Learn Forex: Day Trading Forex Momentum

Article Summary: The EURGBP has advanced 276 pips to start 2013 trading. To find if day trading opportunities remain present, traders turn to identifying short term momentum on the 30 minute chart.

When considering day trading a Forex strategy, traders should first have the ability to identify the trend and market momentum.These skills can be developed through an understanding of price action and technical analysis on shorter term time charts. Today we will review the ongoing EURGBP trend and see if there is an opportunity for scalping by identifying both market momentum and the trend.

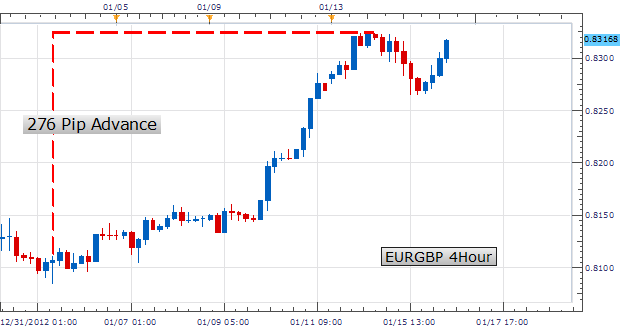

Below we can see a 4Hour chart of the EURGBP, with the pair advancing as much as 276 pips for the 2013 trading year. Currently price remains under its monthly high at .8324, but price has seen a series of higher highs and higher lows created for the better part of two weeks. These higher highs are indicative of an uptrend, giving traders an opportunity to buy the EURGBP, but we still need to identify if short term momentum is set to continue. To see if this trend is viable for day trading opportunities we can now move into a 30minute chart to better identify short term market momentum.

Learn Forex – EURGBP 4Hour Trend

(Created using FXCM’s Marketscope 2.0 charts)

EURGBP Building Blocks

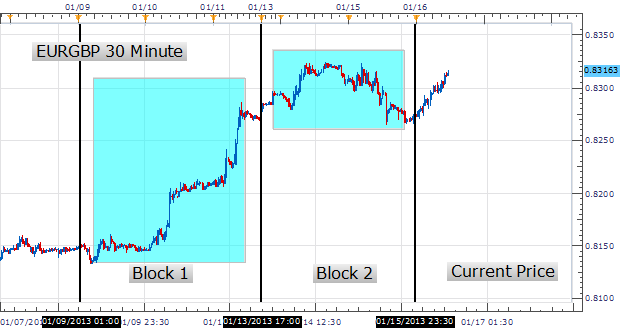

Pictured below we can see our current downtrend in the GBPNZD divided into Building Blocks on a 30 minute graph. Our first Building Block 1 is created by identifying last Wednesday the 9th. The pair quickly advanced from this point, moving as much as 192 pips higher. Since a higher high and a higher low were created, Block 1 has been labeled in blue to indicate its strong bullish bias. Once the direction of Block 1 is found, our analysis shifts to Block 2 to find out if momentum is continuing in the same direction.

Block 2 analysis begins where Block 1 concluded on Sunday the 13th. Taking another look at the graph below, we can see that Block 2 depicts a continuation of our strong uptrend. Block 2 printed both a higher high and a higher low when compared to previous price action. With momentum continuing to the upside Block 2 has been painted blue as well.

Learn Forex – EURJPY Building Blocks

(Created using FXCM’s Marketscope 2.0 charts)

With price heading up in both Building Blocks, the EURGBP stands as one of the Forex markets strongest trends. This will allow day traders and scalpers alike to continue to look for short term trading opportunities with continued upside momentum. This analysis would only be invalidated on the creation of a lower low, potentially marking a temporary reversal in the trend.

---Written by Walker England, Trading Instructor

To contact Walker, email WEngland@FXCM.com . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to WEngland@FXCM.com .

Been trading FX but wanting to learn more? Been trading other markets, but not sure where to start you forex analysis? Register and take this Trader Quiz where upon completion you will be provided with a curriculum of resources geared towards your learning experience.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance