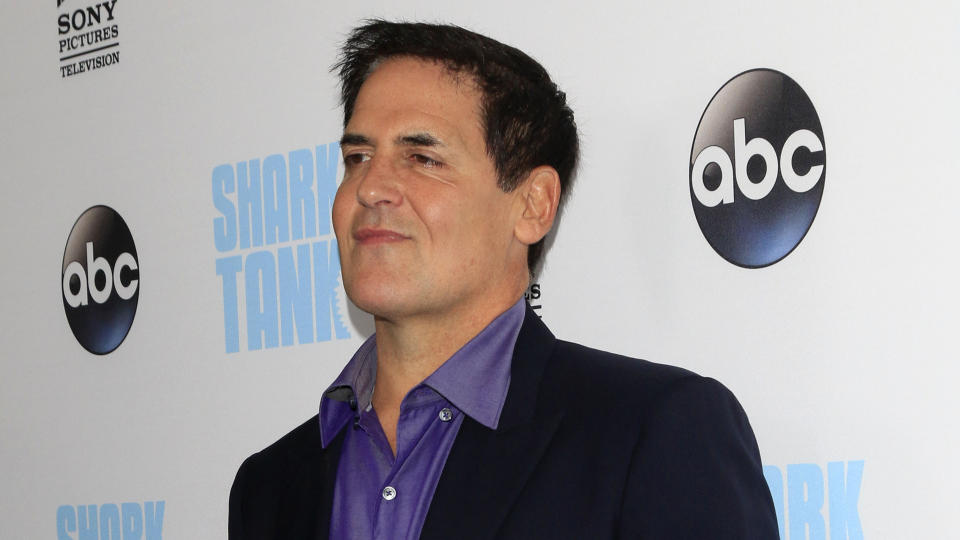

Mark Cuban’s Genius Money Move Made Him Over $2 Billion: 4 Lessons You Can Learn

An undisputed billionaire and highly respected investor, Mark Cuban is no stranger when it comes to taking risks. He, however, always hedges his bets. Take, for instance, when he received billions of dollars’ worth of Yahoo stock after the web service provider acquired his internet radio company Broadcast.com.

Instead of getting greedy, the eventual “Shark Tank” star protected his investment and ended up walking away with over $2 billion. His trade, as he told Howard Stern in an interview, was considered one of the top 10 on Wall Street since it not only protected his stock but also prevented him from being crippled by the internet bubble burst of 2000.

Read More: I Followed Mark Cuban’s Genius Advice and Am on Track To Become a Millionaire

Find Out: 5 Subtly Genius Things All Wealthy People Do With Their Money

Read on to learn more about Cuban’s genius money move that made him billions and takeaways you can apply to your own investing strategies.

Wealthy people know the best money secrets. Learn how to copy them.

What Was Mark Cuban’s Genius Money Move?

A clip from a 2013 interview Mark Cuban did with Howard Stern provides insight into how the well-known entrepreneur turned his Yahoo stock into a multibillion-dollar payday. Cuban explained to Stern that when Yahoo bought Broadcast.com, a company he co-owned, it paid him in stock.

The deal resulted in Mark and his two partners receiving $5.7 billion worth of Yahoo stock. Cuban hedged his roughly 33% stake of the payout in what he said people called “one of the top 10 trades all time on Wall Street.” He explained that everyone thought the internet boom was going to last forever, but he didn’t trust it. To protect his stock, he sold calls and bought puts, watching as his investment went up to where his hedge was before cashing out.

While people at the time thought he sold too soon, within six weeks, the internet bubble burst. Trusting his gut instinct about the market, avoiding being greedy and protecting his stock through a hedge made him over $2 billion.

While it is important to note that Cuban is a sophisticated investor who has an in-depth understanding of the market, there are some lessons that can be learned from his approach. As always, before implementing an investing strategy or purchasing stock, it is strongly recommended that you speak with a financial advisor or other professional.

Try This: Mark Cuban’s Best Advice on How To Become Rich

Lessons You Can Learn From Cuban’s Strategy

When asked about Cuban’s philosophy, James White, a CFA and the CEO of Amazing Moves, explained, “During the internet bubble, Mark Cuban played skeptic to overvalued tech stocks with one of the best examples being Yahoo. He could recognize the speculative nature of the market and looked on toward doing a fundamental analysis rather than following through on hype or trends.

“In the disciplined approach that Cuban adopts toward investing in volatile market conditions, there are a number of lessons for investors,” White said. “As a matter of fact, ordinary investors, with a proper set of fundamentals and diversified portfolios keeping away from herd mentality and adopting risk management policies, can face the cycles of markets much more effectively.”

Focus On Fundamentals

There are several lessons that can be learned from the multibillion-dollar businessman’s strategy. “Just like Cuban, average investors should major in understanding company fundamentals. This shall include financial statement analysis, growth prospects analysis, competitive advantages and quality of management,” White said.

Diversification

When asked about takeaways from Cuban’s success, White said, “He focused on diversification across sectors and asset classes.” He added that focusing on diversification “reduces the risk from an overly high exposure to the volatility in a single stock or industry.”

Avoid the Herd Mentality

Trusting your gut and not jumping on the bandwagon can help protect your investment. “Markets, during speculative bubbles, are driven by herding and hype. The approach of Cuban keeps investors skeptical not to follow the herd without doing research,” White said.

Risk Management

“Modifying the risk by assessment and management is important,” White said. “Cuban insulated himself, as he identified stocks that were overvalued relative to their intrinsic value. The average investor can do this pretty well with the help of available tools like stop-loss orders and proper asset allocation.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Mark Cuban’s Genius Money Move Made Him Over $2 Billion: 4 Lessons You Can Learn