Bank of England holds interest rate as it warns over Brexit uncertainty — live updates

Bank of England keeps policy interest rate at 0.75pc

MPs demand clarity on Mark Carney’s successor at Bank

FTSE 100 drags its feet as pound finds gains

Trump attacks “gutless” Powell as Fed cuts interest rate to combat President’s trade war damage

Ambrose Evans-Pritchard: Iran and Saudi Arabia must take great care to preserve their golden goose

Bank notes intensities over trade war, warns about impact of no-deal Brexit

Policymakers voted unanimously to hold the bank rate at 0.75pc. The Bank says:

Since the MPC’s previous meeting, the trade war between the United States and China has intensified, and the outlook for global growth has weakened. Monetary policy has been loosened in many major economies. Shifting expectations about the potential timing and nature of Brexit have continued to generate heightened volatility in UK asset prices, in particular the sterling exchange rate has risen by over 3½%.

It adds:

For most of the period following the EU referendum, the degree of slack in the UK economy has been falling and global growth has been relatively strong. Recently, however, entrenched Brexit uncertainties and slower global growth have led to the re-emergence of a margin of excess supply. Increased uncertainty about the nature of EU withdrawal means that the economy could follow a wide range of paths over coming years. The appropriate response of monetary policy will depend on the balance of the effects of Brexit on demand, supply and the sterling exchange rate.

It is possible that political events could lead to a further period of entrenched uncertainty about the nature of, and the transition to, the United Kingdom’s eventual future trading relationship with the European Union. The longer those uncertainties persist, particularly in an environment of weaker global growth, the more likely it is that demand growth will remain below potential, increasing excess supply. In such an eventuality, domestically generated inflationary pressures would be reduced.

In the event of a no-deal Brexit, the exchange rate would probably fall, CPI inflation rise and GDP growth slow. The Committee’s interest rate decisions would need to balance the upward pressure on inflation, from the likely fall in sterling and any reduction in supply capacity, with the downward pressure from any reduction in demand. In this eventuality, the monetary policy response would not be automatic and could be in either direction.

BREAK: Bank of England holds policy interest rate at 0.75pc

As expected, the Bank has held rates. Here’s how that looks in the longer term:

Kier shares swing back on positive commentary

After starting the morning in the dumps (see 8:54am update), Kier Group shares are now up nearly 6pc up on the day. It looks like some positive commentary by analysts might be behind the turnaround.

Peel Hunt have stuck a ‘buy’ rating on the struggling outsourcer, saying its full-year results showed “clear strategic progress”. Analyst Andrew Nussey wrote:

The disposal of Kier Living is progressing well and we are encouraged by the progress in reshaping Kier and the strengthening of the balance sheet. The new management is positioned to restore value.

Here’s how the movement had looked today:

Debenhams defeats Mike Ashley in High Court battle over store rents

Debenhams has defeated Sports Direct owner Mike Ashley in its bid to press ahead with a proposal to begin a process that will lead to location closures.

Mr Ashley had funded a case by landlords against the beleaguered department store, which was taken to the High Court.

Debenhams will now be continue with its company voluntary arrangement process: letting it renegotiate rents on its stores, and close some locations.

Its boss Stefan Vansteenkiste said:

We are delighted that the court has today confirmed that our CVA is effective and will continue to be implemented as planned.

Here’s Chief City Commentator Ben Marlow:

Debenhams lives to fight another day as Mike Ashley-backed High Court challenge to CVA is thrown out. Here is something I penned recently on how the future of both Debs and the wider high street hinged on the case: https://t.co/HvS1ggMnE5

— Ben Marlow (@benjaminmarlow) September 19, 2019

(Another) full report: Ryanair shareholders rebel against O’Leary pay package

The news articles keep rolling in! Here’s Sophie Smith with more on that Ryanair revolt:

Ryanair shareholders have narrowly approved the airline’s plan to give its long-serving chief executive Michael O’Leary a bonus package that could earn him up to €99m (£87.5m).

The remuneration scheme, which requires him to either double the profitability or share price of the low-cost carrier within five years, was approved by 50.5pc of votes.

It means Mr O’Leary could still be in line for one of the biggest payouts in British corporate history, despite a tumultuous year for the company.

Full report: OECD blames trade war for growth forecast cut

Economics editor Russell Lynch has a full report on the latest OECD report. He writes:

The Organisation for Economic Co-operation and Development’s updated economic outlook slashed growth prospects for almost all the world’s major economies in 2019 and 2020, calling for “collective effort” to halt the trade war.

The OECD cut world growth forecasts by 0.2 percentage points to 2.9pc for this year, while the 2020 outlook is now 0.4 percentage points below its estimates four months ago — “the weakest annual global growth rates since the financial crisis”.

In the UK, where the prospect of a no-deal Brexit remains a “serious downside risk”, the OECD cut growth estimates to 1pc from 1.2pc in 2019, and expects the economy in 2020 to advance by just 0.9pc.

United Utilities shares slip after Jefferies downgrade

The UK’s biggest water company, United Utilities, is one of the biggest fallers on the FTSE 100 today, following a downgrade by Jefferies analyst Ahmed Farman.

Jefferies had offered a broadly supportive assessment of the UK’s water sector in June, but Mr Farman wrote in a note today:

However, our mark-to-market assessment of regulation suggests that baseline returns are likely to see a further cut in December. With this, we see amplified risks around the sustainability of UU's current dividend policy, and see material downside to consensus forecasts.

The note was more positive on British Gas-owner Centrica. Mr Farman wrote:

We see Centrica's new strategy delivering stable earnings and a more resilient dividend and balance sheet. Clearly, there are execution risks relating to cost-cutting measures and disposals, but with the stock trading at a 50pc discount to the utilitysector (at historical lows of 8x forward P/E) and offering 6.7pc cash yield, we see the risk-reward as attractive.

Here’s a summary of Jefferies’ utility picks:

Meanwhile, in Westminster...

...the Supreme Court is set to hear from former Prime Minister Sir John Major, who is arguing against the prorogation of Parliament by Boris Johnson.

You can follow our live blog here: Brexit latest news: Watch the final day of the Supreme Court challenge to prorogation as Sir John Major intervenes

Ryanair investors rebel against remuneration report

Ryanair has suffered a major insurrection from its investors, with nearly nearly half voting against its remuneration plans after boss Michael O’Leary was granted a bonus that includes options worth nearly €100m.

Only 50.5pc of votes were cast in favour of the report, putting the airline within a hair’s breadth of defeat. There were also protests against several board appointments, with around a quarter of votes casts against the re-appointment of chairman David Bonderman.

A Ryanair spokesperson said:

Ryanair is, and will continue to, consult with its shareholders, and we will report back to them over the coming year on how the Board will adapt its decision making to reflect their advice and input on all these topics.

The company’s share price has slid in recent years. It argues Mr O’Leary’s basic pay and bonus have been cut, and that he will only be able to cash in on the options he being offered if it can hit the targets set by its “ambitious” plans.

European stocks up across the board

The FTSE has joined the bullish sentiment:

Sterling is flat against the euro and dollar currently.

Exclusive: Hargreaves Lansdown scraps controversial exit charges

A cracking exclusive from Telegraph Money’s Jonathan Jones today: Hargreaves Lansdown has removed nine investor charges including controversial exit fees as it seeks to repair its reputation following its involvement in the Neil Woodford debacle.

Jonathan reports:

In the wake of the freezing of Mr Woodford’s giant Equity Income fund this newspaper called on the stockbroker – Britain's largest – to let affected customers switch providers free of charge.

It refused, but now in a u-turn it has decided that all investors will not be charged fees normally levied ostensibly to cover the cost of administrative tasks, including selling lines of stock or funds when moving money elsewhere.

You can read his full report here: Exclusive: Hargreaves Lansdown scraps controversial exit charges

Investment editor Taha Lokhandwala explains:

The idea that you could be charged for taking your business elsewhere has always been absurd. Imagine this in any other industry. Imagine having to pay to walk out of Tesco to go Sainsbury’s across the road.

Today’s news is a victory for the everyday investor. Hargreaves Lansdown is the biggest fund shop in the country but its fee structure always left a bitter taste. Particularly after its plugging of Neil Woodford’s fund when others were astutely advising customers to steer clear.

There is more to be done though. For investors to receive the best service and the best value for money, they need to able to swap between fund shops for free and with ease. Hargreaves has made the right call and rivals AJ Bell and The Share Centre should follow suit.

OECD cuts global forecast, says no-deal Brexit could push UK into recession

The OECD has released its latest Interim Economic Outlook report, win which it has slashed its outlook for global growth to the lowest level since the financial crisis.

It now expects total global growth of 2.9pc, down from 3.2pc, amid trade war worries and other issues.

The OECD said:

The outlook identifies the trade conflicts as the principal factor undermining confidence, growth and job creation across the world economy, and underlines that continuation of trade restrictions and political uncertainty could bring additional adverse effects.

It adds, addressing Brexit directly:

Substantial uncertainty persists about the timing and nature of the withdrawal of the United Kingdom from the European Union, particularly as concerns a possible no-deal exit which could push the UK into recession in 2020 and lead to sectoral disruptions in Europe.

You can read the full report here: OECD sees rising trade tensions and policy uncertainty further weakening global growth

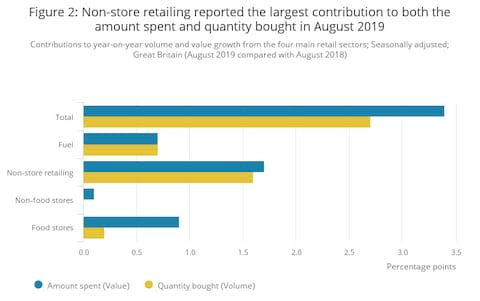

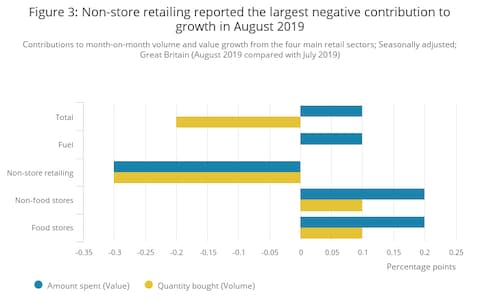

Reaction: Retail sector ‘looks solid despite fading online sales boost’

Responding to those retail sector figure, Capital Economics’ Andrew Wishart says:

The fall in sales on the month was driven by a 3.2pc fall in non-store (i.e. online) sales. But that just marked the partial unwinding of a 7.6pc m/m jump in July due to promotions including Amazon’s prime day. What’s more, while overall sales fell in August, the monthly rise in July was revised up from 0.2pc to 0.4pc. That left 3m/3m growth in sales at 0.6pc, unchanged from Q2.

Looking ahead, surveys of retail sales are dire, suggesting sales will stagnate at best. But they have been overly-pessimistic for some time. With real pay rising at its fastest pace since 2016, there is a good chance retail sales growth will actually pick up from here.

He (along with nearly everyone else), thinks continued strong consumer demand means the Bank of England will hold rate, and avoid the global trend toward easing — unless there is a no-deal Brexit.

Investors adjust options to prepare for a no-deal Brexit

It looks like some investors are already getting prepared for a possible no-deal Brexit.

Money-market traders having been taking contracts for bets or hedges against the UK’s interest rates, amid expectations that the Bank of England may rapidly slash its policy rates in the event of a disorderly exit.

In (hopefully) plainer English, that means they — one investor of more — are ensuring that they can take a long position in short-sterling futures, i.e. they will be able to place a bet that the pound’s value will fall, a likely side-effect of rates cuts.

Here’s how those built-up options look over time:

The intense spike massively outstrips the increase in the build-up to Britain’s postponed exit at the end of March.

The Financial Times reports that option positions on an interest rate cut hit a record high via London’s main derivatives exchange. It says:

Open interest — a measure of traders’ live positions in futures and options on UK rates over the next three months — surged to 18.4m contracts on Tuesday at ICE Futures Europe, the main derivatives exchange in London. The options, if exercised, would allow investors to profit from unexpected rate cuts or protect themselves from the damage stemming from rapid rate rises.

The FT says many of the contracts will expire by by the end of the year, with others holding deeper in 2020.

As a reminder, no cut is expected from the Bank today, so these positions are aimed at expected moves later in the year — with Britain set to exit on 31 October.

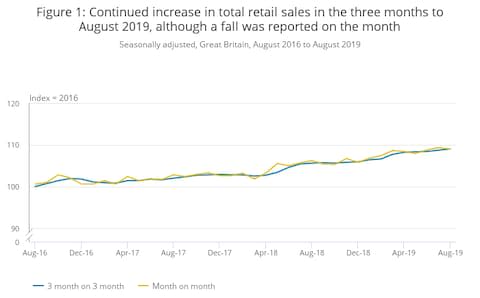

Retail sales: key takeaways

Here are the Office for National Statistics’s main takeaways from the retail figures:

You can read the full ONS report here: Retail sales, Great Britain: August 2019

#Softer news on #UK#consumer spending front as #retail sales volumes edged down 0.2% month-on-month in August (+0.4% in July) causing year-on-year increase to moderate to 2.7% from 3.4%. But 3-month/3-month growth rate in volumes edged up to 0.6% in August from 0.5% in July

— Howard Archer (@HowardArcherUK) September 19, 2019

Just in: Retail sales slipped in August

Retail sales fell narrowly in August, from 3.3pc yeay-on-year in July to 2.8pc. July’s figures were revised upwards 0.2pc.

More follows...

Next leads FTSE 100 fallers

Despite rising profits, retailer Next is leading fallers on the FTSE 100 today. It looks like investors may be seizing on comment from boss Lord Wolfson in a press release accompanying the results. He said:

So far, we have weathered the retail storm, we have adapted what we do and have a business model that, for the moment, works in an online world. Our sales and Earnings per Share are ahead of where they were five years ago, our business delivers healthy net margins and we remain highly cash generative.

But although we can see a way through the woods, we are not out the other side yet. Consumer markets remain extremely volatile, the Online world changes rapidly, and the uncomfortable transition away from high retail rents is by no means complete. It would be a huge mistake to underestimate the scale of the challenge facing our business or assume that, from here-on-in, all will progress smoothly.

Its shares are currently off 4pc, having climbed almost 50pc this year.

JD Sports mulls options ahead of Footasylum takeover probe

Sportswear retailer JD Sports has announced it is considering accepting a full (Phase 2) probe of its acquisition of rival Footasylum by the Competition and Markets Authority.

The CMA has already said it plans to undertake the investigation, but it could be avoided if JD and the watchdog can settle on other changes.

JD chairman Peter Cowgill said:

We continue to believe that Footasylum would be a positive addition to the Group, bringing a differentiated customer demographic and fashion-led product range that is complementary to our existing business. We also believe that there will be significant operational and strategic benefits from a combination of the two businesses.

Our discussions with the CMA are ongoing as we consider whether to proceed to Phase 2 or if acceptable remedies can be agreed at this stage. We look forward to working constructively with the CMA in this regard and will provide further updates in due course.

The announcement seems to have landed poorly with investors, pushing the retailer’s shares down just under 2pc.

Kier Group shares plummet further after it swings to loss

Struggling outsourcer Kier Group has swung to a full-year loss of £345m, and announced it has begun looking for a new chairman.

The full-year loss is the latest blow to the company, which has been struggling to shake off doubts about its performance as it undertakes a restructuring plan following a series of setbacks including an accounting error and a profit warning.

Philip Cox, the group’s chairman since 2017, is now heading for the door, having overseen the selection of a new management team.

Commenting on the results, chief executive Andrew Davies said:

Kier experienced a difficult year, resulting in a disappointing financial performance. However, we are building firm foundations for the future: we have a new management team in place, we have defined our strategic priorities and we are taking decisive actions to deliver them

Liberum analysts branded the results “grubby” and said Kier is “not out of the woods yet entirely”, but added: “revised earnings estimates are now very achievable”.

Shares in the firm are down a further 7pc this morning:

Look ahead: Bank of England expected to hold policy interest rate

Today’s big economic event is the Bank of England’s Monetary Policy Committee meeting, where it is expected to maintain its policy interest rate of 0.75pc.

We’ll find out what decision the Bank has made at 12pm. It has been keeping its powder dry in the run-up the Brexit, with governor Mark Carney repeatedly emphasising that it would aim to be reactive to events, rather than pre-empting an economic shock.

The focus in Westminster is increasingly shifting to who might succeed Mr Carney. Economics editor Russell Lynch reports Chancellor Sajid Javid has come under pressure from MPs to say when he will appoint a new Bank of England Governor amid fears of a delay in filling the vital role. He writes:

The call from the Treasury select committee follows reports that Mark Carney’s successor may not be named until after a general election, and that the Canadian could be asked to stay on if Brexit is delayed.

Former Chancellor Philip Hammond told the committee in April the role would be filled “at some point in the autumn”.

Mr Carney’s current finishing date of January 31 coincides with the date of a potential Brexit if Prime Minister Boris Johnson fails in his “do or die” bid to leave on October 31 and rebels force the UK to stay in the European Union for another three months.

Read more here: MPs demand clarity on Mark Carney’s successor at Bank of England

Further doubt was thrown over the issue earlier this week, after the Financial Times reported the appointment could be pushed back due to a looming General Election.

FTSE flat as pound strengthens

European markets have been open for just over twenty minutes.

The overall picture is fairly flat, with the recently-volatile Spanish IBEX grabbing the biggest gains straight out of the gate.

The FTSE 100 is slightly down, with a mildly stronger pound likely hurting the exporter-heavy index.

Diageo says year has started well, but it is not ‘immune’ to trade war pressures

Drinks giant Diageo said it “would not be immune from significant changes to global trade policy”, in a note of caution as it updated the City on its performance ahead of its annual general meeting.

The company — which owns brands including Guinness and Baileys — said the fiscal year had “started well”, adding:

Based on the current environment, we continue to expect fiscal 20 organic net sales growth to be toward the mid-point of the 4pc to 6pc range and organic operating profit growing roughly one percentage point ahead of organic net sales. This is consistent with what we are targeting over the medium-term.

Online growth pushes Next to profit rise

Next reported a 2.7pc increase in profit for the first half of the year, as strong online growth helped the retailer offset a decline at its high-street stores.

The FTSE 100 company, which has managed to stay above the gloom engulfing much of the UK’s retail sector, said it was maintaining its guidance for the full year.

Total sales increased by 3.7pc, driven by double-digit growth in its online business.

Royal Bank of Canada analyst Richard Chamberlain said:

Online Next has continued to develop its strong platform with more personalisation, a deeper range of branded products, better search functions, better advertising and strong international sales. It is also improving the availability of key lines through further warehouse and distribution efficiencies.

Ofcom: Royal Mail and Salesgroup ‘part of an illegal anti-competitive agreement’

Ofcom says Royal Mail and an online reseller of its parcel delivery services, Salesgroup, have admitted to being part of an “illegal anti-competitive agreement”.

The regulator says Royal Mail had reported in 2018 that its ParcelForce division had an agreement with Despatch Bay (Salesgroup’s operating name), under which “neither company would offer parcel delivery services to the other’s business customers”.

Ofcom has made a provisional finding that the agreement broke competition law.

Under Competition and Markets Authority rules, Royal Mail has received immunity from fines for bring the issue to light. SalesGroup, Ofcom said, has accepted a “significant” fine of £40,000.

What happened overnight

Asian shares turned lower on Thursday after the US Federal Reserve cut interest rates as expected but signalled a higher bar to further policy easing.

Treasury yields rose broadly and the curve flattened as Fed Chairman Jerome Powell took a cautious approach to any further reductions in borrowing costs, while division among central bankers has increased uncertainty over how much further rates might fall.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.36pc. Hong Kong shares shed 1pc, but Japan’s Nikkei rose 0.56pc.

The yen rose from a seven-week low versus the dollar and held onto those gains after the Bank of Japan kept policy on hold, as expected, but signalled it could ease next month.

US stock futures fell 0.23pc in Asia on Thursday. The S&P 500 reversed losses to end 0.03pc higher after Powell said he did not see an imminent recession or think the Fed would adopt negative rates.

Agenda: Guts and glory

Good morning. Yesterday Donald Trump launched another attack on the Federal Reserve, saying its chairman had “no guts” as Federal Reserve cut benchmark interest rates by a quarter point.

Today, the Bank of England’s Monetary Policy Committee has its final meeting before a potential no-deal Brexit departure on October 31, which may continue yesterday's excitement.

5 things to start your day

1) Federal Reserve chief shrugs off Trump insults to deliver insurance policy for shaky US economy: Donald Trump delights in calling his top central banker Jay Powell a “bonehead” and an “enemy of the people”, so he was quick to throw more insults at the Federal Reserve chief following Wednesday's modest cut in interest rates. “No guts, no sense, no vision,” the President fumed.

2) The outgoing boss of River Island said the family-owned fashion chain was committed to the high street despite a fall in sales and profits. Chief executive Ben Lewis, nephew of the retailer’s founder, said: “We maintain our investment in stores. We believe in the future of the high street."

3) Struggling South East drags house price growth to lowest since 2012: Average UK house prices rose just 0.7pc in the year to July – the weakest performance since September 2012 – driven largely by flagging markets in the more expensive South East and London, according to Land Registry data.

4) Hong Kong is under growing pressure to sweeten the terms of its £32bn offer for the London Stock Exchange as a takeover battle for the British bourse intensifies. Executives from Hong Kong Exchanges and Clearing (HKEX) have launched a charm offensive with top LSE investors after its shock approach last week was snubbed by the group's board.

5) Families’ spending power is surging at the fastest pace in three years as price inflation slows and wage growth picks up. Cheaper clothes, toys and petrol helped pull inflation down to 1.7pc in August, its weakest annual pace since December 2016.

Coming up today

Next, says Hargreaves Lansdown’s Emilie Stevens, “remains defiant in the face of the high street storm”. The company recently bucked the sector trend by upgrading its forecasts after rising sales. The retailer – like many of its rivals – is trying to move more of its sales on to online channels to offset a decline in the fortunes of its bricks-and-mortar stores, so the ratio between the two business sections will be closely watched.

Reporting preliminary results for the full year will be Kier Group, the debt-addled outsourcer that has been at the centre of short-sellers’ crosshairs since the collapse of sector giant Carillion. Jefferies analysts say the group’s operating profit will likely be materially down, but that its outlook “is the focus”.

“We believe more evidence of net debt reduction is needed and until asset sales are agreed scope for a re-rating may be limited,” they wrote.

Interim results: Lamprell, Next, Saga

Preliminary results: Kier Group

Revenue update: IG Group

Economics: Retail sales, BoE bank rate (UK), current account balance, jobless claims and home sales (US)

Yahoo Finance

Yahoo Finance