List of current en bloc developments and their likelihood of success

Tender for Horizon Towers’ fifth attempt at collective sale will close on 30 March. (Picture: Samuel Isaac Chau/EdgeProp Singapore)

SINGAPORE (EDGEPROP) - The en bloc sale of condominiums is viewed by many owners as a windfall, and some property investors intentionally seek out properties with en bloc potential. In this article, we will examine the factors that affect the en bloc market. We will also explore the likelihood of a successful sale for condominiums that have been put up for collective sale and residential developments that may be launched for a collective sale.

Headwinds for the residential en bloc market

Patience is required for investors hoping for a windfall from a collective sale because the whole process can take up to two years, and there is no guarantee of success. Moreover, current market sentiment is dampened by a weaker economic outlook and changes to government regulations.

If private residential owners sell their private property, they have to wait 15 months before they can buy a non-subsidized resale HDB flat. Only owners who are 55 years old and above and are purchasing a four-room or smaller HDB flat are exempted from this regulation. (Find HDB flats for rent or sale with our Singapore HDB directory)

As a result of the regulation that was implemented as part of cooling measures in September last year, owner-occupiers below 55 years old will be forced to buy another condominium unit as a replacement home if they require immediate housing. The high replacement cost for a comparable condominium unit, coupled with rising mortgage rates, could deter some young owner-occupiers from putting their condominium unit up for en bloc sale.

The owner-occupiers who choose to purchase a resale HDB flat will have to rent an interim house to wait out the 15-month period. Limited supply and strong demand have driven up housing rents in recent years. The average housing rent for condominiums in Singapore surged from $4.04 psf per month in 2021 to the current $4.83 psf per month. The high rents will add to the reluctance of some owner-occupiers to agree to an en bloc sale. Investors may also be unwilling to forgo their strong rental income stream.

The remittable portion of the Additional Buyer's Stamp Duty (ABSD) for developers was increased from 25% to 35% in December 2021. The ABSD will be remitted to developers only if they can complete and sell all units in their development within five years. As such, development risk has increased, causing developers to become more stringent in their site selection.

Successful deals this year

The en bloc tender for Bagnall Court, located along Upper East Coast Road, closed last year. In January, the 43-unit development was sold via private treaty to a consortium led by Roxy-Pacific Holdings for $115.28 million ($1,106 psf per plot ratio). A new five-storey condominium with 113 units is planned for the freehold site.

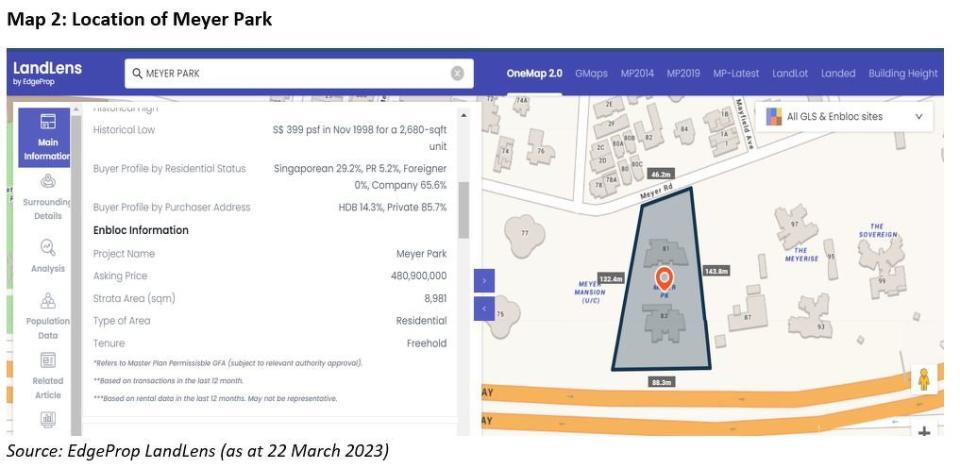

The 60-unit Meyer Park, located along Meyer Road, was sold to UOL and Singland for $392.18 million ($1,668 psf per plot ratio) in February. The freehold site will be redeveloped into a luxury condominium with 230 to 250 units.

The 19-unit freehold Holland Tower, located along Holland Heights, was sold to a wholly-owned subsidiary of Wing Tai Holdings for $76.3 million ($1,746 psf per plot ratio) in March.

Low Choon Sin, managing partner of SRI Capital Market reckons that “reasonable and realistic land pricing will be one of the key factors in determining the success of an en bloc. There are ample options in the private en bloc market as well as government GLS land so developers are unlikely to rush for an over-priced site.”

Besides pricing, the freehold tenure and small development size of Bagnall Court, Meyer Park, and Holland Tower contributed to their success rate. Additionally, Bagnall Court is located in the Bayshore area, where there are government plans to transform the neighbourhood, and Meyer Park is located nearby in an established residential enclave. Holland Tower's location in prime District 10 definitely contributed to its successful sale.

According to Chia Mein Mein, head of capital markets (land & collective sale) from Knight Frank Singapore, “potential collective sale site must possess attractive real estate attributes such as being in a popular neighbourhood, close proximity to a MRT station and panoramic views. Its location within an existing residential enclave could draw upgraders attached to the area if there are new products available. The size of the existing residential project and its absolute cost are further considerations.”

Likelihood for success

At the time of writing, there were five condominiums whose en bloc tenders will close later this year. Of the five developments, only Horizon Tower is in a prime district, but Lakeside Tower is in the up-and-coming Jurong Lake District. Additionally, three of the developments are freehold, but all five developments are more than 20 years old.

Lakeside Tower has a high chance of a successful en bloc sale because of its location within Jurong Lake District, which is slated to be Singapore’s second CBD. Additionally, the Jurong Region Line will greatly improve connectivity in the west region when it is fully completed in 2029.

A drawback for Lakeside Tower is its 99-year leasehold tenure, but the successful en bloc sales of two leasehold neighbours - Lakeside Apartments and Park View Mansions – indicate that the leasehold tenure may not be a deterrent for properties in the area. The main drawback for Lakeside Tower will be potential competition from two upcoming projects that are within a 500m radius.

Nearby Lakeside Apartments was sold via en bloc in May last year for $273.88 million ($1,250 to $1,260 psf ppr) to Wing Tai Holdings, who plans to build a residential development with more than 300 units.

Park View Mansions is another nearby development that was successfully sold via en bloc in August last year. A joint venture comprising CEL Development, Sing-Haiyi Pearl, and TK 189 Development snapped up the site for $260 million ($1,023 psf ppr) and plans to build a residential development with up to 440 units.

Park View Mansions was successfully sold in a collective sale for $260 million last year. (Picture: Albert Chua/EdgeProp Singapore)

Freehold Hong Heng Mansions is another development that is expected to attract interest from developers because of its proximity to the Springleaf MRT Station (TEL). Moreover, there has been increasing interest in the neighbourhood after several sites surrounding the nearby Lentor MRT Station (TEL) were sold under the government land sales (GLS) program. Additionally, Lentor Modern, which will be built on one of the sold GLS sites, saw 80% of its units sold during launch.

Freehold Hong Heng Mansions is up for en bloc sale with a reserve price of $133 million. (Picture: ERA)

In the pipeline?

According to the ongoing online survey by EdgeProp Singapore, the responses indicate that due to the continued strong housing demand, more condominiums may be launched for en bloc in the near future.

An interested buyer must be found within 12 months of obtaining the minimum number of owners’ signatures for consent to a collective sale. If an interested buyer is not found within the timeframe, the entire en bloc process restarts and consent signatures must be obtained from owners again. As a result, some condominiums that failed in their en bloc attempt this year may launch another attempt to take advantage of the 12-month timeframe. (See potential condos with en bloc calculator)

The condominiums in the table below had an en bloc tender earlier this year that closed without any announcement of a successful sale. These developments will likely be put up for another en bloc tender if the previous attempt is unsuccessful.

Outlook for this year

In the face of weaker economic fundamentals and growing resistance to increasing property prices, caution is expected to be the prevailing sentiment among developers.

Swee Shou Fern, head of investment advisory from Edmund Tie says that “developers will continue to be cautious not to overbid in order to fulfil the undertaking to finish building and selling all units in the new development within five years for the remission of ABSD amounting to 35% of the land acquisition cost, while adjusting to the change in the floor area definition and the higher Buyer’s Stamp Duty”.

The ramp-up in supply has resulted in a slower pace of growth in residential property prices, which may encourage more owners to lower their asking prices to avoid missing the en bloc opportunity. As such, there may be more successful en bloc sales as the price difference between owners and developers narrows.

Check out the latest listings near Horizon Towers, Lakeside Tower, Hong Heng Mansions, Roselane Court, Kingsley Mansions, Meyer Park, Springleaf MRT Station, Lentor MRT Station

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Roselane Court in Tanjong Katong launched for sale by tender at $23 mil

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance