Mairs and Power Amplifies Apple Stake in Q2 2024, Signaling Strategic Portfolio Adjustments

Insight into Mairs and Power (Trades, Portfolio)'s Latest 13F Filings and Strategic Stock Movements

Mairs and Power (Trades, Portfolio), a distinguished investment firm based in Minnesota, recently disclosed its 13F filings for the second quarter of 2024. The firm, known for managing three mutual fundsthe Growth Fund, the Balanced Fund, and the Small-Cap Fundadheres to a focused long-term investing process established since 1931. Mairs and Power (Trades, Portfolio)'s investment philosophy centers on selecting companies that exhibit consistent, above-average growth, robust returns on invested capital, and sustainable competitive advantages. Their low turnover strategy emphasizes long-term gains over short-term fluctuations, focusing on less efficient market segments to maximize investor returns.

New Additions to the Portfolio

Mairs and Power (Trades, Portfolio) expanded its portfolio by adding six new stocks in the second quarter of 2024. Noteworthy new acquisitions include:

The S&P MidCap 400 ETF (MDY), purchasing 985 shares valued at approximately $527,050.

GE Vernova Inc (NYSE:GEV), with 1,942 shares, representing a total investment of around $333,070.

HP Inc (NYSE:HPQ), acquiring 5,814 shares, totaling about $203,610.

Significant Increases in Existing Positions

During the same period, Mairs and Power (Trades, Portfolio) increased its holdings in 53 stocks. Key increases include:

Apple Inc (NASDAQ:AAPL), where an additional 347,651 shares were purchased, bringing the total to 1,303,200 shares. This adjustment marks a significant 36.38% increase in share count and a 0.71% impact on the current portfolio, with a total value of $274,480,020.

Alliant Energy Corp (NASDAQ:LNT), with an additional 510,031 shares, increasing the total to 3,831,399 shares. This represents a 15.36% increase in share count, valued at $195,018,210.

Positions Completely Exited

Mairs and Power (Trades, Portfolio) also decided to exit 11 holdings entirely in the second quarter of 2024, including:

Marcus Corp (NYSE:MCS), selling all 169,856 shares, impacting the portfolio by -0.02%.

iShares Russell Mid-Cap ETF (IWR), liquidating all 2,385 shares, with a negligible impact on the portfolio.

Reductions in Key Holdings

The firm reduced its positions in 116 stocks. Significant reductions were made in:

Alphabet Inc (NASDAQ:GOOG), with a decrease of 389,741 shares, resulting in a -12.16% reduction and a -0.58% portfolio impact. The stock traded at an average price of $170.1 during the quarter.

Ecolab Inc (NYSE:ECL), reducing holdings by 157,173 shares, marking a -15.85% decrease and a -0.35% impact on the portfolio. The stock's average trading price was $231.07 during the quarter.

Portfolio Overview and Sector Allocation

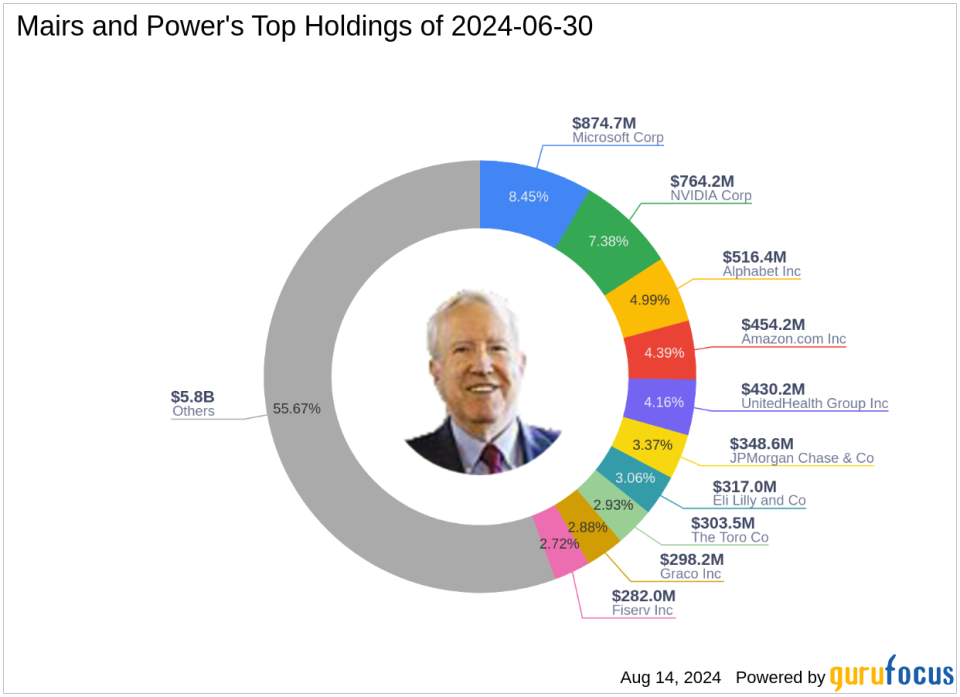

As of the second quarter of 2024, Mairs and Power (Trades, Portfolio)'s portfolio included 222 stocks. The top holdings comprised 8.45% in Microsoft Corp (NASDAQ:MSFT), 7.38% in NVIDIA Corp (NASDAQ:NVDA), 4.99% in Alphabet Inc (NASDAQ:GOOG), 4.39% in Amazon.com Inc (NASDAQ:AMZN), and 4.16% in UnitedHealth Group Inc (NYSE:UNH). The investments are predominantly concentrated across 11 industries, with significant allocations in Technology, Industrials, and Healthcare sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.