MGM Resorts (MGM) Stock Gains on Q4 Earnings & Revenues Beat

MGM Resorts International MGM reported strong fourth-quarter 2021 results, wherein both earnings and revenues beat the Zacks Consensus Estimate. While the bottom line surpassed the consensus mark for the seventh straight quarter, the top line beat the same for the fifth consecutive quarter. The top and the bottom lines increased on a year-over-year basis. Following the results, shares of the company have increased 2.1% in the after-hour trading session on Feb 9.

The company’s results in the quarter benefited from the removal of authorized operational and capacity restrictions and an increase in travel.

Bill Hornbuckle, CEO and president of MGM Resorts International, has said “The strategic milestones we achieved in 2021 position us for further success in2022, and we remain excited about our long-term opportunities including: leading the U.S. sports bettingand iGaming market through BetMGM, pursuing disciplined geographic expansion such as the Japanintegrated resort, and reinvesting in our core business to drive sustainable growth.”

Earnings & Revenue Discussion

MGM Resorts reported adjusted earnings per share of 12 cents, beating the Zacks Consensus Estimate of 2 cents. In the prior-year quarter, the company had reported an adjusted loss of 90 cents per share.

Total revenues were $3,056.9 million, which surpassed the Zacks Consensus Estimate of $2,767 million. The top line soared 105% from $1,493.5 million reported in the year-ago period. The upside was primarily driven by the rise in Casino, MGM China, BetMGM, and other sports betting and iGaming revenues.

MGM China

MGM China’s net revenues rose 3% year over year to $315 million. However, the figure is still down 57% compared with third-quarter 2019. VIP Table Games Hold adjusted MGM China net revenues improved 3% year over year to $313 million but were down 55% compared with fourth-quarter 2019.

MGM China’s adjusted property EBITDAR (Earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs) amounted to $5 million, reflecting a decline of 88% year over year stemming from a $23 million bonus reversal in the prior-year quarter and a $13 million rise in bad debt expenses. VIP Table Games Hold adjusted MGM China adjusted property EBITDAR was $2 million, plunging 96% year over year.

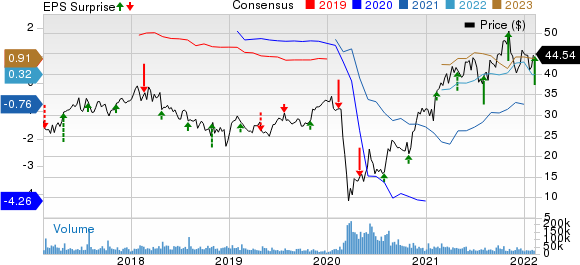

MGM Resorts International Price, Consensus and EPS Surprise

MGM Resorts International price-consensus-eps-surprise-chart | MGM Resorts International Quote

Domestic Operations

Net revenues at Las Vegas Strip Resorts in the fourth quarter were $1.8 billion, up 277% year over year owing to the removal of operational and capacity restrictions and increase in travel. The segment’s revenues rose 27% compared with fourth-quarter 2019. Adjusted property EBITDAR improved to $699 million, surging a whopping 1,196% year over year. Casino revenues in the quarter under review were $541 million, up 169.2% year over year.

During the quarter under review, net revenues from the company's regional operations totaled $900 million, up 51% from the prior-year quarter. This growth was primarily attributable to the elimination of mandated operational as well as capacity restrictions and increase in travel.

Adjusted property EBITDAR was $309 million, up 95% year over year due to cost-saving efforts. Adjusted property EBITDAR margin expanded 774 basis points year over year to 34.4%.

Casino revenues in the quarter under review rose 42% from the year-ago level of $697 million.

Balance Sheet & Share Repurchase

MGM Resorts ended the fourth quarter with cash and cash equivalents of $4,703.1 million compared with $5,101.6 million on Dec 31, 2020. The company’s long-term debt at the end of the quarter stood at $11,770.8 million, down from $12,376.7 million as of Dec 31, 2020.

During the fourth quarter, the company repurchased nearly $17 million of shares at an average price of $42.42 per share for $727 million.

Zacks Rank & Key Picks

MGM Resorts carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Consumer Discretionary sector are Crocs, Inc. CROX, RCI Hospitality Holdings, Inc. RICK and JAKKS Pacific, Inc. JAKK. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Crocs flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 41.6%, on average. Shares of Crocs have increased 37.6% in the past year.

The Zacks Consensus Estimate for CROX’s 2022 sales and EPS indicates a rise of 48.5% and 23.2%, respectively, from the year-ago period’s levels.

RCI Hospitality flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 63.2%, on average. Shares of RCI Hospitality have surged 39.3% in the past year.

The Zacks Consensus Estimate for RICK’s 2022 sales and EPS suggests growth of 33.7% and 18.9%, respectively, from the year-ago period’s levels.

JAKKS Pacific flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 48.9%, on average. Shares of JAKKS Pacific have increased 45% in the past year.

The Zacks Consensus Estimate for JAKK’s 2022 sales and EPS suggests growth of 4.9% and 227.8%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JAKKS Pacific, Inc. (JAKK) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

RCI Hospitality Holdings, Inc. (RICK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance