Marriott (MAR) Meets Q2 Earnings Estimates, Trims '19 View

Marriott International, Inc. MAR reported mixed second-quarter 2019 results, wherein earnings matched the Zacks Consensus Estimate but revenues lagged the same. Notably, this marked the sixth straight quarter of revenue miss. Following the quarterly results, shares of the company declined 2.8% in the after-hours trading session on Aug 5.

Adjusted earnings of $1.56 per share, came in line with Zacks Consensus Estimate but decreased 9.3% year over year. The company’s earnings in the year-ago quarter include 26 cents gain from an asset sale.

Total revenues of $5,305 million missed the consensus mark of $5,531 million. The top line also declined 2% on a year-over-year basis.

RevPAR & Margins

In the quarter under review, RevPAR for worldwide comparable system-wide properties increased 1.2% in constant dollars (down 0.3% in actual dollars) driven by a 1.1% improvement in average daily rate (ADR). The metric was partially offset by a flat occupancy.

Comparable system-wide RevPAR in North America grew 0.7% in constant dollars (up 0.4% in actual dollars) owing to a 1.3% gain in ADR, partially overshadowed by a 0.5% decline in occupancy.

On a constant-dollar basis, international comparable system-wide RevPAR rose 2.8% (down 2.4% in actual dollars). Both occupancy rate and ADR improved 1.5% and 0.6%, respectively.

Meanwhile, worldwide comparable company-operated house profit margins decreased 10 bps as robust cost control and synergies from the Starwood acquisition were overshadowed by marginal growth in RevPAR and increase in wages.

North American comparable company-operated house profit margins contracted 50 basis points (bps). On the flip side, house profit margins for comparable company-operated properties outside North America expanded 30 bps.

Total expenses decreased 7% year over year to $4.9 billion mainly due to a decline in Owned, leased, and other expenses.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) summed $952 million, up 1% year over year.

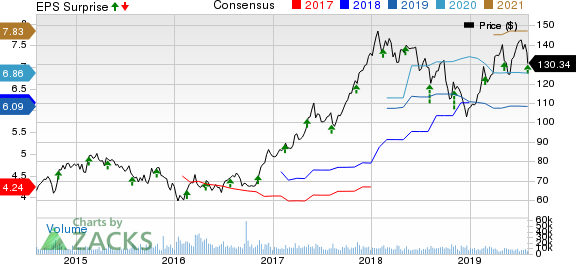

Marriott International Price, Consensus and EPS Surprise

Marriott International price-consensus-eps-surprise-chart | Marriott International Quote

Third-Quarter 2019 Outlook

For the third quarter of 2019, the company expects comparable system-wide RevPAR to increase in the range of 1-2% in North America (in constant currency). Marriott anticipates the same metric to rise 2-3% outside North America and approximately 1-2% worldwide.

Furthermore, gross fee revenues are projected between $945 million and $960 million, up 1-3% on a year-over-year basis. Operating income is anticipated between $725 million and $745 million.

General, administrative and other expenses are expected to be in the $220-$225 million band. Adjusted EBITDA is anticipated to be $896-$916 million, flat to up 2% year over year. Earnings per share are envisioned in the $1.47-$1.51 range compared with adjusted earnings of $1.70 in third-quarter 2018. The Zacks Consensus Estimate for third-quarter earnings is pegged at $1.61.

Fourth-Quarter 2019 View

For the fourth quarter of 2019, the company expects comparable system-wide RevPAR to increase in the range of 1-2% in North America (in constant currency). Marriott anticipates the same to rise 2-3% outside North America and approximately 1-2% worldwide.

Furthermore, gross fee revenues are projected between $981 million and $996 million, up 8-9% on a year-over-year basis. Operating income is anticipated between $744 million and $764 million.

General, administrative, and other expenses are expected to be $249-$254 million. Adjusted EBITDA is anticipated to be $917-$937 million, up 6-8% year over year. Earnings per share are envisioned in the $1.53-$1.58 band.

2019 Guidance

For 2019, Marriott anticipates earnings of $5.97-$6.06 per share compared with $5.97-$6.19 projected earlier. The Zacks Consensus Estimate for full-year earnings is pegged at $6.09. Gross fee revenues are expected between $3,820 million and $3,850 million, up 5-6% from the year-ago period.

Comparable system-wide RevPAR is expected to increase in the range of 1-2% in North America, 2-3% outside North America and 1-2% worldwide. Marriot now expects room additions of nearly 5.5.5% in 2019, which comprises deletions of 1-1.5%.

Operating income is envisioned to be $2,910-$2,950 million compared with 2,925-$3,025 million estimated earlier. General, administrative and other expenses are anticipated to be $920-$930 million. Adjusted EBITDA is projected in the band of $3,586-$3,626 million, up 3-4% from 2018.

Zacks Rank & Key Picks

Marriott has a Zacks Rank #3 (Hold). Better-ranked stocks worth considering in the same space include Wyndham Destinations, Inc. WYND, Wyndham Hotels & Resorts, Inc. WH and Huazhu Group Limited HTHT, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wyndham Destinations reported earnings beat in the trailing four quarters, the average being 6.5%.

Wyndham Hotels & Resorts and Huazhu Group has an impressive long-term earnings growth rate of 11.5% and 12.7%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International (MAR) : Free Stock Analysis Report

China Lodging Group, Limited (HTHT) : Free Stock Analysis Report

Wyndham Hotels & Resorts Inc. (WH) : Free Stock Analysis Report

WYNDHAM DESTINATIONS, INC. (WYND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance