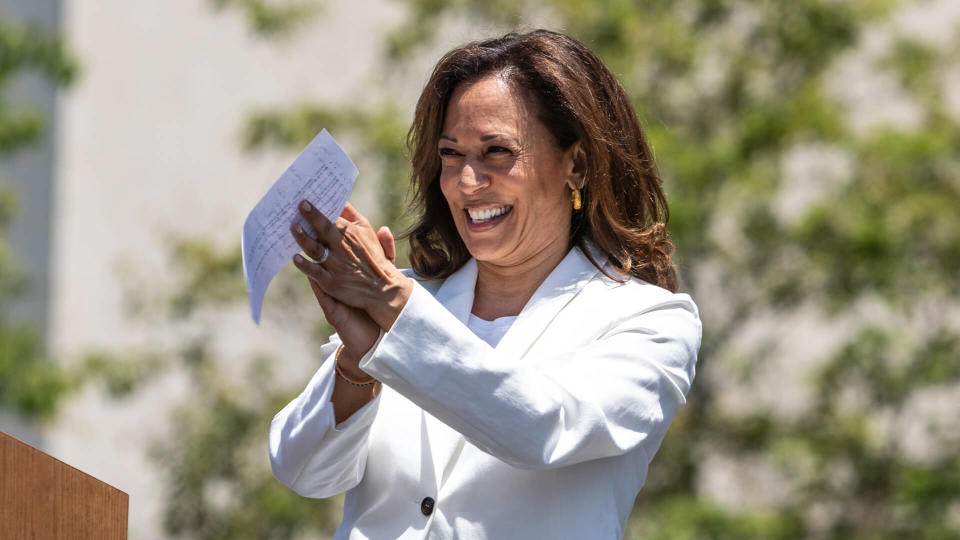

I’m a Retirement Planner: 6 Moves You Should Make If You Think Harris Will Win the Election

The 2024 presidential election will be here before you know it and many of us are concerned about the consequences of whoever takes over the white house.

One area of interest? Retirement. GOBankingRates spoke with retirement planners to find out what Americans should do if they think Harris will win in November. Here’s a look at some strategies retirement planners and financial experts recommend considering.

Also here’s another take on what a Harris presidency could mean for retirees.

Trending Now: Trump Wants To Eliminate Income Taxes: How Would That Impact You If You Are Retired?

Find Out: The Surprising Way You Can Get Guaranteed Retirement Income for Life

Wealthy people know the best money secrets. Learn how to copy them.

Stay the Course With Your Long-Term Investment Strategy

Despite the temptation to make drastic changes based on election outcomes, all of our experts consistently advised against it.

Paul Tyler, chief marketing officer at Nassau Financial Group, explained the importance of perspective. “Time frames make all the difference when it comes to saving for retirement.

“The average worker who starts a job at 21 and retires at age 65 has over 11,000 days to make the right savings decisions. Consistent investment habits over that time frame will negate any politician’s impact on a person’s retirement future,” he said.

Read More: Here Are All the Promises Trump Has Made About Social Security If He’s Reelected

Consider Increasing International Exposure

Thomas Brock, chartered financial analyst (CFA) and certified public accountant (CPA), shared his take on what a Harris presidency could possibly lead.

“If you think Harris is likely to win, a shrewd move would be to underweight your allocation to domestic stocks and overweight your allocation to international developed and emerging market stocks,” he said. “More substantial overseas exposure could help you overcome flagging economic performance and a weakened U.S. dollar.”

Maintain Adequate Liquidity

Regardless of the political climate, Brock explained the importance of liquidity. “I strive to always have an adequate liquidity reserve,” he said. This will ensure you have cash on hand for emergencies and opportunities, regardless of what’s happening in the market.

Stay Invested Regardless of Party Control

Edelman Financial Engines‘ research shows that it’s smart to stay invested regardless of which party controls the White House. Their study found that $10,000 invested consistently from 1948 to present, regardless of the president’s party, would have grown to $37,198,830. This dramatically outperformed strategies that invested only during presidencies of one party or the other.

Specifically, the study showed that if Americans invested only when a Democrat was president, starting in 1948, $10,000 would have grown to $1,200,696. If invested only when a Republican was president over the same time period, $10,000 would have grown to $309,811. The stark difference between these figures and the result of staying consistently invested ($37,198,830) underscores the importance of maintaining a long-term investment strategy regardless of political outcomes.

Focus on Personal Financial Goals

The Edelman Financial Engines’ Everyday Wealth in America study found that 73% of Americans are concerned about the election’s impact on their financial security. That makes sense, but the firm advises clients not to act out of fear or change their long-term plans based on election results. Instead, you should focus on your personal financial goals and the factors you can control.

Seek Professional Advice

Given the complexity of retirement planning and the potential for policy changes, it’s never a bad idea to book time with a financial advisor. They can help you navigate potential changes and ensure your retirement strategy is consistent with your long-term goals, regardless of political outcomes.

Editor’s note on election coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. For more coverage on this topic, please check out I’m a Retirement Planner: 5 Moves You Should Make If You Think Trump Will Be Re-Elected.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: I’m a Retirement Planner: 6 Moves You Should Make If You Think Harris Will Win the Election