Magna (MGA) Up 5.2% Despite Q3 Earnings Miss, Lowers '21 View

Magna International’s MGA shares have moved up 5.2% since it released third-quarter 2021 results. While the firm’s quarterly profit lagged estimates, revenues managed to surpass the same. Weaker-than-expected contribution from Body Exteriors & Structures and Complete Vehicles segments resulted in the earnings miss. Nonetheless, revenues from each segment outpaced the Zacks Consensus Estimate.

The auto equipment provider reported third-quarter 2021 adjusted earnings of 56 cents per share, declining from the year-ago figure of $1.95. The bottom line also missed the Zacks Consensus Estimate of 75 cents per share. For the reported quarter, net sales slipped 13.3% from the prior-year quarter to $7,919 million but came ahead of the consensus mark of $7,849 million.

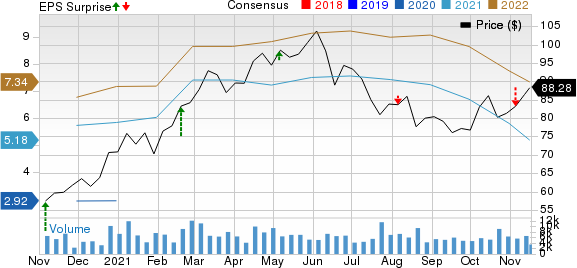

Magna International Inc. Price, Consensus and EPS Surprise

Magna International Inc. price-consensus-eps-surprise-chart | Magna International Inc. Quote

Segmental Performances

The Body Exteriors & Structures segment’s revenues for the reported quarter were $3,185 million, contracting 17% year over year owing to lower global light vehicle production amid chip crunch. The metric, however, came ahead of the consensus mark of $3,183 million. The segment reported an adjusted EBIT of $98 million, tanking 75% year over year amid lower sales and high costs. The EBIT also missed the consensus mark of $123 million.

For the September-end quarter, the Power & Vision segment revenues dipped to $2,501 million from the prior-year figure of $2,722 million. The metric, however, beat the consensus mark of $2,246 million. Lower year-over-year sales, high production costs and electrification spending resulted in segmental EBIT of $67 million, plummeting from $227 million recorded in the comparable year-ago period. The metric, however, topped the consensus mark of $53 million.

Revenues in the Seating Systems segment fell 12% year over year to $1,123 million for the quarter under review but came ahead of the consensus mark of $1,056 million. The segment reported a pretax profit of $22 million, dwindling 67% year over year but beating the consensus mark of $12 million.

For the July-September period, the Complete Vehicles segment’s revenues tailed off 10% year over year to $1,255 million amid lower assembly volumes. The segmental revenues also surpassed the consensus mark of $1,157 million. Adjusted EBIT tapered off 57% year over year to $30 million and lagged the consensus mark of $35 million.

Financials & Updated Guidance

Magna had $2,748 million cash and cash equivalents as of Sep 30, 2021. It had long-term debt of $3,908 million. For the reported quarter, cash provided from operating activities totaled $400 million.

In the light of global microchip concerns, Magna has trimmed its 2021 view. It now expects full-year 2021 revenues in the band of $35.4-$36.4 billion, down from the prior guided range of $38-$39.5 billion. Adjusted EBIT margin is anticipated to be 5.1-5.4%, down from the previous projection of 7-7.4%. The Zacks Rank #5 (Strong Sell) company envisions capital spending of $1.5 billion in 2021.

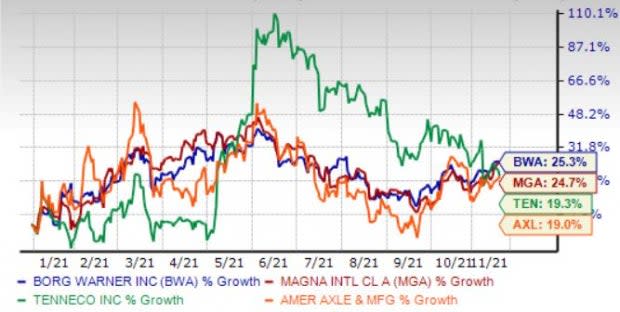

Shares of MGA have edged up 24.7% year to date. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

MGA’s Q3 Results Comparison With Key Peers

Amid lower year-over-year vehicle production, components shortages, and manufacturing inefficiencies, most of Magna’s peers including BorgWarner BWA, American Axle AXL as well as Tenneco TEN also reported weaker third-quarter 2021 earnings than the corresponding period of 2020. Shortage of semiconductor supply prompted these auto equipment suppliers to slash full-year projections. The companies cited low light vehicle production, manufacturing inefficiencies, logistical constraints, high commodity costs and a tough labor market as the key factors behind the trimmed forecasts.

Here is a rundown of key takeaways from the quarterly results of Magna’s close competitors.

BorgWarner reported adjusted earnings of 80 cents per share for third-quarter 2021, declining from 88 cents recorded in the prior-year period. The bottom line, however, beat the Zacks Consensus Estimate of 66 cents. Net sales of $3,416 million outpaced the Zacks Consensus Estimate of $3,342 million. The top-line figure also grew 34.8% year over year, thanks to the Delphi Technologies buyout and increased demand for products.

For full-year 2021, BorgWarner anticipates net sales within $14.4-$14.7 billion, down from the previous guided range of $15.2-$15.6 billion. Free cash flow is projected in the band of $600-$700 million versus the prior guided range of $800-$900 million. BWA currently carries a Zacks Rank #4 (Sell). Shares of the firm have increased 25.3% year to date.

American Axle reported adjusted earnings of 15 cents per share for third-quarter 2021, topping the Zacks Consensus Estimate of 2 cents. The bottom line, however, fell from $1.15 a share earned a year ago. The company generated quarterly revenues of $1,213.1 million, surpassing the Zacks Consensus Estimate of $1,179.6 million. Revenues declined 14.2% on a year-over-year basis, led by the unfavorable impact of semiconductor chip shortage.

For full-year 2021, American Axle envisions revenues in the range of $5.15-$5.25 billion, down from the previous projection of $5.3-$5.5 billion. Adjusted FCF is now projected at $400 million instead of the prior forecast of $350-$425 million. AXL currently carries Zacks Rank #4. Shares of the firm have moved up 19% year to date.

Tenneco reported third-quarter 2021 adjusted earnings of 17 cents per share, which topped the Zacks Consensus Estimate of 15 cents. The bottom line, however, compared unfavorably with the year-ago figure of 33 cents a share. Revenues of $4,332 million topped the Zacks Consensus Estimate of $3,995 million and improved around 2% year over year.

Tenneco now anticipates full-year revenues within $17.75-$17.85 billion, down from the prior view of $18.3-$18.6 billion. Adjusted EBITDA for 2021 is now estimated in the band of $1.25-$1.28 billion, lower than the previous guided range of $1.36-$1.44 billion. TEN currently carries a Zacks Rank #4. Shares of the company have risen 19.3% year to date.

Year-to-Date Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

American Axle & Manufacturing Holdings, Inc. (AXL) : Free Stock Analysis Report

Tenneco Inc. (TEN) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance