Medtronic PLC Sees Major Reduction in Manning & Napier's Latest 13F Filing

Insight into Manning & Napier Group, LLC (Trades, Portfolio)'s Q2 2024 Investment Moves

Manning & Napier Group, LLC (Trades, Portfolio), a prominent investment firm established in 1970, recently disclosed its 13F filing for the second quarter of 2024. Renowned for its proprietary investment process that combines bottom-up and top-down research, the firm caters to a diverse clientele including high-net-worth individuals and institutional investors. Manning & Napier offers a variety of investment solutions ranging from equity and fixed income portfolios to blended asset portfolios, emphasizing a rigorous fundamental analysis to identify and maintain high-quality investments.

New Additions to the Portfolio

In a strategic move to diversify and strengthen its portfolio, Manning & Napier Group, LLC (Trades, Portfolio) introduced 165 new stocks in the second quarter of 2024. Noteworthy new additions include:

L3Harris Technologies Inc (NYSE:LHX), acquiring 939,022 shares, making up 2.38% of the portfolio, valued at $210.89 million.

AstraZeneca PLC (NASDAQ:AZN), with 2,416,672 shares, representing 2.13% of the portfolio, totaling $188.48 million.

HDFC Bank Ltd (NYSE:HDB), adding 2,591,465 shares, accounting for 1.88% of the portfolio, valued at $166.71 million.

Significant Increases in Existing Positions

The firm also increased its stakes in several key holdings, with the most significant boosts in:

Coca-Cola Co (NYSE:KO), which saw an addition of 1,969,353 shares, increasing the total to 2,960,693 shares. This adjustment represents a 198.66% increase in share count and impacts the portfolio by 1.42%, with a total value of $188.45 million.

Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM), with an additional 709,812 shares, bringing the total to 1,312,929 shares. This represents a 117.69% increase in share count, valued at $228.20 million.

Complete Exits from Positions

During the same quarter, Manning & Napier Group, LLC (Trades, Portfolio) exited completely from 212 holdings, including:

Ambev SA (NYSE:ABEV), selling all 52,662,595 shares, impacting the portfolio by -2.97%.

Booking Holdings Inc (NASDAQ:BKNG), liquidating all 163,613 shares, resulting in a -2.57% portfolio impact.

Major Reductions in Holdings

The firm also reduced its positions in several stocks, with significant cuts in:

Medtronic PLC (NYSE:MDT), reducing its stake by 4,963,275 shares, a -93.84% decrease, impacting the portfolio by -3.3%. The stock traded at an average price of $81.98 during the quarter and has seen a -4.43% return over the past three months and -3.89% year-to-date.

Novartis AG (NYSE:NVS), cutting down by 4,251,345 shares, a -96.78% reduction, impacting the portfolio by -3.13%. The stock's average trading price was $100.38 this quarter, with a 17.50% return over the past three months and 13.98% year-to-date.

Portfolio Overview and Sector Allocation

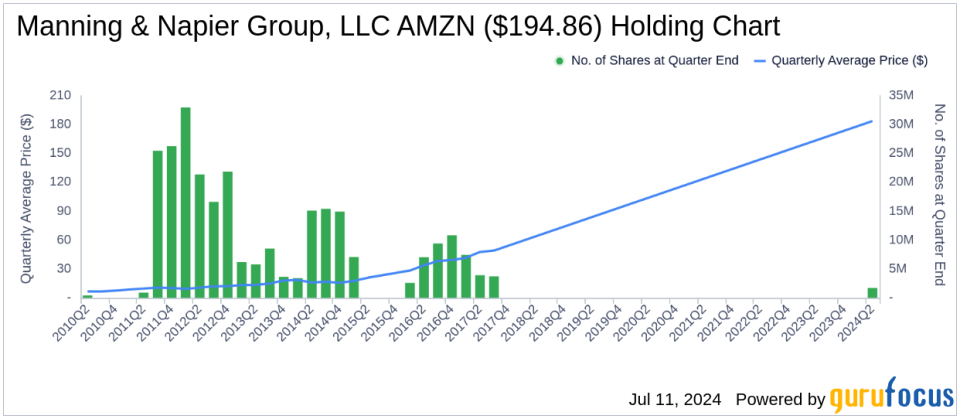

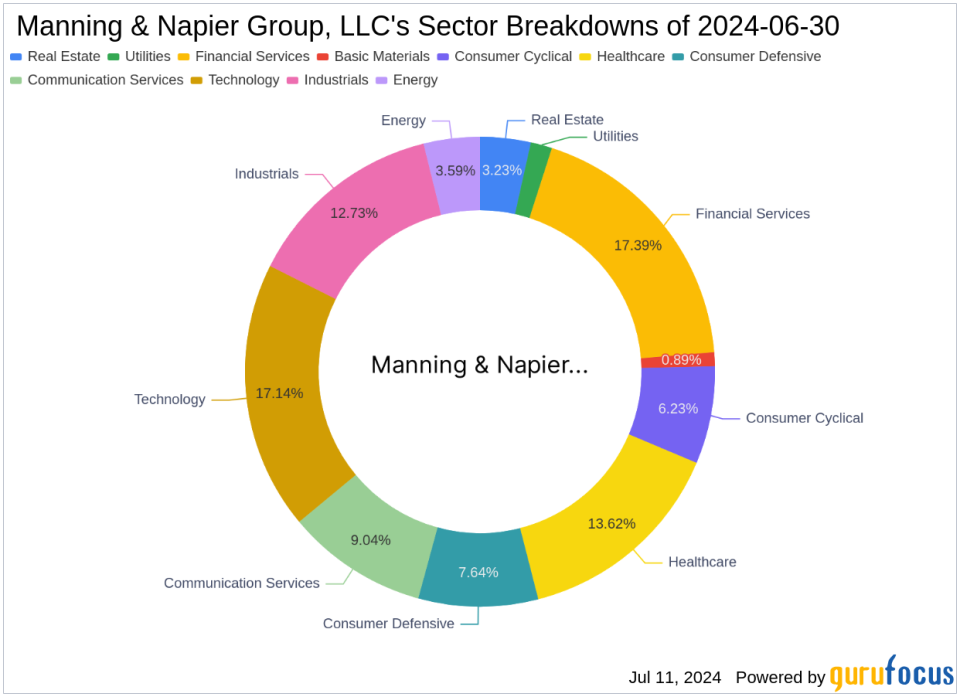

As of the second quarter of 2024, Manning & Napier Group, LLC (Trades, Portfolio)'s portfolio included 272 stocks. Top holdings were 3.72% in Amazon.com Inc (NASDAQ:AMZN), 3.44% in Alphabet Inc (NASDAQ:GOOGL), 3.23% in Meta Platforms Inc (NASDAQ:META), 2.93% in Mastercard Inc (NYSE:MA), and 2.6% in Johnson & Johnson (NYSE:JNJ). The investments are predominantly concentrated across all 11 industries, including Financial Services, Technology, Healthcare, and more.

This detailed analysis of Manning & Napier Group, LLC (Trades, Portfolio)'s latest 13F filing highlights strategic adjustments and insights that could influence investment decisions and market perspectives. For more detailed information and updates, visit GuruFocus.com.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.