LEN or DHI: Which Housing Bigwig Has More Potential in 2022?

It’s a fact that historically-low inventory levels, rising prices, supply chain bottlenecks, and affordability issues have been taking a toll on the U.S. housing market these days. Nevertheless, strong demand arising from the strengthening job market is a major tailwind.

Also, the expected rise in mortgage rates is driving sales for new homes in the market. With the Fed pulling back on its purchases of mortgage-backed securities, the prospect of higher interest rates in 2022 is accelerating the decision for buyers in an otherwise slow season.

Notable homebuilders like D.R. Horton, Inc. DHI, Lennar Corporation LEN, Meritage Homes Corporation MTH and Toll Brothers, Inc. TOL have been experiencing strong demand. As released by the National Association of Home Builders/Wells Fargo Housing Market Index, builders’ confidence in December edged higher for the fourth consecutive month. Even the component measuring sales expectations in the next six months held steady for the third consecutive month at 84.

Given the current scenario, quality homebuilding stocks could offer a safe haven because of their stability and the fact that these are fundamentally strong enough to withstand the industry woes. The Zacks Building Products - Home Builders industry currently carries a Zacks Industry Rank #57, which places it at the top 22% of more than 250 Zacks industries.

Among the industry bellwethers, D.R. Horton and Lennar are the most prominent ones. At present, the market capitalization of D.R. Horton is $35.53 billion, while that of Lennar stands at $33.59 billion. Both D.R. Horton and Lennar currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Before drawing a head-to-head comparison between DHI and LEN, let’s check out a few key statistics of the companies.

What Defines These Homebuilders?

D.R. Horton offers a diverse line of homes across various price points through a multi-brand platform like D.R. Horton, Emerald Homes, Express Homes and Freedom Homes. Moreover, the company enjoys one of the broadest geographic diversities in the industry and is not dependent on any particular market. It has a strong presence in 98 markets across 31 states in the East, Midwest, Southeast, South Central, Southwest and West regions of the United States. With 81,965 homes closed in fiscal 2021 for $26.5 billion, D.R. Horton completed its 20th consecutive year as the largest homebuilder in the United States.

D.R. Horton reported solid results for fiscal 2021, with a 37% increase in Homebuilding revenues to $27.8 billion and 78% growth in earnings to $11.41 per share. As of Sep 30, 2021, the value of backlog sales orders was $9.5 billion (26,221 homes), an increase of 16% from $8.2 billion (26,683 homes) as of Sep 30, 2020.

Conversely, Lennar operates as a homebuilder primarily under the Lennar brand in the United States, targeting first-time, move-up, and active adult homebuyers. The company provides mortgage financing and related services to customers through the financial services segment.

Lennar’s core homebuilding results remained resilient in fiscal 2021. The results also benefited from effective cost control and focus on making its homebuilding platform more efficient, which in turn resulted in higher operating leverage. Full-year 2021 earnings came in at $13.00 per share, up 66% from the fiscal 2020 level. Revenues were $27.1 billion, up from $22.5 billion a year ago. Deliveries grew 13% to 59,825 homes from fiscal 2020. Backlog at fiscal 2021-end climbed 26% from a year ago to 23,771. Potential housing revenues from backlog advanced 45% year over year to $11.4 billion.

Stock Performance

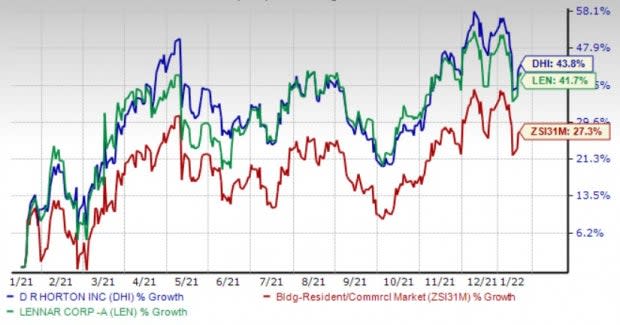

DHI and LEN have gained 43.8% and 41.7%, respectively, over the past year. The industry has collectively gained 27.3% during the period. Although both the stocks have outperformed the industry, DHI fared much better than LEN on this front.

Image Source: Zacks Investment Research

Earnings Growth Rate & Surprises

The ability to consistently boost profit levels defying industry woes is a defining characteristic of the best companies. Analysts expect DHI’s earnings to grow 27.7% in the current year. Comparatively, LEN’s earnings are expected to grow 9.3% over the same time frame. Hence, DHI’s higher growth rate implies a greater potential for capital appreciation.

Considering earnings history, DHI and LEN both surpassed estimates in all the last four quarters, delivering average earnings surprise of 14.1% and 14%, respectively.

Valuation

The industry is clearly undervalued than the S&P 500, with respect to the forward 12-month price-to-earnings (P/E) ratio. This implies that the industry has upside potential for the near future. The industry has an average forward 12-month P/E ratio — which is the best multiple for valuing homebuilding stocks — of 6.96, which is below the S&P 500’s average of 21.6. Hence, it might be a good idea to focus on stocks belonging to this particular industry.

Coming to the two stocks under consideration, DHI and LEN — with a 12-month forward P/E ratio of 6.72 and 6.89, respectively — are undervalued than the S&P 500 and the industry.

Comparing the two stocks, DHI is less pricey than LEN.

Returns

Return on Equity (ROE) is a measure of a company’s efficiency in utilizing shareholders’ funds. ROE in the trailing 12 months for DHI is 30.2%. LEN’s trailing 12-month ROE is 19.5%. Markedly, DHI provides more impressive returns to investors than LEN and the industry’s 19.5%.

Bottom Line

Currently, D.R. Horton’s industry-leading market share, solid acquisition strategy, well-stocked supply of land, lots and homes, along with affordable product offerings across multiple brands and strong operational performance make it a better housing pick than Lennar. Specially, in terms of share price performance, earnings growth rate, returns and valuation, D.R. Horton has more upside potential than Lennar in 2022.

A Brief Overview of the Other Two Stocks

Toll Brothers currently sports a Zacks Rank #1. This Horsham, PA-based luxury homebuilder builds single-family detached and attached home communities; master-planned luxury residential resort-style golf communities; and urban low, mid, and high-rise communities, principally on the land it develops and improves. It has been benefiting from the strategy of broadening product lines, price points and geographies.

Toll Brothers’ earnings for fiscal 2022 are expected to rise 46.3% year over year.

Meritage Homes currently carries a Zacks Rank #2. Its successful execution of strategic initiatives to boost profitability and focus on entry-level LiVE.NOW homes bode well.

Meritage Homes’ earnings are expected to rise 23.4% year over year in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance