The market's top stocks were far more extreme during the Dotcom bubble

The Dotcom bubble came with a steep drop.

The markets may feel exuberant, but we’re nowhere near the extremes of the Dotcom bubble and a sell-off isn’t imminent, J.P. Morgan analysts write.

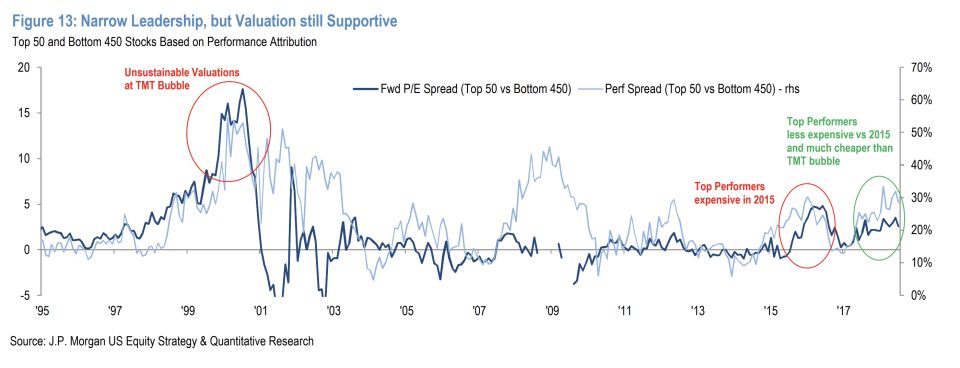

Calling the top stocks today as “more sensibly valued,” the analysts looked at the top 50 U.S. equities that have been weathering the vagaries of President Donald Trump and his position on geopolitics and trade, and showed how even though market leadership was narrowing, that didn’t mean that there’s a major sell-off on the horizon.

During the Dotcom (or TMT) bubble, U.S. equity valuations rose exponentially fueled by investments in Internet companies in the late 90s, which resulted in a crash in 2000.

While the analysts agree that market leadership is narrowing, they disagree that bad times are coming.

Market leadership refers to when a few stocks like the FANGs — Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google (GOOGL) — dominate the stock market with gains being concentrated among them.

Signs of trouble

So as the valuations of these stocks rise and they become overvalued, some argue the risk of a sharp near-term sell-off also rises.

“Rising volatility and changing market leadership are now pointing towards the possible conclusion that the stock market peaked in late January 2018,” said Douglas Kass, president of Seabreeze Capital Management earlier this year.

Others see the recent sell-off in Chinese internet stocks as a sign of a looming rout: “Over time, the breadth of the market tends to narrow, you have smaller leadership groups and once they begin to roll over, which perhaps Tencent is telling us is about to happen, then the broader markets have more of a reason to sell off,” said Peter Cecchini, managing director and chief market strategist at Cantor Fitzgerald.

Dotcom bubble was ‘much more extreme’

J.P. Morgan analysts disagree that it’ll become a problem since the current backdrop is “more resilient due to fiscal policy tailwinds, healthier fundamentals, more reasonable valuations, higher sustainable payouts and lower equity positioning across discretionary and systematic strategies.”

They emphasized that the dot-com bubble was a completely different scenario, as “the TMT bubble was much more extreme in terms of market concentration, valuation, and investor participation.”

The Dotcom or the TMT bubble saw the rapid rise in U.S. equity valuations was fueled by investments in Internet companies in the late 90s. Valuations grew exponentially resulting in the bubble bursting in 2000.

Because of equity valuations for the top stocks being unrealistic, market concentration during the Dotcom bubble was severe, with valuation spreads between the top 50 and bottom 450 stocks “having reached unprecedented levels,” they wrote, and can be seen in the chart above.

“The top 50 stocks during the TMT bubble accounted for 42% of all trading volume compared to 24% currently,” the analysts wrote, “Which shows the extent of investor euphoria/exuberance.”

They added that buybacks are also far stronger today than during the bubble.

Concentration is not unusual

J.P. Morgan’s sentiments were also echoed by UBS strategist Julian Emanuel, who wrote a note from June that said it wasn’t unusual for gains to be this concentrated among a few stocks.

“Since 1993, there have been four years of comparable return ‘clustering’ in positive S&P 500 years – 1993, 1999, 2005 and 2007,” Emanuel wrote.

“What is notable is that of the four previous years, MSFT (1999, 2007) and AAPL (2005, 2007) appear twice, and in 2000, MSFT declined 62.8% while in 2008 MSFT was -45.4% and AAPL was -56.9%; such declines now appear as blips on a long term chart.”

Follow Aarthi on Twitter.

Related:

Yahoo Finance

Yahoo Finance