Melco Resorts (MLCO) Q2 Earnings Top Estimates, Revenues Lag

Melco Resorts & Entertainment Limited MLCO reported mixed second-quarter 2022 results, wherein the top line missed the Zacks Consensus Estimate but the bottom line beat the same.

The company reported an adjusted loss per share of 51 cents, narrower than the Zacks Consensus Estimate of a loss of 52 cents. Notably, the company had reported adjusted earnings per share of 35 cents in the prior-year quarter.

Quarterly net revenues totaled $296.1 million, missing the consensus estimate of $384 million. Net revenues plunged 48% year over year, owing to heightened border restrictions in Macau as well as mainland China due to COVID-19.

Let’s take a closer look at the quarterly results.

Property Performances

City of Dreams

Net revenues at City of Dreams were $97.3 million compared with $347.6 million reported in the prior-year period. Adjusted EBITDA was ($28.5) million against an adjusted EBITDA of $79.5 million in the prior-year quarter. The deterioration was primarily due to the dismal performance of all gaming segments and lower non-gaming revenues.

Rolling chip volumes totaled $748.1 million compared with $4.55 billion in the prior-year quarter. The rolling chip win rate was 2.57% compared with 2.74% in the year-ago quarter.

Total non-gaming revenues at City of Dreams in the quarter were $24.3 million compared with $52.2 million in the prior-year quarter.

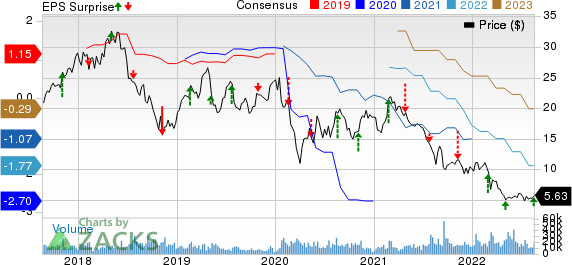

Melco Resorts & Entertainment Limited Price, Consensus and EPS Surprise

Melco Resorts & Entertainment Limited price-consensus-eps-surprise-chart | Melco Resorts & Entertainment Limited Quote

Altira Macau

Net revenues at Altira Macau were $7.2 million compared with $18.3 million reported in the year-ago quarter. This segment generated adjusted EBITDA of ($11.3) million in the reported quarter compared with the prior-year quarter’s ($17.3) million.

Additionally, the rolling chip volume was $857.3 million. The rolling chip win rate was 1.62%, below the company’s expected rolling chip win rate range of 2.85% - 3.15%.

Meanwhile, total non-gaming revenues at Altira Macau totaled $1.9 million compared with $3 million at the end of second-quarter 2021.

Mocha Clubs

Net revenues from Mocha Clubs were $17 million, down 29.5% year over year. Adjusted EBITDA of $2.5 million decreased 55.4% year over year.

The gaming machine handle for the quarter under review was $406.8 million, down 26.3% year over year. The gaming machine win rate was 4.2% in the quarter, down 20 bps from the year-ago quarter.

Studio City

In the reported quarter, net revenues at this property totaled $35.9 million compared with $104.5 million in the prior-year quarter. Adjusted EBITDA was ($31.1) million compared with EBITDA of ($1.2) million at the end of the year-ago quarter.

While rolling chip volume totaled $104.1 million, the rolling chip win rate was 5.33% in the quarter (above the guided range of 2.85-3.15%).

Total non-gaming revenues at Studio City in the quarter under review were $8.3 million, down 62.3% year over year.

City of Dreams Manila

In the second quarter, net revenues at City of Dreams Manila were $111.7 million compared with $52.7 million. Adjusted EBITDA was $49 million compared with $13.3 million reported in the prior-year quarter.

Rolling chip volume totaled $771.3 million, down 183.9% from the year-ago quarter figure. However, the rolling chip win rate was 2.95% compared with 5.37% in the year-ago quarter.

Total non-gaming revenues at City of Dreams Manila were $27.3 million compared with $6.9 million at the end of second-quarter 2021.

Balance Sheet

Total cash and bank balances as of Jun 30, 2022, were $1.65 billion, including $0.4 million of restricted cash, which was primarily related to Studio City.

Total debt, net of unamortized deferred financing costs at the end of second-quarter 2022, was $7.33 billion. Capital expenditures in the second quarter grossed $167.7 million.

The company currently has a Zacks Rank #4 (Sell).

Key Picks

Some better-ranked stocks in the Consumer Discretionary sector are Hyatt Hotels Corporation H, Marriott International, Inc. MAR and Choice Hotels International, Inc. CHH.

Hyatt currently carries a Zacks Rank #2 (Buy). H stock has increased 36.1% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for H’s current financial year sales and EPS indicates growth of 78.1% and 93.9%, respectively, from the year-ago period’s reported levels.

Marriott currently carries a Zacks Rank #2. MAR has a trailing four-quarter earnings surprise of 1.4%, on average. The stock has increased 25.9% in the past year.

The Zacks Consensus Estimate for MAR’s current financial year sales and EPS indicates growth of 44.6% and 93.7%, respectively, from the year-ago period’s reported levels.

Choice Hotels carries a Zacks Rank #2, at present. CHH has a trailing four-quarter earnings surprise of 20.4%, on average. The stock has increased 6.4% in the past year.

The Zacks Consensus Estimate for CHH’s current financial year sales and EPS indicates growth of 13.6% and 17.7%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Melco Resorts & Entertainment Limited (MLCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance