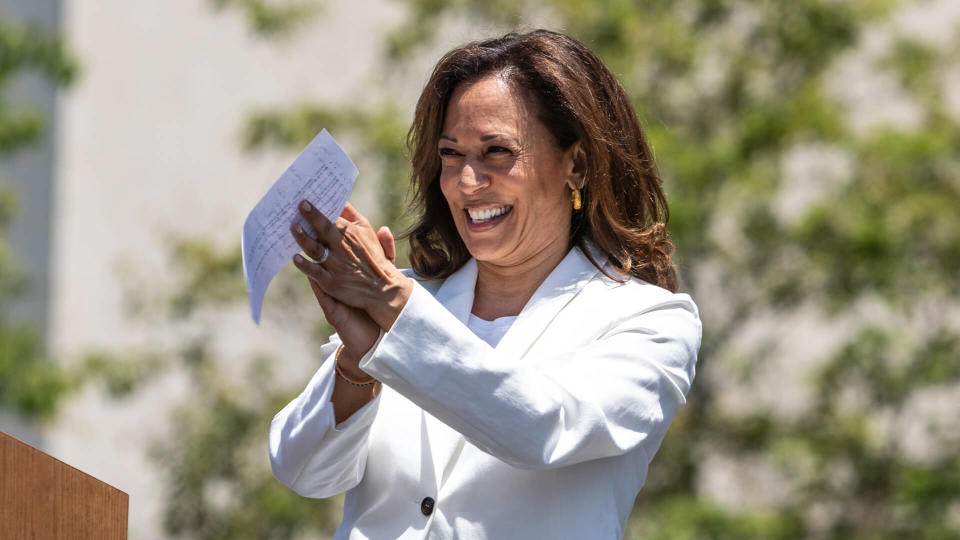

I’m an Investor: 8 Stocks You Should Buy If You Think Harris May Win the Election

The stock market is as active as ever and many of us are wondering how we should approach it in the future. If you think Harris will win the election this November, you might be curious as to where you should invest.

GOBankingRates spoke with investors to find out where they think you should put your hard-earned cash if you think Democrats will win this fall. Here are eight stocks you should buy if you think Harris will win the election.

In contrast, here’s where you should invest your money if you think Trump may win.

Check Out: In 5 Years, These 2 Stocks Will Be More Valuable Than Apple

Consider This: 7 Reasons You Must Speak to a Financial Advisor To Boost Your Savings in 2024

Earning passive income doesn't need to be difficult. You can start this week.

The Political Landscape

Before diving into specific stock recommendations, Diego Apaza, day trader and founder of Alpha Stocks Lab, offers his perspectives on stocks that could perform well under a Harris administration.

“I think it’s important to preface my response with the fact that neither presidential candidate has offered any protections regarding investing,” he said. “They haven’t proclaimed to favor certain outcomes or are rooting for stocks and crypto outside appearances, sticking to a general favor of it.”

With this caveat in mind, Apaza explained that certain stocks may become more favorable based on Harris’ policy positions and the industries she has expressed strong support for.

Read Next: I’m a Self-Made Millionaire: 5 Stocks You Shouldn’t Sell

Enphase Energy (ENPH)

Apaza recommended Enphase Energy as a potential winner under a Harris administration, citing her strong support for environmental protections and renewable energy.

“She champions renewable energy and environmental protections, so my pick would be to invest in Enphase Energy (ENPH). They contribute to these ideals by constantly searching to lower energy consumption and facilitate the switch to solar,” she said.

NextEra Energy (NEE) and First Solar (FSLR)

David Materazzi, investment expert and CEO of Galileo FX, echoed the sentiment on renewable energy stocks and suggested two additional companies.

“If you think Kamala Harris will win the U.S. election, load up on NextEra Energy (NEE), First Solar (FSLR) […] now. Harris’ all-in push for renewable energy will turn NextEra and First Solar into Wall Street darlings.”

Tesla (TSLA)

Despite recent market volatility, Materazzi sees potential in Tesla under a Harris presidency.

“Tesla, despite its recent dips,” he said, “is a heavyweight set to electrify the future of transportation.”

Teladoc Health (TDOC)

Apaza pointed to Harris’ focus on affordable healthcare as a reason to consider Teladoc Health.

“She has spoken on how fundamental affordable healthcare is to her platform,” he said. “I think Teladoc Health (TDOC) will see a boost because they intend to expand the reach of healthcare through a focus on telehealth services.”

UnitedHealth Group (UNH)

Materazzi also sees potential in the healthcare sector — specifically in UnitedHealth Group.

“With Harris championing healthcare reform, UnitedHealth Group is poised to become a cash cow,” he said.

Coursera (COUR)

Apaza highlighted Harris emphasis on education as a reason to consider Coursera.

“Equal access to education is a big one as well. Programs like Coursera (COUR) offer online classes and degrees,” he said. “I expect that stocks catering to enhanced education and job access will also serve her platform founded on revitalizing the economy.”

Lemonade (LMND)

Addressing Harris’ focus on reducing poverty and homelessness, Apaza likes the look of Lemonade.

“Less homelessness and poverty are included in her ideals as well,” he said. “Lemonade (LMND) offers affordable insurance that is tech-driven and economically inclusive.”

Palo Alto Networks (PANW)

Materazzi sees potential in cybersecurity stocks, specifically mentioning Palo Alto Networks.

“Palo Alto Networks will ride the wave of her stringent data privacy policies, becoming a fortress in cybersecurity,” he said.

Investment Strategy and Caution

Both experts emphasized the potential upside of these stocks if Harris wins the election. Materazzi went as far as to say that betting on these stocks is like “hitting the jackpot in a Harris-led future — miss out and you’ll be left in the dust.”

That said, it’s important to remember stock performance is influenced by many factors — most of them beyond just election outcomes. Keep in mind that political landscapes can shift and nobody knows the future.

A Word of Wisdom: Don’t Overhaul Your Portfolio Just Yet

Before you rush to buy all these stocks, hold up. We’ve got some sage advice from another expert that might make you think twice.

Thomas Brock, chartered financial analyst (CFA), certified public accountant (CPA), expert contributor for Annuity.org, offered a more cautious approach.

“I do not encourage a long-term investor to significantly change his or her investment strategy in light of presidential elections and changes in Congress,” Brock said. “Regardless of the political environment, I always maintain an adequate liquidity reserve, invest meaningfully in equities and real estate and embrace diversification throughout my portfolio.”

In other words, don’t put all your eggs in one basket just because of an election.

Brock explained a potential strategy if you’re convinced Harris will win. “If you think Harris is likely to win, a savvy maneuver is to trim your allocation to domestic stocks and increase your allocation to international developed and emerging market stocks,” he said. He thinks greater international exposure is a smart move if Harris wins the election.

More From GOBankingRates

What a Trump Presidency Could Mean for Social Security in 2025

Shop Online? Here's How to Get 3% Cash Back For Things You Already Buy

6 Subtly Genius Things All Wealthy People Do With Their Money -- That You Should Do, Too

This article originally appeared on GOBankingRates.com: I’m an Investor: 8 Stocks You Should Buy If You Think Harris May Win the Election