London’s Kensington and Chelsea record the most £1 mil+ property sales in 2019

According to research by UK-based lettings and sales agent Benham and Reeves, about 59% of all property sales in London’s Kensington and Chelsea neighbourhoods were transacted at £1 million ($1.78 million) or higher in 2019.

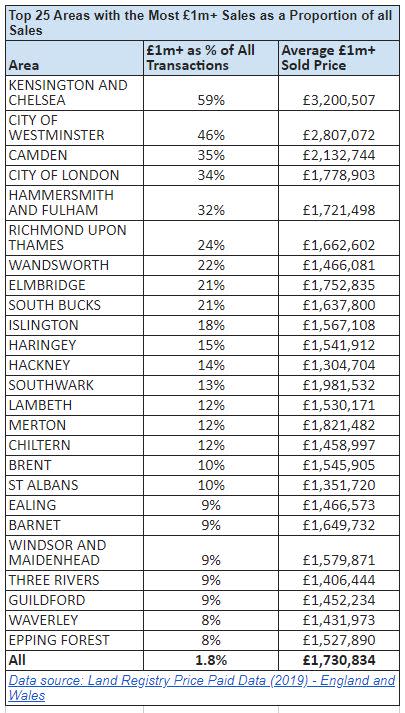

The two upmarket areas topped the list of areas with the most £1 million+ sales as a percentage of total transactions last year, based on property transactions across England and Wales.

Overall, property transactions worth £1 million+ accounted for 1.8% of all transactions during the year. “There’s no denying that month after month of uncertainty surrounding Brexit had caused the market to grind to stutter and at the very top end, where even the smallest margins can equate to substantial sums of money, there had understandably been a sharp drop in buyer interest,” says Marc von Grundherr, director of Benham and Reeves.

But high-end properties in London remain “a very attractive proposition to the wealthiest buyers”, he says, adding that prime neighbourhoods in the capital accounted for 13 of the top 15 areas where sales at £1 million or above made up the highest percentage of all transactions.

The City of Westminster recorded the second-highest proportion of high-end property sales, with 46% of transactions at £1 million or more. Other top-ranked neighbourhoods include Camden with 35%, the City of London at 34%, and Hammersmith and Fulham at 32%.

Outside of London, Elmbridge and South Bucks saw 21% of transactions exceed £1 million, followed by 12% in Chiltern, 10% in St Albans, and Three Rivers and Guildford hitting 9%.

“While Kensington, Westminster and Camden placed with the highest proportion of transactions as a percentage of all transactions at both the £5 million+ and £10 million+ price brackets, Runnymead was a new entry with the area ranking fourth in both price brackets,” says Benham and Reeves.

Prime neighbourhoods in London accounted for 13 of the top 15 areas in England and Wales where sales at £1 million or above made up the highest percentage of all transactions last year. (Picture: Pixabay)

“Now that we’ve seen the bottom of the market and a Boris bounce has opened the floodgates of both buyer and seller activity, domestic and foreign investment in the most valuable pockets of the market should start to regain momentum,” says Grundherr.

He adds that buyers who committed to a purchase last year could do well in terms of value for money, as prices in the high-end segment “will no doubt start to climb in price as the year plays out”.

Read also:

Europe and Asia Pacific ranked as top investment destinations in 2020

Demand for London super-prime homes expected to rise after UK election

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

Home buyers return to London’s property market amid greater certainty

Elite Commercial REIT reports public tranche for IPO 8.3 times subscribed

Frasers Property to acquire London business park for $238 mil

Singapore ranks third in global survey for real estate demand

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance