Melrose chief: Who is our GKN bid hostile to?

‘You have to question who is hostile to who,” says Simon Peckham, chief executive of Melrose. Peckham is, of course, referring to his firm’s £8.1bn bid for aerospace and car parts giant GKN, which has triggered the fiercest takeover battle the City has witnessed in a decade.

It’s a provocative point. Yet the 55-year-old is relaxed as he sets out his argument from the company’s Mayfair boardroom, where it launched the largest contested bid for a UK company since Kraft’s swoop on Cadbury in 2009.

Peckham says it boils down to this: GKN has been underperforming for ages and Melrose would be much better at running it. Melrose, with its record of buying struggling businesses, taking up to five years to improve them, then selling them for a big profit, is evidence of this.

“It’s not right that a management team, which accepts it is not doing a good job – and revolutionised how it looks at its business since we turned up – has the opportunity to bar someone else who says ‘We can do a better job’.”

Peckham insists that Melrose always prefers to do deals in private on terms that both sides agree to. Any “hostility” is from GKN’s management towards its own shareholders, he says. His case is that by fighting Melrose they are reducing their shareholders’ chances of owning a better business with different bosses.

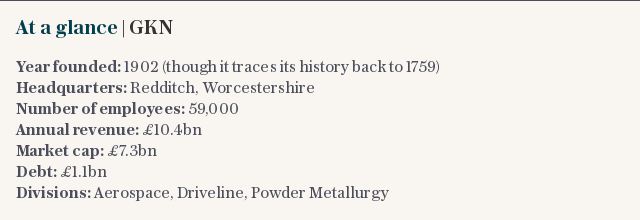

A lawyer by training, Peckham makes it all sound very logical. Still, Melrose’s approach for the Redditch-based engineer has grabbed headlines, with politicians, unions, investors and the company’s pension scheme weighing in.

Melrose has been labelled a short-termist asset stripper whose plans for GKN will lead to major job losses, under-investment that will damage Britain’s industrial footprint, and wreck the 260-year-old company’s retirement scheme.

Criticism has been compounded by a £285m payout that Peckham and three fellow executives stand to share if they hit ambitious growth targets after the deal. “Greedy” and “fat cat” are the more polite things said about the quartet, with calls for such a huge amount to be invested back into GKN, instead of going to just a few bosses.

Peckham scoffs at the claims. “Some think we buy GKN and get handed a £285m cheque,” says Peckham. He emphasises his response. “It. Is. Not. True.” But the deal documents state that such a payout is possible.

To earn that amount, he counters, Melrose would have to “do the same amount of value creation in two years as GKN has done in 250 years – we’d have to have to add £6bn.”

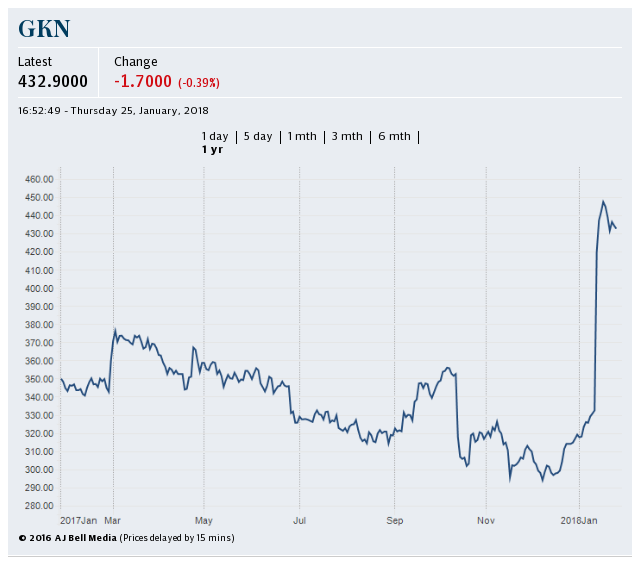

Peckham explains he will get “nothing” until GKN’s market value – currently £7.5bn – has increased by £1bn. Adding £6bn in two years is a tough target, but Melrose’s approach has sparked a 25pc surge in GKN’s share price.

Peckham is speaking on the day Airbus, GKN’s biggest customer, said it would be “practically impossible” to give the business new work if Melrose took over.

“I can’t tell you we weren’t disappointed,” says Peckham about the statement from Airbus’s plain-speaking chief operating officer Tom Williams. The Melrose chief says he’s due to meet with Airbus to “alleviate their concerns” and emphasise that his company is a long-term R&D investor.

However, he’s also somewhat puzzled by the news, pointing out that Airbus doesn’t ban private equity-owned companies from its supply chain. “That’s not to compare us to private equity,” Peckham is quick to say. “We don’t use their levels of leverage and we develop the companies we own.”

Melrose’s track record speaks for itself, he claims, pointing to it sinking almost £500m into the other companies in its portfolio over the past five years. “Our point is that while we might not own a company forever, while we do own it we treat it as if we were going to own it forever,” he adds.

He dismisses as “utter rubbish” suggestions Melrose is over-egging its past investment levels. The numbers have to be verified under takeover rules, he points out. “We’ve never been asked by the Takeover Panel to clarify anything … that’s not the same for GKN,” Peckham says with a smile. “The short answer is we don’t fib.”

He takes another swipe at GKN with his assessment of its management. “I don’t think anyone – even GKN’s management – will argue that the company has been well stewarded,” Peckham says. He points out that just days after Melrose first met GKN in January, the company came out with a plan to improve the business. Peckham says GKN has gone from “don’t sell anything, we’ll improve … then it metamorphosed into sell powder metallurgy [a big division], sell Driveline now [its automotive arm], let’s keep aerospace [the other half].”

Initially, GKN talked about the potential for the automotive business, but now it is planning to merge it with US peer Dana. The proposal highlights GKN management’s “fundamental misunderstanding” of what shareholders want, he says.

“We could not believe how they structured the Dana deal,” says Peckham, referring to terms that will give GKN investors shares in a US company, something likely to result in a tax bill. “That’s if you are a small shareholder. They don’t care about them, they did not even say sorry.

“But for big shareholders, well, they knew a lot of their big UK shareholders cannot hold US shares. And they didn’t appear to care.” Peckham says GKN has “slowly but surely lost the support of UK institutional investors”. He goes further, saying GKN is “run by people who don’t have an owner mentality. They have a manager mentality.” Peckham points to Melrose’s management being the eighth largest shareholders in Melrose, saying it gives them “skin in the game”.

But how would Melrose do it differently?

He won’t be drawn beyond this, saying Melrose will “sit down with individual business and work out what that plan is, we can’t pre-judge it”.

He won’t rule out job losses. “We want to invest to improve productivity. Automation and mechanisation is part of that,” Peckham says, noting that 40 years ago GKN had 69,000 UK staff, and now it has 6,000. “You can try to protect businesses and say, ‘We’re going to prevent the world’s effects from getting to them’ but then all that happens is you lose the businesses. I’m not trying to be alarmist but part of being a responsible owner is you run it properly.”

Peckham says GKN is “very capable of going back to being where it should be if it had been run properly”, but it fundamentally needs a change of culture. Running a business responsibly also means taking care of the 32,000-member pension scheme, which has become a key point of the battle, with concerns over how to solve the £1.1bn deficit.

“The deficit grew up on GKN’s watch, it’s a problem they have created. That we don’t have big deficits, it is not a coincidence, we did something about it.” Yet, the scheme’s trustees are happy with GKN’s own plans but not convinced by Melrose’s pledges. Peckham says “we would write a £150m cheque on day one” but won’t go further. “There’s a process to be worked through with the trustees,” he says. “We will come to an arrangement that will make them happy. And if we can’t we will be able to explain publicly why we can’t and people can make their own minds up.”

Peckham has made a compelling case for Melrose but the battle is over – unless there’s a major intervention – and it’s now up to investors to decide by the end of the month who ends up in control.

What if they decide to stick with the current management? “We’ll walk away,” says Peckham bluntly. “I’ll go away for the weekend and come back on Tuesday and we’ll do something else.”

Yahoo Finance

Yahoo Finance