Time Inc explores bid for Yahoo's core business - source

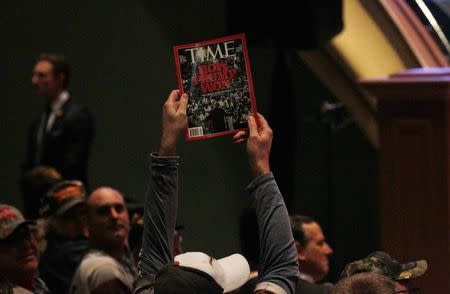

By Jessica Toonkel and Sai Sachin R (Reuters) - Time Inc, publisher of Sports Illustrated, People and Time magazines, has been exploring a bid to acquire Yahoo Inc's core Internet business for several weeks, a source familiar with the situation told Reuters on Tuesday. Time Inc has been reaching out to bankers on pursuing a deal with Yahoo, according to the source, who wished to remain anonymous, not being permitted to speak to media. Time Inc, which has seen print advertising dollars dry up in recent quarters, has been trying to boost its digital presence through acquisitions of online properties, saying this month it would buy social networking pioneer MySpace. Verizon Communications Inc, which owns Internet pioneer AOL, has expressed interest in Yahoo's core business, which includes Mail, its news and sports sites and advertising technology. Analysts at SunTrust Robinson Humphrey have valued the core business at $6 billion to $8 billion. It is unclear if the company has retained an investment bank as financial advisor on the potential bid. Yahoo officially launched the sale of its core business on Friday. Time Inc could pursue a Reverse Morris Trust transaction with Yahoo, a tax-free deal in which one company merges with a spun-off unit, Bloomberg reported earlier on Tuesday. Yahoo Chief Executive Marissa Mayer would not be part of the company under such a deal, Bloomberg reported, citing one of its sources. Time Inc has heard a presentation from Citigroup Inc bankers on pursuing a deal with Yahoo, the Bloomberg report said, adding that Time had not retained Citigroup. (http://bloom.bg/1mUM7lQ) Time Inc and Yahoo declined to comment on the report while Citigroup could not immediately be reached for comment. Earlier this month, the magazine publisher reported a bigger-than-expected drop in fourth-quarter profit, hobbled by a strong dollar and a drop in income from print ads, and said ad revenue would likely be flat or fall in the current quarter. Time Inc's U.S. beauty, fashion, retail and financial magazines have all experienced a drop in ad sales as more people go online for news and information. The company said this month it would buy advertising company Viant as it seeks to boost revenue from digital properties. Time Warner Inc spun off its publishing business Time Inc in 2014 to focus on its more profitable broadcasting businesses. Time Inc shares were down 2 percent at $14.04 in afternoon trading on Tuesday. Yahoo shares dipped about 1.4 percent to $30.73. (Additional reporting by Sai Sachin R in Bengaluru)

Yahoo Finance

Yahoo Finance