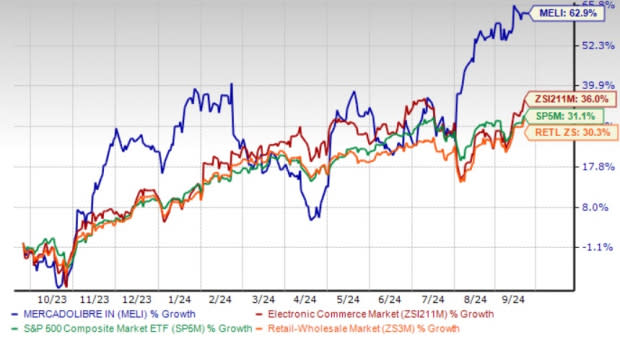

MELI Stock Up 62.9% in a Year: Can E-commerce Strength Fuel Growth?

MercadoLibre MELI, the leading e-commerce platform in Latin America, has seen its stock jump 62.9% over the past year, outperforming the Zacks Internet-Commerce industry’s return of 36%, the broader retail sector’s rally of 30.3% and the S&P 500 index’s gain of 31.1%.

This impressive growth has been fueled by several factors, including MELI’s growing e-commerce business, robust shipping services, and strong presence in Brazil, Mexico and Argentina.

The company is also benefiting from the solid momentum in its Mercado Pago fintech platform that allows users to send and receive payments seamlessly, which is another positive.

One-Year Price Chart

Image Source: Zacks Investment Research

Although MercadoLibre has a strong foothold in the online retail market of Latin America, rising competitive pressure from the e-commerce giant Amazon AMZN, which is making strong efforts to expand its presence in LATAM, is concerning. MELI also faces strong competition from the retail behemoth Walmart WMT, which is making good progress in the region, especially in Mexico.

Market uncertainties, high inflation, recessionary fears and weakening macro conditions are headwinds for MercadoLibre.

Margins are currently under pressure due to increased investments in free shipping, loyalty programs, and improvement in customer services, marketing and chargebacks, as well as higher maintenance, hosting and fraud prevention.

Against this backdrop, the question that arises is - How should investors play the MELI stock? Are a strong e-commerce business, growing fintech business and expanding logistics operations enough to jump into the stock or should investors worry about the headwinds surrounding the company’s prospects?

MELI’s Long-Term Prospects Ride on E-commerce Strength

MercadoLibre’s expanding logistic operations are shaping up the growth trajectory of its e-commerce business.

Its growing efforts toward delivering enhanced user experience for buyers on the back of an expanding logistic and fulfillment network are positive. MELI has become a natural destination for buyers and sellers by building the fastest and most extensive delivery network in the region, and by offering the widest assortment.

MercadoLibre’s latest introduction of robotics in its distribution center in Cajamar, remains noteworthy. It intends to deploy more than 300 robots by the end of this year. These robots will manage tasks like transporting shelves containing products from storage areas, which will optimize processing time by 20% and increase total storage capacity by up to 15% per square meter. These robots are capable of handling up to 20,000 items and 2,500 shelves per day, helping automate repetitive tasks like product sorting.

The company is also gaining traction with its MELI Delivery Day, which helps in the reduction of its last-mile delivery costs. With the option of MELI Delivery Day, several deliveries at a single address can be made on a single drop.

MercadoLibre introduced a concept called slower shipment service with its SLOW in order to bring flexibility to its logistic operations. SLOW offers shipping options for buyers who opt for slower shipping options. With SLOW shipments, the shipping window becomes larger and more flexible for MELI.

The company’s strong efforts to expand outside of LATAM, especially in the United States, are noteworthy. In the quarter ending in June, MELI launched a fulfillment center in Texas to bring U.S. sellers into its ecosystem in order to boost the assortment of products for customers in Mexico.

On the back of this move, customers in north Mexico are receiving their orders from the United States within a couple of days for free.

In addition to logistics initiatives, MELI’s efforts to improve product selection are driving growth across verticals, particularly fashion, consumer electronics, apparel and sports categories. It has integrated standardized filters across brands and sellers on its commerce platform.

Growing momentum across the MELI+ loyalty program is a major positive. The company remains optimistic about the impacts of MELI+ on future growth and customer retention as the user base continues to scale. MercadoLibre has observed that customers who enroll in the program increase their spending and buying frequency and shop across more categories than prior to enrollment.

Fintech Momentum Drives MELI’s Growth

Solid momentum in MercadoLibre’s Mercado Pago fintech platform and its well-performing credit business are major positives.

MercadoLibre’s strong efforts to deliver an enhanced experience to Mercado Pago users are positive. Strength in assets under management and the Mercado Pago credit card is crucial for boosting user engagement of Mercado Pago.

The company is leveraging its rich data to cross-sell in the LATAM region and bolster its fintech business. The data also enables MELI to have a better view of credit risks and operate a business that matches the lowest cost-to-serve in the region.

Solid Projections Bode Well For MELI

MercadoLibre’s long-term prospects are expected to benefit from strengthening commerce and fintech businesses. Its leading position in LATAM as an e-commerce and fintech company is anticipated to instill investor optimism in the stock.

The Zacks Consensus Estimate for 2024 is pegged at $20.58 billion, indicating year-over-year growth of 42.2%. The consensus mark for 2024 earnings stands at $35.79 per share, suggesting a year-over-year rise of 83.9%. Earnings estimates have moved north by 1.7% over the past seven days.

Image Source: Zacks Investment Research

MecadoLibre Stock Overvalued Right Now

The MELI stock is not so cheap, as the Value Score of C suggests a stretched valuation at this moment.

MELI is trading at a premium, with a forward 12-month Price/Sales of 4.49X compared with the industry’s average of 1.72X.

Image Source: Zacks Investment Research

Final Note

MercadoLibre’s leading position in Latin America’s e-commerce market, a growing footprint in the fintech domain and a strong logistic network are the key catalysts despite a stretched valuation.

However, challenging macroeconomic conditions, persistent inflation and intensifying competition are concerning for the stock.

Hence, existing investors may consider holding their positions in the stock, but new investors should exercise caution, potentially waiting for a more favorable entry point. MercadoLibre currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report