Meritage Homes (MTH) Introduces Quarterly Cash Dividends

In an effort to maximize long-term value for its shareholders, Meritage Homes Corporation MTH initiated a recurring quarterly cash dividend of 27 cents per share on its common stock. The first dividend will be paid on Mar 31, 2023, to its shareholders of record as of Mar 15.

This initiative is reflective of its focus on a balanced capital allocation strategy via balance sheet strength and operational excellence. The announcement also reflects this U.S.-based, fifth-largest homebuilder’s confidence in its future performance and ability to drive shareholder value.

Phillippe Lord, chief executive officer of MTH, stated, “We believe we are well-positioned to return capital to shareholders and attract a broader investor base without limiting our growth opportunities, given our sustainable free cash flow generation and strong balance sheet.”

Strong Liquidity Position to Boost Investors Value

In this challenging housing market and uncertain macroeconomic environment, when many companies are backing off from dividend hikes and repurchases, Meritage Homes has ample liquidity and a healthy balance sheet to cheer its stockholders.

At the end of 2022, cash and cash equivalents totaled $861.6 million compared with $618.3 million on Dec 31, 2021. It had nothing drawn under the credit facility during the quarter, with availability of $780 million.

Total long-term debt was $1.14 billion as of Dec 31, 2022, slightly above with 2021-end. The company doesn’t have any significant debt maturities until 2025. Total debt to capital at 2022-end was 22.6% compared with 27.6% at 2021-end. MTH repurchased 1,166,040 shares of its common stock for $109.3 million during 2022.

Stock Performance

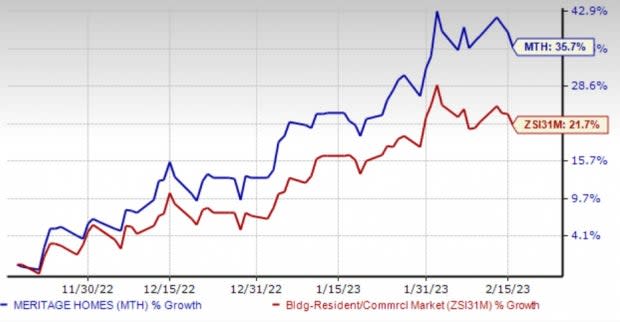

Shares of this Zacks Rank #3 (Hold) company grew 35.7% in the past six months, outperforming the Zacks Building Products - Home Builders industry’s 21.7% growth.

Image Source: Zacks Investment Research

Although the Zacks Consensus Estimate of $12.69 per share reflects a 52.5% year-over-year decline, it has moved north from $12.18 in the past 30 days. This means analysts are a bit optimistic about the company’s growth potential.

Recently, it reported fourth-quarter 2022 earnings and total closing revenues that surpassed the Zacks Consensus Estimate by 0.9% and 2%, respectively. The metrics also rose 13% and 33%, respectively, from the year-ago quarter’s levels, thanks to higher volumes and pricing. The uptrend was due to higher home closing revenue, improved overhead leverage and a lower outstanding share count.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

United Rentals, Inc. URI — currently sports a Zacks Rank #1. The long-term earnings growth rate of the company is 16.3%.

The Zacks Consensus Estimate for URI’s 2023 sales and EPS suggests growth of 20.3% and 28.3%, respectively, from the year-ago period’s reported levels.

Skyline Champion Corporation SKY — currently flaunts a Zacks Rank #1. SKY has a trailing four-quarter earnings surprise of 43.2%, on average.

The Zacks Consensus Estimate for SKY’s fiscal 2024 sales and EPS suggests declines of 11.7% and 37.9%, respectively, from the fiscal 2023 reported levels.

Sterling Infrastructure, Inc. STRL — carrying a Zacks Rank #2 (Buy) — provides transportation, e-infrastructure and building solutions.

STRL’s expected earnings growth rate for 2023 is 9.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Skyline Corporation (SKY) : Free Stock Analysis Report