Investor Central

Investor CentralLionGold Corp Ltd - MANAGEMENT REPLY: Does takeover of Acadian Mining require shareholder approval as 'major transaction'?

26/8/2013 – Another company linked to Innopac CEO Wong Chin Yong has launched a takeover for another listed company belonging to Australian mining identity Joseph Gutnick.

After Innopac failed in its takeover of ASX-listed Merlin Diamonds, LionGold Corp Ltd is now offering to buy Acadian Mining Corporation in an all-cash deal.

Acadian is ultimately controlled by Gutnick, while Wong is a substantial shareholder of LionGold Corp.

LionGold will pay 12 Canadian cents per share, a premium of 21.2% over a recent average price, to the shareholders of Acadian Mining Corp, which is listed on the TSX Venture Exchange in Canada and the OTCQX in the US.

In Singapore dollar terms, the acquisition will cost LionGold S$9.1 mln at 14.8 Singapore cents per Acadian Mining Corp's share (C$1 = S$1.23).

LionGold's offer is subject to acceptances of at least two-third shareholders of Acadian Mining Corp (Source).

The deal also needs to be approved by the TSX Venture Exchange and the Supreme Court of Nova Scotia, Canada.

But from a shareholder perspective, the acquisition seems like a done deal as the substantial shareholders of Acadian Mining Corp own more than two-third shares to vote in favour of the deal.

Here's why:

Acadian Mining Corp was 71.48% owned by Golden River Resources Corporation, which had bought the stake on June 30, 2011 (refer page 13 of this release by Golden Rivers Resources).

Golden River Resources Corp is a Delaware-based mining and exploration company which bought almost its entire stake – or 68% - at 3 Canadian cents per share (refer this release by Golden Rivers Resources).

In turn, Golden River Resources Corp is a 96.6% subsidiary of Northern Capital Resources Corporation (refer page 9 of this release by Golden Rivers Resources).

And the shareholders of Northern Capital Resources Corp are Legend International Holdings, Inc (with a 31.48% stake), Fast Knight Nominees P/L (with a 24.66% stake) and Chabad House of Caufield with an 8.97% stake .

Legend International Holdings, Inc and Chabad House of Caufield are the entities controlled by Joseph Gutnick, and he appears to own 10% of Fast Knight Nominees.

Therefore, it seems clear that Joseph Gutnick bought a controlling 71.48% stake in Acadian Mining Corp via his stake in Golden River Resources Corp for about 3 Canadian cents per share.

But less than a year after acquiring it, Gutnick's Golden River Resources Corp sold a 19.9% stake in Acadian Mining Corp to Igneous Capital Limited – a BVI company controlled by mining investor Edward Henry Graham on February 2, 2012 (Page 21 of this disclosure by Acadian Mining).

Graham paid 15 Canadian cents per share – a whopping four-fold gain in less than a year! (refer page 7 of this source).

A few months later, on October 26, 2012, Golden River Resources Corp sold another 19.9% stake in Acadian Mining Corp to Nelson Fernandez (refer 21 of this disclosure by Acadian Mining).

Fernandez is a Malaysian national residing at Bukit Damansara in Kuala Lumpur (Source).

This time, Mr Gutnick's company sold the stake at 13 Canadian cents per share – a more than three-fold gain!

Finally, on December 10 last year, Golden River Resources Corp sold another 9.97% stake to Wong Chin-Yong (refer page 21 of this disclosure by Acadian Mining).

This time, Mr Gutnick's company sold the stake at 11 Canadian cents per share – an almost three-fold gain!

After all these transactions, Acadian Mining Corp's substantial shareholders on December 31, 2012 were:

Gutnick's Golden River Resources Corp (with a 22.19% stake), Igneous Capital Ltd (with a 19.9% stake), Nelson Fernandez (with a 19.9% stake) and Wong Ching Yong (with a 9.97% stake)(refer page 21 of this disclosure by Acadian Mining).

In March this year, in a private placement, Acadian Mining Corp issued 10 mln new shares at 9 Canadian cents per share to three investors. (refer this disclosure by Acadian Mining).

These are: LionGold Corp Ltd (which bought 6 mln shares), Nelson Fernandez (who bought 2 mln shares) and Igneous Capital Ltd (which also bought 2 mln shares).

After the private placement, and in the absence of any other announcement, this is how we see the latest shareholding pattern of Acadian Mining Corp:

Golden River Resources Corp (with an 18.74% stake), Igneous Capital Ltd (with a 19.92% stake), Nelson Fernandez (with a 19.92% stake), LionGold Corp (with a 9.35% stake) and Wong Chin Yong (with an 8.41% stake). (refer page 21 of this disclosure by Acadian Mining).

Other than the direct stakes in Acadian Mining Corp, Golden River Resources Corp and Igneous Capital Ltd own convertible debentures of the company.

Issued on June 6 last year, Golden River Resources Corp bought a convertible debenture worth C$420,000 while Igneous Capital Ltd bought a convertible debenture worth C$180,000 (refer page 22 of this disclosure by Acadian Mining).

The debentures carry an interest of 8%pa and are convertible into Acadian Mining Corp's shares at 12 Canadian cents per share.

Golden River Resources Corp can convert the debenture into 3.5 mln Acadian Mining Corp shares before June 6 next year.

But Igneous Capital Ltd had the right to convert the debenture into 1.5 mln shares before June 6 this year.

So far, Acadian Mining Corp has not announced if Igneous Capital Ltd has converted the debenture into shares.

Acadian Mining Corp had also issued more than a million options which were deeply out-of-the-money and have been surrendered by the option holders (page 13 of this disclosure, as well as this disclosure by Acadian Mining).

In a nutshell:

Together, Joe Gutnick through Golden River Resources Corp, Edward Graham through Igneous Capital Ltd, Nelson Fernandez, Wong Chin Yong and LionGold Corp Ltd own a 76.34% stake in Acadian Mining Corp.

This would rise further if Golden River Resources Corp and Igneous Capital Ltd convert their debentures into shares of the company.

'

Investor Central. Asian insights for global investors. We ask the tough questions of Asian companies which global investors need answers to.

1. Does takeover of Acadian Mining require shareholder approval as a 'major transaction'?

In its July 29 announcement, LionGold Corp said the acquisition of Acadian Mining Corporation was a 'discloseable transaction' – as opposed to a major transaction - according to the SGX Mainboard Listing Rules.

That's because LionGold Corp reported the net loss of Acadian Mining Corp for the four quarters ended March 31 was 19.26% of LionGold Corp's net loss for the same period.

This barely scrapes in as a 'disclosable transaction', because Rule 1010 of the Listing Manual, says a transaction is 'disclosable' if any of the relative figures computed on the bases set out in Rule 1006 exceeds 5% but does not exceed 20%.

And if it exceeds 20%, Rule 1014 says it is a 'major transaction'.

As per Rule 1014, a 'major transaction' needs to be approved by the shareholders in a general meeting.

A circular containing the information in Rule 1010 must be sent to all shareholders.

No such approval from shareholders is required in case of a 'disclosable transaction'.

We might be wrong, but it looks to us like a major transaction, requiring shareholder approval.

Here's why.

In note 1 on page 2 of its July 29 announcement, LionGold Corp said Acadian Mining Corp's net loss was S$2,216,483 for the year ended March 31 (C$1 = S$1.23).

In other words, Acadian Mining Corp's net loss for the year ended March 31 was C$1,802,019, before income tax, minority interests and extraordinary items.

As per Rule 1002, "net profits" means profit or loss before income tax, minority interests and extraordinary items.

'

But that doesn't give LionGold the ' discretion to adjust profit figures as it desires.

In any case, Acadian Mining Corp's financial statements have not classified 'impairment of mineral resource properties' as an extraordinary item.

So why should LionGold?

Moreover, the losses Acadian booked are not extraordinary.

A quick look at Acadian Mining Corp's FY12 financials shows the extraordinary item, which LionGold Corp seems to have set aside, is an impairment of mineral fields of Acadian Mining Corp (refer page 3 of this disclosure by Acadian Mining).

This 'impairment of mineral resource properties' has been elaborated on pages 19 and 20 of Acadian Mining Corp's financials for 2012.

It turns out the impairment is a write-down of the mineral resource properties, which were sold during the year.

In other words, this is a loss on the sale of mineral resource properties.

Now, a loss on the sale of mineral resource properties by a mining company does not appear to us to be an extraordinary item, just like a loss on the sale of land by a developer.

So, what is the big deal about whether or not this is an abnormal loss?

Well, Acadian Mining Corp's financial year is the same as the calendar year, whereas LionGold Corp's financial year ends March 31.

So, for the ease of comparison, LionGold Corp has clubbed together the financials of Acadian Mining Corp for four quarters ended March 31.

Now, according to page 3 of Acadian Mining Corp's management discussion for quarter ended March 31, the company made a combined net loss of C$3,044,735 in four quarters ended March 31.

In Singapore dollar terms, that's a net loss of S$3.75 mln, which is more than 33% of LionGold Corp's net loss after tax of S$11.2 mln for the year ended March 31 (refer page 62 of LionGold's 2012 Annual Report), and therefore that seems to indicate that LionGold Corp's acquisition of Acadian Mining Corp a 'major transaction' which must be voted upon by LionGold Corp's shareholders at a general meeting.

By setting aside Acadian Mining Corp's C$1.3 mln (about S$1.6 mln) impairment loss, it falls below the threshold for which a shareholders meeting must be called (refer page 3 of this disclosure by Acadian Mining).

Management replyUnder the SGX-ST Listing Manual, "net profits" are defined in clause 1002(b), being profit or loss before income tax, minority interest and extraordinary items. The prescribed definitions in the Listing Manual will apply for purposes of the computation of the categories under clause 1004, and as such, the acquisition of Acadian Mining Corp does not classify as a 'major transaction' for LionGold.

That takes us to the next question:

2. Why would LionGold Corp want to avoid shareholders voting on the acquisition of Acadian Mining Corp?

Further, while buying placement shares of Acadian Mining Corp, on March 1, LionGold Corp said 'Prior to the Subscription Agreement, neither the Company nor any of its directors or substantial shareholders has any dealings (business or otherwise) with ADA or any of the directors of ADA or the other placees'.

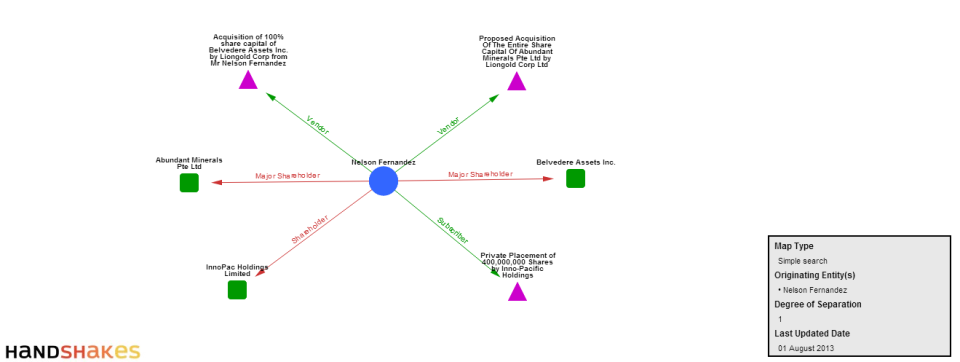

But it turns out, LionGold Corp has been in business relationships with a substantial shareholder of Acadian Mining Corp - Nelson Fernandez - since 2011.

For example, on April 25, 2011, LionGold Corp (then known as The Think Environmental Co Ltd) announced plans to buy Belvedere Assets Inc (BAI) for US$1.15 mln (refer this disclosure by LionGold).

BAI was owned by Nelson Fernandez.

Two months later, on June 23, 2011, LionGold Corp - still known as The Think Environmental Co Ltd - announced plans to buy Abundant Minerals Pte Ltd (AMPL) for US$16 mln from Nelson Fernandez (refer this disclosure by LionGold).

However, LionGold Corp terminated plans to buy BAI a year later, on April 24, 2012, having spent S$75,000 on professional fees (refer this disclosure by LionGold).

It also ended plans to buy AMPL on January 14, 2013, having spent S$580,000 on professional fees (refer this disclosure by LionGold).

The following Handshakes map summarises LionGold Corp's past dealings with Nelson Fernandez:

So, LionGold had done business with Mr Nelson Fernandez on at least two previous occasions.

Therefore, its assertion on March 1, 2013 that it had not had any dealings with other placees is demonstrably false.

Nelson Fernandez also owns a 3.44% stake in SGX-listed Innopac Holdings Ltd (refer page 87 of this source).

Jadensworth Holdings Pte Ltd – a wholly-owned subsidiary of Innopac Holdings Ltd – owns a 3.46% stake in LionGold Corp (refer page 157 of LionGold's Annual Report 2012).

Jadensworth Holdings Pte Ltd is also the 19th largest warrant holder of LionGold Corp (refer page 158 of LionGold's AR 2012 ).

Therefore that makes Nelson Fernandez an indirect shareholder of LionGold Corp.

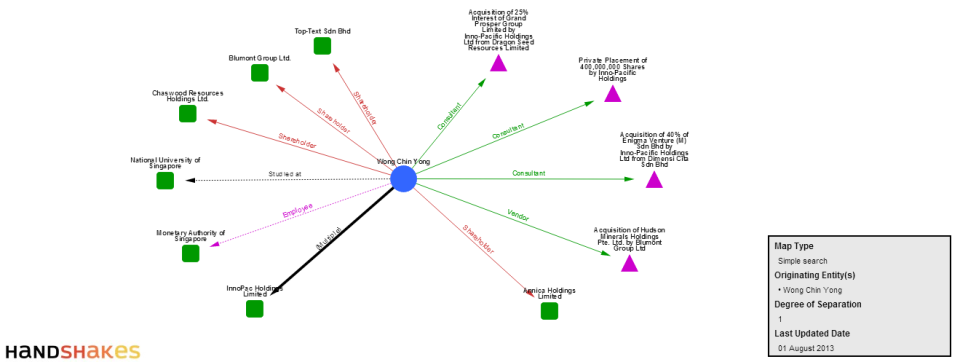

Wong Chin Yong (announcements of Golden River Resources Corp, Acadian Mining Corp name him as Chin-Yong Wong) – another substantial shareholder of Acadian Mining Corp – is also related to LionGold Corp.

The following Handshakes' chart gives a bird's eye view of the relationship:

Wong Chin Yong has been the managing director and CEO of Innopac Holdings Ltd since September 18, 2001 (refer page 6 of Innopac's Annual Report 2012).

That makes Mr Wong interested in Innopac Holdings Ltd's stake in LionGold Corp.

As of today, Joseph Gutnick is the largest shareholder (with a more than 10% stake) of Innopac Holdings Ltd.

So, he is also interested and related to LionGold Corp by virtue of Innopac's stake in it.

On the other side, Mr Gutnick has been a controlling shareholder of Acadian Mining Corp through his subsidiary Golden River Resources Corp.

Even today, Gutnick's Golden River Resources Corp owns an 18.74% stake and debentures convertible into 3.5 mln new shares in Acadian Mining Corp.

Therefore looking at the broader picture, the Acadian Mining Corp deal is nothing but a transaction involving two SGX-listed entities - LionGold Corp Ltd and Innopac Holdings Ltd, and people connected to them.

Management replyNelson Fernandez, Wong Chin Yong and Joseph Gutnick are related to Acadian Mining and not LionGold Corp.

3. How much will Mr Fernandez and Mr Wong benefit?

LionGold Corp's offer for Acadian Mining Corp, on July 29, was at a premium of 21.12% to the 20-day volume weighted average price of its shares.

But the offer of 12 Canadian cents per share is about 140% higher than Acadian Mining Corp's stock price of about 5 Canadian cents per share at the beginning of 2013.

Even at 5 cents per share, Joseph Gutnick is sitting on a handsome profit on his investment.

But the same can't be said for Nelson Fernandez and Wong Chin Yong.

Nelson Fernandez was making a loss of more than 60% on his investment made in October last year.

Whereas Wong Chin Yong's investment in December had almost halved within a matter of days.

4. How was the purchase price of 15 Singapore cents per Acadian share arrived at?

Management replyThe proposed takeover price of Acadian Mining is C$0.12 per share and not C$0.15 per share. The price considers our assessment of the company's projects and acceptability to a majority of Acadian shareholders.

5. Will Joseph Gutnick sell out before the deal goes through, again?

Innopac Holdings Ltd's acquisition of Merlin Diamonds Ltd didn't go through.

But Mr Gutnick must not be worried as he successfully sold almost all of his shares in Merlin Diamonds to a group of Singaporean businessmen highlighted in our earlier report.

Also, LionGold Corp bought shares of Acadian Mining Corp in March, a month after Innopac Holdings Ltd announced the acquisition of Gutnick's Merlin Diamonds Ltd.

Those who have read our earlier reports would recall that LionGold Corp Ltd and Innopac Holdings Ltd are part of the a peculiar network of listed companies on SGX.

Therefore that makes us wonder if the acquisition of Acadian Mining Corp is part of a structured deal between Mr Gutnick and a select group of companies in Singapore.

We thank the management for its responses.

©2013 Investor Central® - a service of Hong Bao Media

Yahoo Finance

Yahoo Finance