Medical Product Stock Earnings Roster for Apr 26: BAX & More

The first-quarter earnings season is fast unfolding, with 87 members of the elite S&P 500 index having reported financial numbers as of Apr 20. As per the latest Earnings Preview, total earnings of these companies have increased 25% on a year-over-year basis on 10.7% higher revenues. Further, a whopping 82.8% of these companies have surpassed earnings estimates, while 67.8% beat the revenue mark.

However, the number of positive revenue surprises this season is lagging the preceding year’s numbers. By the end of this week, 178 S&P 500 companies are set to release results.

Medical, one of the 16 Zacks sectors, is expected to deliver strong results. The Medical Product space has lately seen a slew of favorable developments. The changing market dynamics toward Artificial Intelligence (AI) & big-data applications, upbeat consumer sentiment, abolition of taxes and increased business investments have been driving growth in the sector.

So, it would rather be interesting to see how the major Medical Product companies are placed ahead of the reporting cycle and what are the major factors shaping up the releases.

Inside the Medical Sector

Medical Products has been a very profitable investment space of late.

Favorable consumer behavior, growing prevalence of minimally-invasive surgeries, demand for liquid biopsy tests, use of IT for ensuring quick and improved patient care along with the shift of the payment system to a value-based model are the supposed growth drivers.

The latest Tax Cuts and Jobs Act, which was finally signed by President Trump on Dec 22, has finally cheered the US healthcare fraternity. The Act has lowered corporate tax rates to 21% from the earlier 35%, which buoys optimism. Additionally, the Senate’s decision of postponing the Medical Device tax, which will be put into effect on Jan 1, 2020, has instilled confidence in investors. The bill also delays the so-called Cadillac tax, a 40% tax on employer insurance, until 2022.

Let’s take a look at the major Medical Product companies, which are set to release results on Apr 26.

Per the Zacks quantitative model, stocks with the advantageous combination of a solid Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP have higher chances of beating estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Baxter International Inc.’s BAX first-quarter 2018 results are expected to show gains from the Hospital Products unit, solid guidance and a plethora of regulatory approvals.

For the first quarter, the Zacks Consensus Estimate for earnings is pegged at 62 cents, which indicates 6.9% year-over-year growth. The same for revenues is fixed at $2.62 billion, reflecting year-over-year growth of 5.9%.

Further, we predict an earnings beat in the quarter, as Baxter has a Zacks Rank #2 and an Earnings ESP of +0.54% (read more: Can Hospital-Products Unit Aid Baxter in Q1 Earnings?). You can see the complete list of today’s Zacks #1 Rank stocks here.

Baxter International Inc. Price and EPS Surprise

Baxter International Inc. Price and EPS Surprise | Baxter International Inc. Quote

ResMed Inc. RMD is expected to gain from strong performance on both domestic and international fronts in the third quarter of fiscal 2018. Revenues across Europe, Asia and other markets are likely to register a solid increase, banking on strong device and masks performance. Moreover, the company’s sleep apnea patient volume has consistently witnessed steady growth.

For the third quarter, the Zacks Consensus Estimate for earnings is pinned at 83 cents, which indicates 16.9% year-over-year growth. The same for revenues is fixed at $564.9 million, reflecting year-over-year growth of 9.9%.

However, per our model, ResMed is unlikely to deliver an earnings beat this season. ResMed has a Zacks Rank #2 and an Earnings ESP of 0.00%, which makes surprise prediction difficult (read more: Can ResMed Repeat Stable Device Growth in Q3 Earnings?).

ResMed Inc. Price and EPS Surprise

ResMed Inc. Price and EPS Surprise | ResMed Inc. Quote

Stryker Corporation’s SYK first-quarter 2018 results are expected to show strong growth on the back of Orthopaedic Implant sales — one of the major revenue components. Additionally, MedSurg, will help the company generate impressive results.

For the first quarter, the Zacks Consensus Estimate for earnings is pinned at $1.60, which indicates 8.1% year-over-year growth. The same for revenues is fixed at $3.20 billion, reflecting year-over-year growth of 8.2%.

Our quantitative model predicts an earnings beat for Stryker. This is because the stock has an Earnings ESP of +0.13% and a Zacks Rank #2 (read more: Will Core Segmental Growth Aid Stryker in Q1 Earnings?).

Stryker Corporation Price and EPS Surprise

Stryker Corporation Price and EPS Surprise | Stryker Corporation Quote

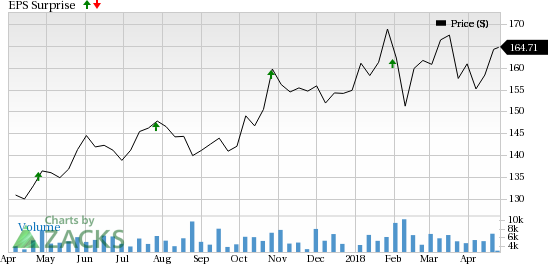

Zimmer Biomet Holdings, Inc.’s ZBH first-quarter 2018 results are expected to show strong top-line numbers within its S.E.T. (Surgical, Sports Medicine, Foot and Ankle, Extremities and Trauma) arm. Moreover, since last November, the company has received several FDA clearances within S.E.T. and is particularly excited about the approval of the Sidus Stem-Free Shoulder system.

For the first quarter, the Zacks Consensus Estimate for earnings is pinned at $1.87, which indicates 12.2% year-over-year decline. The same for revenues is fixed at $1.98 billion, reflecting year-over-year growth of 0.1%.

Zimmer Biomet has a Zacks Rank #4 (Sell), which lowers the predictive power of ESP. It has an Earnings ESP of +0.39% (read more: Can S.E.T. Aid Zimmer Q1 Earnings Despite Supply Woes?).

Zimmer Biomet Holdings, Inc. Price and EPS Surprise

Zimmer Biomet Holdings, Inc. Price and EPS Surprise | Zimmer Biomet Holdings, Inc. Quote

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Baxter International Inc. (BAX) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance