LyondellBasell (LYB) Q1 Earnings Beat Estimates, Sales Lag

LyondellBasell Industries N.V. LYB recorded a first-quarter 2023 profit of $474 million or $1.44 per share, reflecting a fall of 64.1% from the year-ago quarter's profit of $1,320 million or $4 per share.

LYB posted adjusted earnings of $2.50 per share, down 37.5% from the year-ago quarter figure of $4. It surpassed the Zacks Consensus Estimate of $1.80.

The company’s net sales in the first quarter were $10,247 million, which lagged the Zacks Consensus Estimate of $10,354.8 million. Net sales decreased around 22.1% from $13,157 million in the prior-year quarter.

In the reported quarter, global olefins and polyolefins margins increased, driven by reduced ethane costs in the United States, lower energy costs and modestly improved global demand. LYB raised global operating rates in sync with the market conditions. Strong oxyfuels and refining margins were supported by steady demand for fuels.

LyondellBasell Industries N.V. Price, Consensus and EPS Surprise

LyondellBasell Industries N.V. price-consensus-eps-surprise-chart | LyondellBasell Industries N.V. Quote

Segment Highlights

In the Olefins & Polyolefins — Americas division, EBITDA decreased roughly 42.4% year over year to $541 million in the reported quarter. Olefins’ results fell due to lower margins.

The Olefins & Polyolefins — Europe, Asia, the international segment recorded EBITDA of $77 million, down from the prior-year quarter levels of $214 million. Polyolefins results declined due to lower margins resulting from lower polyolefins spreads reflecting weak demand.

The Advanced Polymer Solutions segment posted a loss of $226 million, down from EBITDA of $71 million in the prior-year quarter. High levels of raw material and production costs resulted in a decline in the performance of this segment. The segment also faced lower demand.

EBITDA in the Intermediates and Derivatives segment decreased around 22% on a year-over-year basis to $426 million. The segment reported weaker propylene oxide and derivatives results as lower demand hurt margins in the quarter.

The Refining segment reported an EBITDA of $246 million in the reported quarter, up around 66.2% from the year-ago quarter.

The Technology segment’s EBITDA was $73 million in the reported quarter, down around 29.1% year over year. The downside was due to lower catalyst volumes due to low demand.

Financials

LyondellBasell generated $482 million in cash from operating activities during the quarter. The company returned $460 million as dividends and share repurchases during the quarter.

Outlook

The company anticipates a slight increase in global demand driven by usual seasonal trends. The demand for transportation fuels is expected to increase over the summer, supporting oxyfuels and refining margins. Delays at the beginning of industry-wide capacity expansions for polyethylene in North America are likely to lower new market supply and support polyethylene margins. In order to keep pace with the market expectation, LyondellBasell estimates operating Intermediates & Derivatives assets at 80% and modestly raise global olefins and polyolefins operating rates to 85%. The company will continue to monitor the impact on petrochemical markets in the second half of 2023 of shifting global monetary policies and strengthening economic conditions in China.

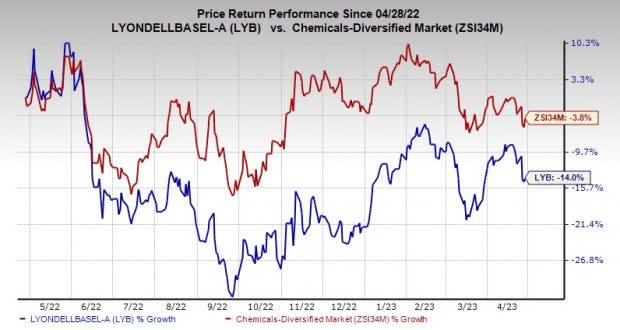

Price Performance

Shares of LyondellBasell have lost 14% in the past year compared with a 3.8% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

LYB currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the Basic Materials space include Steel Dynamics, Inc. STLD, Linde plc LIN and PPG Industries, Inc. PPG.

Steel Dynamics currently carries a Zacks Rank #1 (Strong Buy). Shares of STLD have gained 21.7% in the past year. It topped the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 10.7% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Linde, currently carrying a Zacks Rank #2 (Buy), has a projected earnings growth rate of 9.1% for the current year. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 0.97% upward in the past 60 days. It has a trailing four-quarter earnings surprise of 5.9%, on average. The stock has gained 17.3% over the past year.

PPG Industries currently carries a Zacks Rank #2 and has a projected earnings growth rate of 20.2% for the current year. Shares of PPG have gained 8.6% in the past year. It delivered a trailing four-quarter earnings surprise of 6.8% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance