Can You Live Off a Million Dollars, Forever?

The concept of becoming a millionaire rings a special tone in most people's hearts. It sounds like a dream come true, where you can enjoy a comfortable life without needing to work anymore. But, can you really live off of a million dollars forever even if you don't work for another day? If you don't generate any other source of income, a million dollars can last you about 50 years if you spend S$1,000 per month, no where close enough for living the dream life. As it turns out, however, investing the million dollars to generate even an average return can be enough to help you splurge thousands of dollars every month for the rest of your life.

A Million Dollars Can Last You 50 Years, If Invested Properly

Assuming you've already made your major life purchases like a home, properly investing S$1 million can help you easily afford S$2,000 to S$4,000 of monthly expenditures for 50 years, in terms of today's dollars. Barring any major life events that require a huge lump sum expense, this should be able to let anyone with a million dollars retire sometime in his 30's or his 40's. To arrive at this answer, we use a method we call "run-to-zero" strategy. This means that we calculate the monthly expenditure required for completely use up the million dollars based on a 2% annual inflation and certain rates of investment return.

For example, if we have a monthly budget of S$1,634, we would set aside S$19,608 to spend in the first year and invest the remaining balance of S$980,392. If we were to make a return of 2% on this balance, we would be left with S$1,000,000 at the beginning of the second year. Then, we set aside S$20,000 to spend in the second year (up 2% due to inflation) and invest the rest again. Adjusting our expenditure for inflation ensures that a person is able to maintain his quality of life over a long span of time.

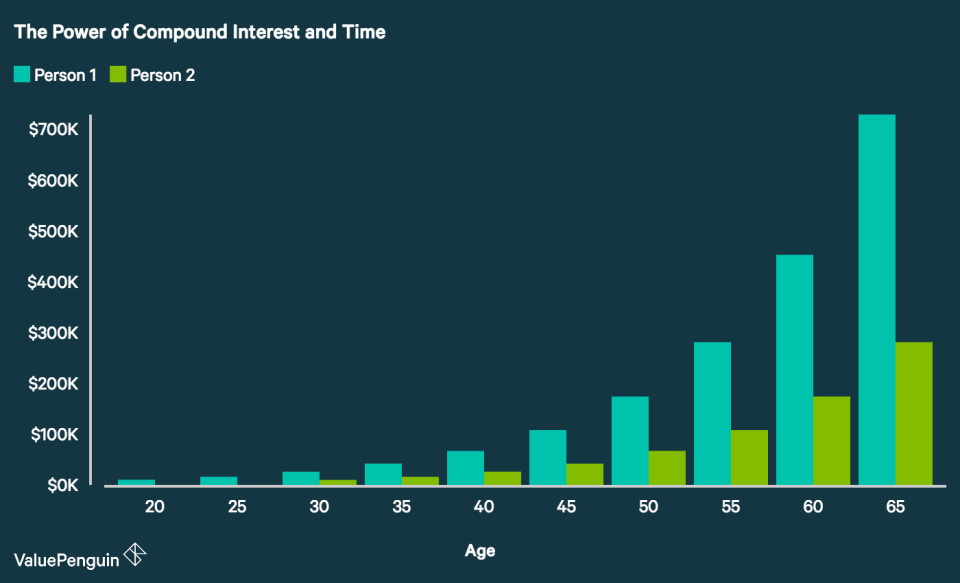

Why Investing Is So Important: Power of Compounding Returns

This example is a useful demonstration of the power of investing. While not investing the million would allow a person to spend only about S$1,000 per month for 50 years, merely generating 3-7% of annual return helps increase this budget to S$2,000 to S$4,000. This is because of a concept called compounding returns. Investing allows your money to earn money for you, resulting in an exponential growth where each dollar you generates additional returns in the future. Therefore, making even a single-digit return on your cash can build on itself into a snowball, giving you a larger budget spread out across a long period of time.

How Can You Make 3-7% Per Year?

Building a well diversified portfolio filled with well-researched investments should produce around 5% per year on a consistent basis. In general, we recommend mixing your investments with some high-risk/high-return investments like stocks with less risky alternatives like bonds. For example, the Straits Times Index has returned 8.4% of annualised return on average from 2002 to 2014. Some government savings bonds also return 2-3% per year. Contrary to popular belief, as long as you are doing your homework and pick your investments carefully, making 3-7% on your money is not as difficult as you may think.

Start Investing Today

Everyone wants to be a millionaire but not everyone can. However, the important lesson here is that putting your money to work and generating some returns can make huge difference in your savings and retirement planning. Earning even a meager 3-5% can increase your wealth dramatically compared to letting inflation just eat away at your savings over time. Most importantly, it's advisable to start an investment portfolio early in your life so that you can let time and compounding do most of the heavy work for you. If you earn 8% annual return on an investment of S$20,000, for example, you will end up with almost S$100,000 after 20 years, an increase of almost 5 fold.

The article Can You Live Off a Million Dollars, Forever? originally appeared on ValuePenguin.

ValuePenguin helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValuePenguin:

Yahoo Finance

Yahoo Finance