Melrose faces pensions hurdle in GKN bid as trustees fire warning shot

Melrose’s hopes to buy GKN face a new hurdle after the target company’s pension trustees warned a bid would have to address the engineer’s towering £1.1bn pension deficit.

In a bold move, the trustees warned Melrose’s £8bn unsolicited approach would have to plug the retirement schemes’ funding gap so it could stand alone.

Trustees stepping in so publicly is an unusual development, especially as Melrose has not formally made a bid.

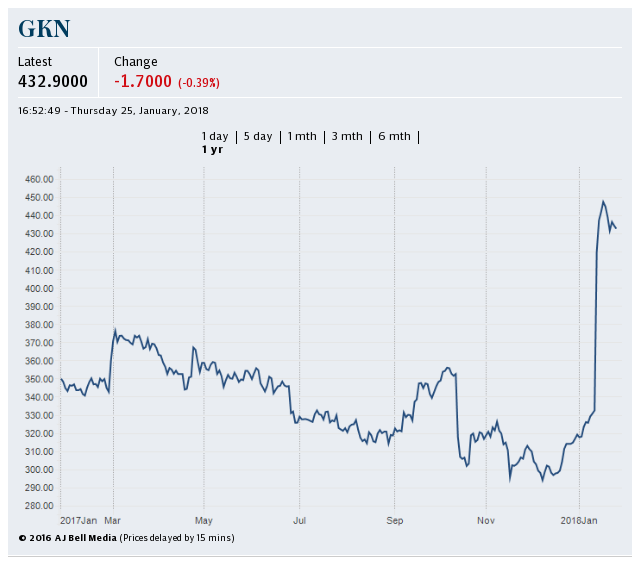

It emerged on Friday that FTSE 100-listed aerospace and automotive parts supplier GKN had rebuffed a 405p cash and shares approach from mid-cap turnaround business Melrose. GKN responded by saying it would split itself up and launch a programme to improve its performance.

Trustees of GKN’s 32,300-member pension schemes said they were “concerned” that any potential buyer should be aware of the funding gap it faces. This currently stands at £1.1bn on a “gilts flat basis”, giving the level of the shortfall if the fund was entirely invested in government bonds.

Trustees described glits flat as a “common yardstick for measuring the potential cost of a pension scheme achieving self-sufficiency”.

Highlighting the dependence the schemes have on GKN, the trustees added: “Given the scale of the deficit, the schemes are very substantial stakeholders in the business with a significant level of reliance on the strength of the GKN covenant.

“Any material change to the corporate and capital structure of GKN would lead the trustees to reassess the strength of covenant going forward and determine appropriate funding plans based on that covenant and its associated level of risk.”

They said they expected “full engagement” from Melrose and GKN should the structure or direction of the business change, warning that “in any discussions safeguarding pensioners’ interest would be the focus”.

Independent pensions consultant John Ralfe said changes to the Takeover Code in 2013 had strengthened trustees’ rights during acquisitions, such as getting them involved at an earlier stage.

However, despite this, he said that, as the ill-fated sale of BHS to former bankrupt Dominic Chappell showed, “with the best will in the world, it is not clear how trustees can block a takeover”.

Mr Ralfe also questioned whether GKN’s plans to split itself up could actually prove more complex than a sale to a single body, with the two units having to work out how to divide up liabilities.

Previous high-profile examples of pension trustees wading into bid situations include the Qatar wealth fund’s £12bn run at Sainsbury's and Sir Philip Green’s £8bn assault on Marks & Spencer in 2004.

Melrose dismissed the trustees’ warning, saying their figures were “entirely in line with our own reading of the pension exposure at GKN”. The group added that Melrose had an “impeccable track record of safeguarding and improving pensioners’ rights in every acquisition we have made” and looked forward to engaging with trustees.

A source close GKN described it as “only natural” trustees had spoken out so early. “Melrose is dealing with something much bigger and complex here than they have ever seen before, no wonder the trustees are concerned,” the source said.

The source added that GKN had a close relationship with the pension trustees, shown by the fact it pumped an extra £250m into the fund last year as it closed the final salary scheme, a decision “which did not face threats of strikes or resistance seen when other companies close their scheme”.

A GKN spokesman added: “We look forward to continuing our close working relationship with the trustees which has been developed over many years."

Yahoo Finance

Yahoo Finance