Marvell (MRVL) Q3 Earnings & Revenues Top Estimates, Up Y/Y

Marvell Technology MRVL reported splendid third-quarter fiscal 2022 results, wherein both earnings and revenues not only surpassed the respective Zacks Consensus Estimate but also improved significantly year over year.

California-based Marvell delivered non-GAAP earnings of 43 cents per share beating the consensus mark of 38 cents per share. The bottom line improved 72% from the year-ago quarter.

Marvell reported revenues of $1.21 billion, which outpaced the Zacks Consensus Estimate of $1.15 billion. The top line increased 61% from the year-earlier quarter’s reported figure. This upsurge can primarily be attributed to substantial growth in all the end markets. The data center end market witnessed 109% year-over-year growth in the third quarter.

The results from Innovium acquisition in October are included in Marvell’s third-quarter performance.

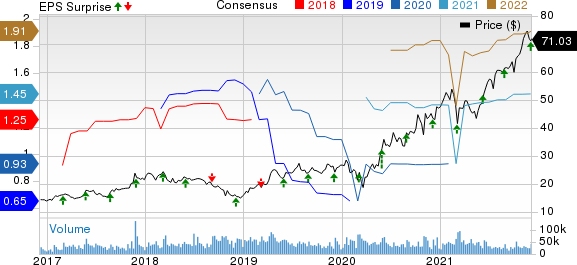

Marvell Technology, Inc. Price, Consensus and EPS Surprise

Marvell Technology, Inc. price-consensus-eps-surprise-chart | Marvell Technology, Inc. Quote

Quarter Details

From second-quarter fiscal 2022, Marvell changed its reporting segments from product basis to end market basis. The new reportable end-market business segments are: data center, carrier infrastructure, enterprise networking, consumer and industrial.

During the third quarter, Marvell’s data center revenues soared 109% year over year to $499.7 million. The segment represented 41% of fiscal third-quarter total revenues, highlighting that it is currently Marvell’s largest end market when compared to the rest.

Carrier infrastructure revenues, which constituted 18% of total revenues, grew 28% year over year to $215.1 million.

Revenues from enterprise networking jumped 56% year on year to $247.2 million and accounted for 20% of the total revenues.

Consumer revenues, representing 15% of total revenues, climbed 20% to $182.5 million.

Lastly, industrial revenues jumped 114% year over year to $66.6 million. Revenues from the industrial segment constituted 6% of total revenues.

Marvell’s non-GAAP gross margin expanded 210 basis points (bps) to 65.1%. Non-GAAP operating expenses flared up 32.4% year over year to $370.5 million. Non-GAAP operating margin expanded 880 bps year on year to 34.5%.

Balance Sheet and Cash Flow

Marvell exited the reported quarter with cash and cash equivalents of $523.5 million compared with the previous quarter’s $560 million. The company’s long-term debt totaled $4.50 billion.

The company generated $265 million of cash through operational activities in the third quarter and $473 million in the first nine months of fiscal 2022.

Marvell returned $50.4 million to shareholders through dividend payments in the third quarter and $140.3 million in the first nine months of fiscal 2022.

Guidance

For the fourth quarter, Marvell expects strong sequential revenue growth driven by the data-center end market, accelerated 5G adoptions in the United States and other regions, and broad growth across multiple products.

Marvell projects fiscal fourth-quarter revenues of $1.320 billion (+/- 3%). The Zacks Consensus Estimate for revenues is pegged at $1.21 billion, suggesting growth of 51.4% from the year-ago quarter.

Non-GAAP earnings per share are expected to be approximately 48 cents (+/- 3 cents). The consensus mark of 43 cents indicates a year-over-year surge of 48.3%.

Non-GAAP gross margin is likely to be approximately 65%, while non-GAAP operating expenses are estimated between $390 and $395.

Zacks Rank & Stocks to Consider

Marvell currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector are Advanced Micro Devices AMD, Qualcomm QCOM and CDW Corporation CDW, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Advanced Micro Devices’ fourth-quarter 2021 earnings has been revised upward by 7 cents to 75 cents per share over the past 60 days. For 2021, earnings estimates have moved north by 1 cent to $2.64 per share in the last 60 days.

Advanced Micro Devices’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 14%. Shares of AMD have rallied 63.3% in the YTD period.

The consensus mark for Qualcomm’s first-quarter fiscal 2022 earnings has been raised to $3.01 per share from $2.63 in the past 30 days. For fiscal 2022, earnings estimates have been revised upward by 14.1% to $10.49 per share in the past 30 days.

Qualcomm’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 11.2%. Shares of QCOM have gained 16.2% YTD.

CDW’s consensus estimate for fourth-quarter fiscal 2021 earnings has been raised to $1.87 per share from $1.83 in the past 30 days. For fiscal 2021, earnings estimates have moved north by 1.4% to $7.81 per share over the past 30 days.

CDW’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 12.2%. Shares of CDW have appreciated 46.9% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

CDW Corporation (CDW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance