May Industrial Dividend Stocks To Look Out For

Although the industrial sector is generally characterized by a wide variety of markets with companies spanning the quality spectrum, most names suffer relatively high cyclicality. Therefore, where we are in the economic cycle determines these companies’ level of profitability. This impacts cash flows which in turn determines the level of dividend payout. During times of growth, these industrial names could provide a strong boost to your portfolio income. If you’re a long term investor, these high-dividend industrials stocks can boost your monthly portfolio income.

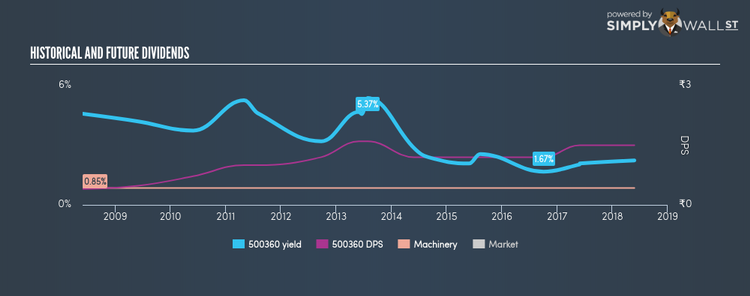

Rapicut Carbides Limited (BSE:500360)

500360 has a good-sized dividend yield of 2.24% and pays out 27.22% of its profit as dividends . While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. It should comfort potential investors that the company isn’t expensive when we look at its PE ratio compared to the IN Machinery industry. Rapicut Carbides’s PE ratio is 12.2 while its industry average is 28.9. Continue research on Rapicut Carbides here.

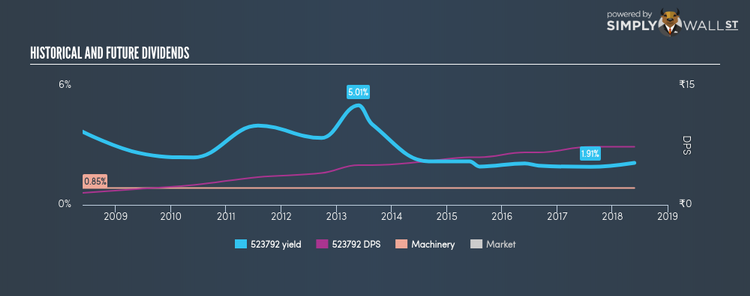

Mazda Limited (BSE:523792)

523792 has a nice dividend yield of 2.11% and pays out 30.95% of its profit as dividends . In the last 10 years, shareholders would have been happy to see the company increase its dividend from ₹1.50 to ₹7.30. Much to the delight of shareholders, the company has not missed a payment during this time. When we compare Mazda’s PE ratio with its industry, the company appears favorable. The IN Machinery industry’s average ratio of 28.9 is above that of Mazda’s (14.7). Continue research on Mazda here.

Ador Fontech Limited (BSE:530431)

530431 has a nice dividend yield of 2.91% and pays 96.97% of it’s earnings as dividends . The company’s dividends per share have risen from ₹1.00 to ₹3.00 over the last 10 years. It should comfort existing and potential future shareholders to know that 530431 hasn’t missed a payment during this time. 530431 also has a miniscule amount of debt on its balance sheet, which is always something that catches my attention. More detail on Ador Fontech here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance