De La Rue 'fiasco' turns British institution 'into bid target'

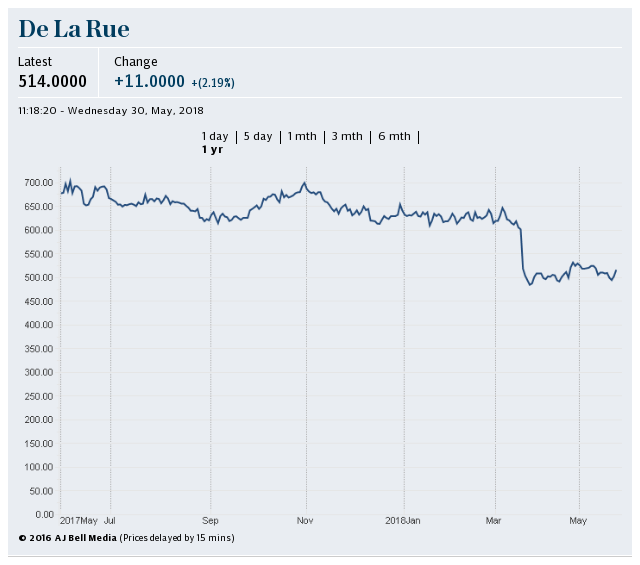

De la Rue’s handling of the new British passport contract has been labelled a “farce” after it drove down the security printer’s share price, leaving it vulnerable to an opportunistic takeover bid from foreign rivals.

Activist investor Crystal Amber said that the company’s strategy had wiped almost £150m off its value in just four weeks and left potential buyers “salivating” at the opportunity to swoop on the historic business at a knock-down price.

Other shareholders questioned chief executive Martin Sutherland’s judgment. One claimed De La Rue had “shot themselves in the foot”.

Richard Bernstein, who leads Crystal Amber, said that De La Rue communications over the passport contract had been “farcical”.

“Another great British company has just made itself a bid target,” warned Mr Bernstein.

It emerged last month that De La Rue had lost the UK passport deal to Franco-Dutch rival Gemalto, sending its shares sliding and sparking an extraordinary response by Mr Sutherland.

He threatened legal action against the Government. However, last week he backed down, saying it was the “sensible and pragmatic choice” having taken legal advice

Yahoo Finance

Yahoo Finance