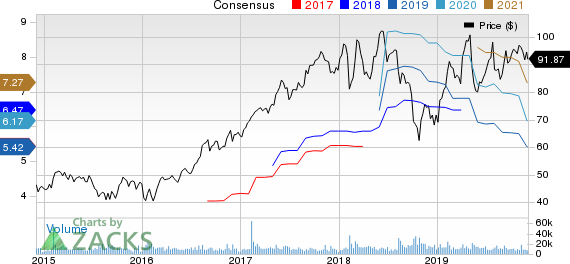

Microchip Technology Incorporated Price and Consensus

Microchip Technology Incorporated price-consensus-chart | Microchip Technology Incorporated Quote

Other Notable Points

Management highlighted that bookings during October and November 2019 continued to remain strong.

Also, per the previous guidance, non-GAAP gross margin is anticipated in the range of 61-61.4%. Non-GAAP operating expenses, as percentage of sales, are projected at 26.2-28%. Operating margin is expected in the band of 33-35.2%. Microchip's inventory days in the third quarter are expected between 131 and 144 days. Capital expenditures are estimated in the range of $20-$25 million.

Wrapping Up

Microchip’s strength in 8-bit, 16-bit and 32-bit microcontroller business holds promise in the long term. Markedly, the company’s microcontroller business has continued to outperform the industry. To further capitalize on this burgeoning business, Microchip is developing and introducing a wide range of innovative as well as proprietary products.

However, management is cautious about a few headwinds such as increasing lead time as well as slim demand trends in ZTE and Bitcoin business domains. Further, significant exposure to Asian markets amid imposition of tariff due to the United States-China trade war is a hurdle. Additionally, Microchip has a highly leveraged balance sheet that adds to its woes.

Zacks Rank & Key Picks

Microchip carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are Qorvo, Inc QRVO, Fortinet, Inc FTNT and Taiwan Semiconductor Manufacturing Company Ltd. TSM. Each of the stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Qorvo, Fortinet and Taiwan Semiconductor is currently pegged at 10.1%, 14% and 10.4%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance