Mark Carney will be Bank of England governor until 2020

Mark Carney will be governor of the Bank of England until 31 January 2020.

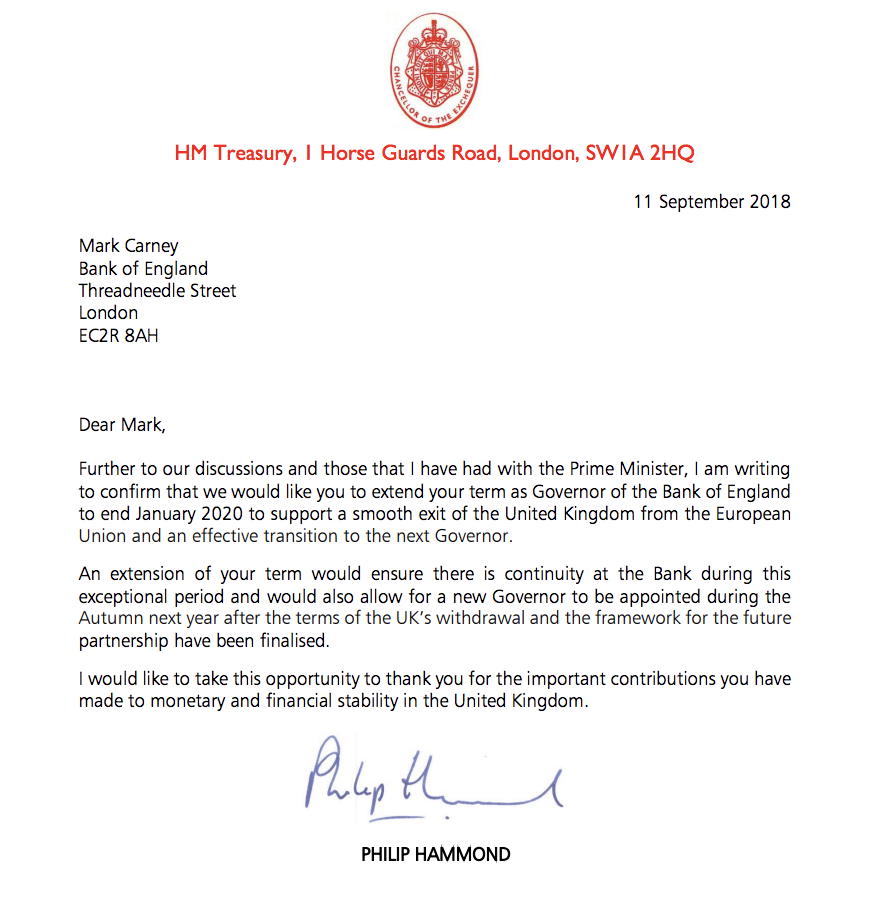

The HM Treasury confirmed in a statement today (11 September) that the extension was agreed in an exchange of letters between Carney and Chancellor Philip Hammond, published this morning.

“I’m delighted that the Governor has agreed to stay in his role for a further seven months to support a smooth exit from the European Union and provide vital stability for our economy,” said Hammond in a statement.

Carney is a Harvard and Oxford-educated Canadian who previously led Canada’s central bank and has been popular within the City for steering the UK economy with a “steady hand.”

He has also issued gloomy forecasts about the economic ramifications of Brexit. He warned last month that the possibility that the UK could crash out of the EU without a formalised deal “is uncomfortably high” and “highly undesirable.” This would lead to higher prices and disruptions to British trade, he said.

READ MORE: Why investors are clamouring to keep Mark Carney at the Bank of England

Carney’s original term as BOE governor was originally meant to be up until June 2019— only around three months after Britain leaves the EU. The UK government, as well as financiers, has been keen to keep Carney on during one of the most crucial changes in the country’s recent history.

While Carney has agreed to stay on for another year, it is still only within the immediate aftermath of Brexit. The transition period is meant to last until the end of 2020.

“Carney’s re-appointment brings continuity to BoE policy. Compared to almost any potential successor, Carney will exert a more firmly dovish influence on UK monetary decision-making, as he has done consistently since he took the helm in 2013,” said Anna Stupnytska, Global Economist, Fidelity International.

“While Carney expects a gradual pace of rate hikes from here, perhaps little more than one per year, as he sees out the rest of his tenure, in reality he will be driven by how smooth or disruptive Brexit turns out to be.

“Indeed, it is perhaps with regards to Brexit where Carney-continuity is more important, and why Theresa May was so keen to keep him on board. In addition to setting interest rates, the Bank of England also supervises and regulates British banks through macro-prudential’ policy. As such, investors can take some comfort that Carney is as well-placed as anyone to navigate any choppy waters that Brexit will bring to threaten Britain’s overall financial system.”

Yahoo Finance

Yahoo Finance