MarketAxess (MKTX) Gears Up for Q4 Earnings: What to Expect

MarketAxess Holdings Inc. MKTX is set to report fourth-quarter 2021 results on Jan 26, before the opening bell.

In the last reported quarter, the leading electronic trading platform operator reported adjusted earnings per share of $1.52, beating the Zacks Consensus Estimate by 7%, backed by higher total credit category’s trading volumes. This was partially offset by escalating costs.

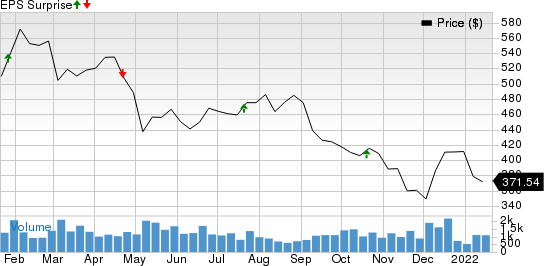

MarketAxess beat the consensus estimate in three of the prior four quarters and missed once, with the average earnings surprise being 3.9%. This is depicted in the graph below:

MarketAxess Holdings Inc. Price and EPS Surprise

MarketAxess Holdings Inc. price-eps-surprise | MarketAxess Holdings Inc. Quote

Let’s see how things have shaped up prior to the fourth-quarter earnings announcement.

Trend in Estimate Revision

The Zacks Consensus Estimate for fourth-quarter earnings per share of $1.44 has witnessed no upward revision but five downward movements in the past 30 days. The estimated figure suggests a decrease of 24.6% from the prior-year reported number.

The consensus estimate for fourth-quarter revenues of $164.4 million indicates a 4.1% decline from the year-ago reported figure.

Factors to Note

MarketAxess has already reported a total trading volume of $1.8 trillion for the fourth quarter, up 20% year over year, thanks to solid contributions made by rates and total other credit volume. Yet, the upside was partly negated by dismal performance of the U.S. high-grade product line of MarketAxess. The U.S. high-grade trading volume plunged 12.7% year over year to $277.9 billion.

The Zacks Consensus Estimate for average daily volume total credit for the fourth quarter is pegged at $9,709 million, indicating a decline from $10,277 million a year ago.

The Zacks Consensus Estimate for total distribution fees is pegged at $31 million, indicating an increase from $27.9 million in the year-ago period. Yet, the consensus mark for total transaction fees is pegged at $113 million, signaling a decrease from the year-ago level of $128 million.

High expenses are likely to have put margins under pressure, reducing the bottom line. The company expects total expenses for 2021 in the range of $360-$365 million, indicating a rise from $314.4 million in the previous year.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for MarketAxess this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here as you will see below.

Earnings ESP: The company’s Earnings ESP is 0.00%. This is because the Most Accurate Estimate is currently pegged at earnings of $1.44 per share, in line with the Zacks Consensus Estimate.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: MarketAxess currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

While an earnings beat looks uncertain for MarketAxess, here are some companies from the Finance space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat for the to-be-reported quarter:

American International Group AIG has an Earnings ESP of +4.88% and a Zacks Rank of 3.

American International is scheduled to report fourth-quarter results on Feb 16.

Marsh & McLennan MMC has an Earnings ESP of +2.76% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

Marsh & Mclennan is scheduled to release fourth-quarter results on Jan 27.

American Express AXP has an Earnings ESP of +2.50% and a Zacks Rank #3.

American Express is scheduled to release quarterly earnings on Jan 25.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Express Company (AXP) : Free Stock Analysis Report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

MarketAxess Holdings Inc. (MKTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance