Malaysia announces stimulus package to blunt coronavirus hit

By Anisah Shukry

(Bloomberg) -- Malaysia, in the grip of a political leadership battle, announced a package of measures to counter the coronavirus outbreak, which will slow the country’s economic growth this year.

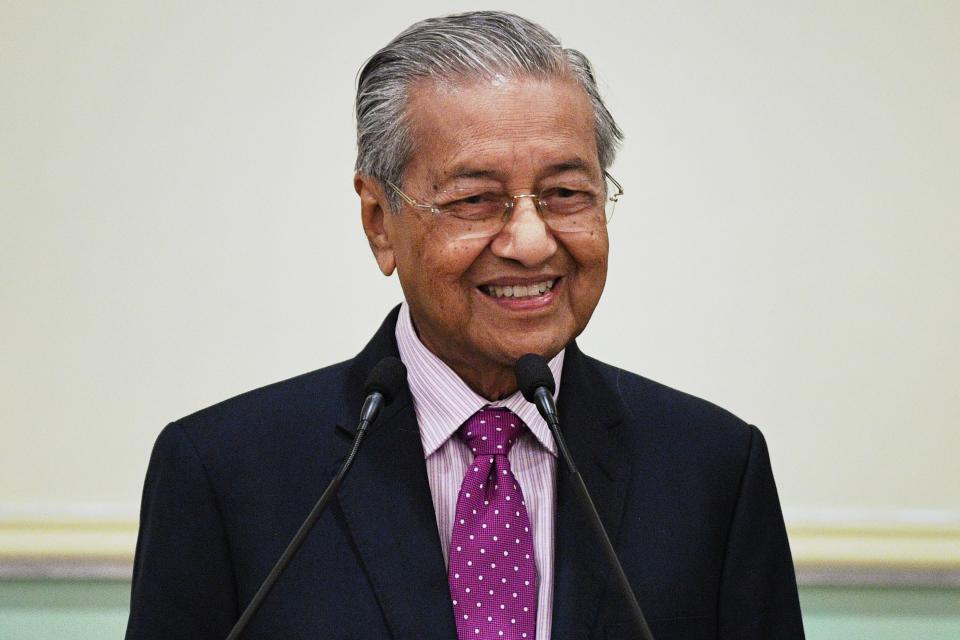

Interim Prime Minister Mahathir Mohamad said Thursday the government will dedicate 20 billion ringgit (US$4.7 billion) to support businesses affected by the virus, particularly in the tourism industry. Mahathir said gross domestic product now is expected to grow 3.2%-4.2% this year, down from an earlier forecast of 4.8%.

The fallout from the virus is wreaking havoc on mobility and supply chains across Asia. Mahathir said the government was further widening its fiscal deficit target to 3.4% of GDP this year from 3.2% previously, which already had been raised from an initial target of 3%.

Malaysia’s stimulus follows fiscal steps taken in recent weeks by Indonesia, Singapore and Hong Kong to counter the economic impact of the virus. Indonesia said this week it will give incentives and tax breaks to businesses in a package worth 10.3 trillion rupiah (US$737 million).

“Lowering the growth target is sensible given the downside risk to growth regionally and globally. The modest widening of the fiscal deficit from 3.2% to 3.4% is tolerable from a rating point of view,” said Winson Phoon, head of fixed-income research at Maybank Kim Eng Securities Ltd. in Singapore. “This will mean a mild 3 billion ringgit increase in government funding needs. Assuming it will be fully funded by raising funds from ringgit bonds, 3 billion ringgit is digestible, as evidenced by recent strong cover ratios in auctions.”

The package announced Thursday includes:

funds and steps to ease cash flow for affected industries

a 6-month extension for tourism businesses to pay taxes

handouts for tour guides, taxi and bus drivers, medical workers and immigration workers

a reduction in the minimum pension-fund contribution

funds for infrastructure upgrades and repair

Malaysia’s outlook is further clouded by political upheaval after Mahathir abruptly resigned as prime minister Monday, only to be reappointed in an interim capacity later the same day, but without his cabinet.

The central bank has already cut its benchmark interest rate once this year, by 25 basis points, and has signaled room for further policy easing. The bank is scheduled to make its next rate decision on March 3.

© 2020 Bloomberg L.P.

Yahoo Finance

Yahoo Finance